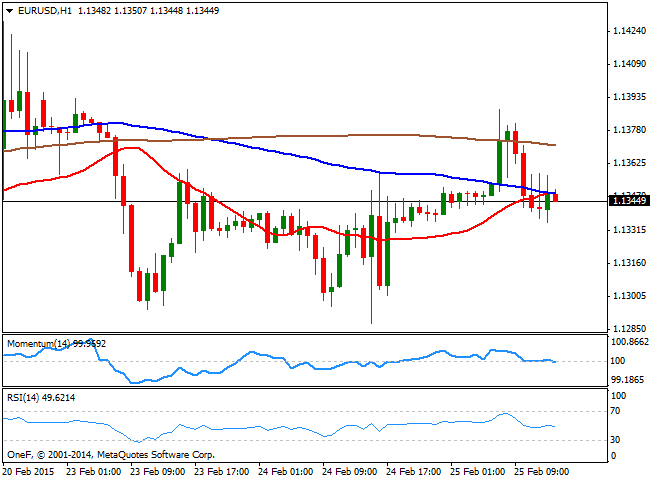

EUR/USD Current price: 1.1335

View Live Chart for the EUR/USD

The EUR/USD pair advanced up to 1.1388, a fresh 3-day high, as the dollar came under broad pressure after Yellen announced yesterday that there won't be a rate hike at least for the next couple of meetings. There have been no fundamental releases that could affect the price of the pair, but both, Yellen from the FED and Draghi from the ECB, are due to testify before their respective Parliaments in separated events during the upcoming hours. In the meantime, the pair trades within its latest range, and the 1 hour chart shows that the price is now contained below its 20 SMA that converges with 100 one around 1.1350, while the indicators present a tepid bearish slope around their midlines. In the 4 hours chart the technical picture remains neutral, as the price needs either to break below 1.1250, or to advance above 1.1440, to be able to gain some directional potential.

Support levels: 1.1320 1.1280 1.1250

Resistance levels: 1.1380 1.1440 1.1485

GBP/USD Current price: 1.5485

View Live Chart for the GBP/USD

The GBP/USD pair advanced up to 1.5538 this Tuesday, retracing from the level more on profit taking ahead of the upcoming Central Bank's heads speeches than because of dollar strength. From a technical point of view, the 1 hour chart shows that the price holds above a bullish 20 SMA although indicators turned lower, now approaching their midlines. In the 4 hours chart the price holds also above a bullish 20 SMA while the technical indicators are retracing from near overbought levels, still well above their midlines. If the price manages to recover above 1.5500, the pair will likely continue advancing towards the 1.5582 level this year high.

Support levels: 1.5450 1.5420 1.5390

Resistance levels: 1.5500 1.5535 1.5580

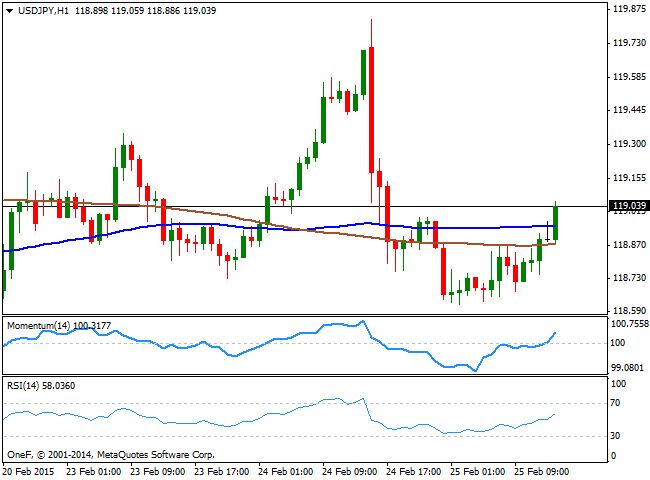

USD/JPY Current price: 119.04

View Live Chart for the USD/JPY

The USD/JPY recovers above the 119.00 level early in the US session, having found support around the 118.60 level. The 1 hour chart shows that the price extends above its 100 and 200 SMAs while indicators head higher above their midlines, supporting additional advances in the short term, albeit some follow through beyond the 119.40 level is required to confirm a stronger advance. In the 4 hours chart, the technical picture is neutral to bullish, as the price found intraday support in a bullish 10 SMA, but indicators lack directional strength.

Support levels: 118.60 118.25 117.80

Resistance levels: 119.40 119.85 120.20

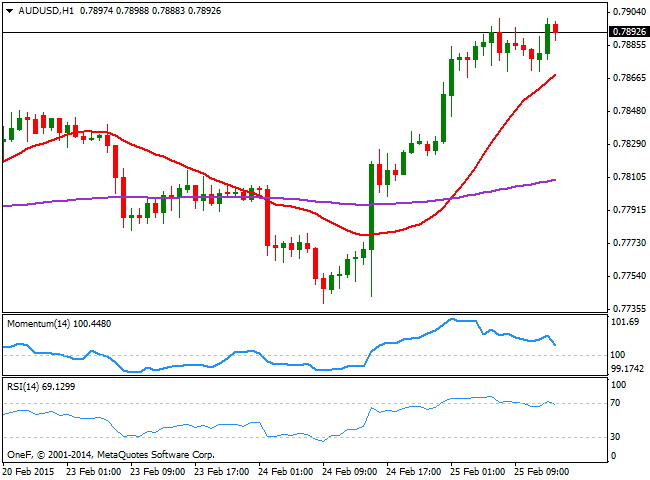

AUD/USD Current price: 0.7892

View Live Chart for the AUD/USD

The Australian dollar continues advancing, having flirted with the 0.7900 level against the greenback. The antipodean currency found support in Chinese data, as the HSBC Flash Manufacturing PMI surprised with a rise above the critical 50 mark, up to 50.1 points for February. Technically, the 1 hour chart shows that the technical indicators are retracing from overbought levels, although the price holds near the highs, suggesting the pair has still scope to advance. In the 4 hours chart the price stalled at the 200 EMA, currently around 0.7900, having been unable to sustain gains above it since July 2014. Therefore, a continued advance above it during the upcoming sessions, should signal an interim bottom in the pair with chances of a break above the 0.8000 mark.

Support levels: 0.7865 0.7830 0.7780

Resistance levels: 0.7900 0.7940 0.7990

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.