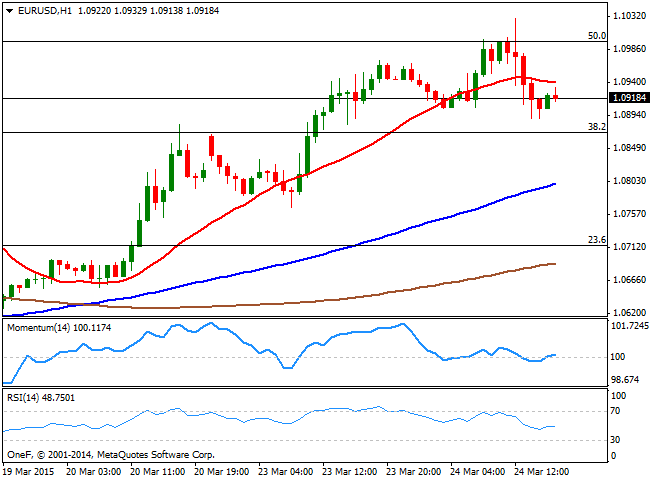

EUR/USD Current price: 1.0919

View Live Chart for the EUR/USD

The dollar stood as the overall winner this Tuesday, after multiple data was released in both shores of the Atlantic. During the European morning the Euro area released the Markit PMI indexes of the region for March, resulting in a modest growth in French manufacturing and services sectors, and a more sustainable one in Germany and the EZ, this last posting the fastest grow rate in almost four years. On the other hand, in the US inflation figures for February resulted up beating, particularly with the year-on-year reading that excludes food and energy, which rose more than forecast, reflecting broad-based gains that helped keep a floor under inflation. Also, New Home Sales rose in February, reaching a seven-year high, climbing at an annual pace of 7.8%.

The EUR/USD pair traded quite volatile all through the day, rising briefly up to 1.1028 before setting a daily low of 1.0890, on the back of mild positive US inflation readings that pushed investors to reevaluate the likelihood of a rate hike in the US next June. The pair ended the day a handful of pips above the 1.0900 level, having been rejected from the 50% retracement of the February/March downward move at 1.0997, and with the short term picture favoring the downside, as the 1 hour chart shows that the 20 SMA heads above the current price, whilst the technical indicators have also turned south, although in neutral territory. In the 4 hours chart the 20 SMA maintains a strong bullish slope well below the current price, acting as dynamic support around 1.0830, while the Momentum indicators has turned sharply lower from overbought territory and maintains its bearish bias above 100, and the RSI indicator stands flat around 60. The 38.2% retracement of the same rally stands at 1.0865, with a break below it probably signaling the USD is ready to resume its advance.

Support levels: 1.0890 1.0865 1.0830

Resistance levels: 1.0920 1.0955 1.1000

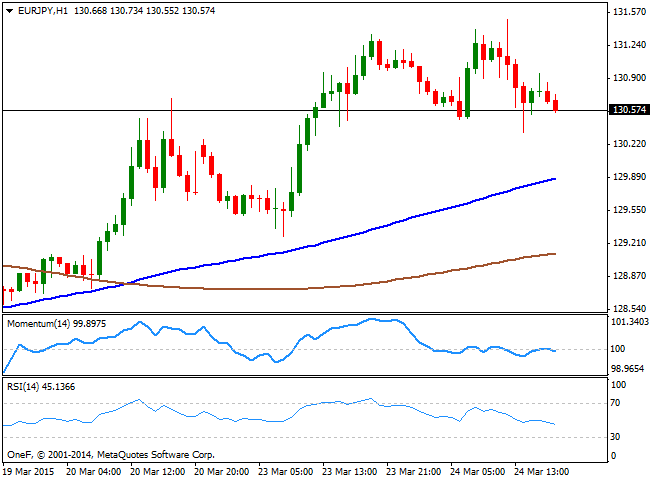

EUR/JPY Current price: 130.58

View Live Chart for the EUR/JPY

The Japanese yen found support in sliding stocks, as indexes edged lower in most of the major markets. The EUR/JPY pair gave up half its Monday gains, down on the day to 130.34, and with the 1 hour chart showing that the technical indicators are gaining bearish strength around their mid-lines, although the price remains well above its 100 and 200 SMAs, with the shortest acting as critical dynamic support around 129.80. In the 4 hours chart the Momentum indicator heads lower in positive territory, not yet signaling a downward continuation, whilst the RSI continues to retrace from overbought levels, and heads lower around 57. Renewed selling interest below the mentioned daily low should see the pair accelerating south, eyeing an approach to the 129.00 level for this Wednesday.

Support levels: 130.30 129.90 129.35

Resistance levels: 130.80 131.30 131.70

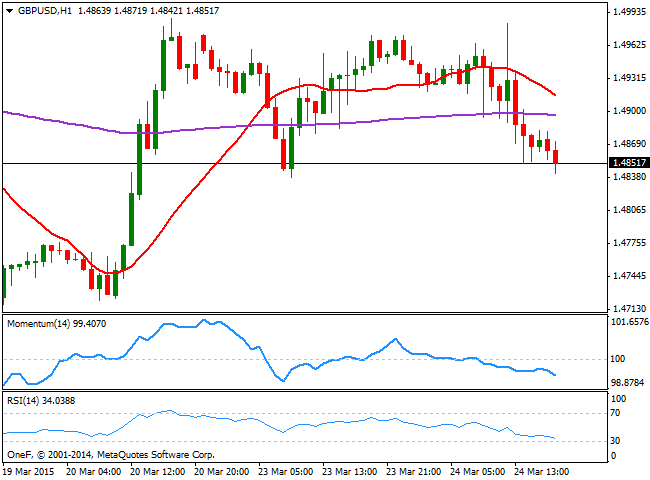

GBP/USD Current price: 1.4850

View Live Chart for the GBP/USD

The GBP/USD pair extended to fresh daily lows around 1.4840 by the end of US session, under pressure ever since the release of the UK inflation figures. Local inflation dropped to zero in February compared to a year before, the first time that happens since the data began to be recorded almost thirty years ago. Also, the UK house prices rose by 8.4% yearly basis in January 2015, which increases fears the housing sector is in a bubble, and that at some point, there will be a massive crash. The technical picture favors further declines, as in the 1 hour chart, the price extends further below a bearish 20 SMA, whilst the technical indicators head strongly south below their mid-lines. In the 4 hours chart the latest candle remains below a flat 20 SMA, currently providing intraday resistance around 1.4880, while the Momentum indicator heads sharply lower below 100, and the RSI also heads lower around 46, signaling additional declines towards 1.4810, the immediate short term support.

Support levels: 1.4810 1.4770 1.4735

Resistance levels: 1.4880 1.4925 1.4950

USD/JPY Current price: 119.60

View Live Chart for the USD/JPY

The USD/JPY pair fell down to a fresh 4-week low of 119.21 during the European morning, bouncing back to flirt with the 120.00 following US encouraging data during the American session. Nevertheless, selling interest around the level and sliding stocks sent the pair back lower, now trading mid-range and with a general bearish tone, according to technical readings. The 1 hour chart shows that the 100 SMA accelerated its decline, and widened the distance with the 200 SMA, with the shortest now acting as dynamic resistance at 120.30, and the technical indicators holding below their mid-lines, albeit lacking strength at the time being. In the 4 hours chart the price failed to advance beyond the 200 SMA, while the Momentum indicator heads higher below the 100 level, but the RSI turned lower in negative territory after a limited upward correction. Renewed selling pressure below the 119.20 level should lead to a quick test of the 118.80 price zone, while only above 120.00 the pair may see some relief to current bearish tone.

Support levels: 119.20 118.80 118.50

Resistance levels: 119.90 120.30 120.80

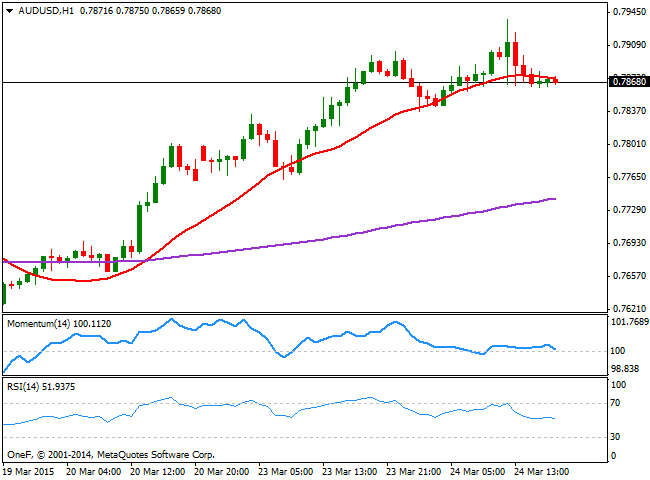

AUD/USD Current price: 0.7867

View Live Chart for the AUD/USD

The AUD/USD pair set a daily high at 0.7937 before turning flat, now trading around its previous Asian session opening. Rates differentials have favored the Aussie since the latest FED's meeting, albeit the pair may have gone too far too fast, considering the daily chart shows a doji, which suggests the pair may have set a short term top around the mentioned high. In the short term, the 1 hour chart shows that the pair has spent most of the American session in a tight range right below a flat 20 SMA, which left the technical indicators flat around their mid-lines. In the 4 hours chart the technical indicators are retracing sharply from overbought levels, but remain well above their mid-lines, which means further declines are necessary to confirm a top is underway. There is a strong static support area between 0.7840/50, with a break below it then required, to see the additional declines this Wednesday.

Support levels: 0.7845 0.7800 0.7770

Resistance levels: 0.7915 0.7950 0.7990

Recommended Content

Editors’ Picks

EUR/USD remains on the defensive near 1.0680 on Dollar strength

The solid performance of the Greenback keeps the price action in the risk-associated universe depressed so far on turnaround Tuesday, sending EUR/USD to multi-day lows in the 1.0680 region.

GBP/USD declines toward 1.2500 on renewed USD strength

GBP/USD turned south and dropped toward 1.2500 in the second half of the day. The US Dollar stays resilient against its rivals following the strong wage inflation data and doesn't allow the pair to gain traction.

Gold stable below $2,300 despite mounting fears

Gold stays under selling pressure and confronts the $2,300 region on Tuesday against the backdrop of the resumption of the bullish trend in the Greenback and the decent bounce in US yields prior to the interest rate decision by the Fed on Wednesday.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Eurozone inflation stable as the outlook on prices gets increasingly muddied

Eurozone headline inflation remains stable at 2.4%. With higher energy prices and improving domestic demand, questions about the direction of inflation become louder.