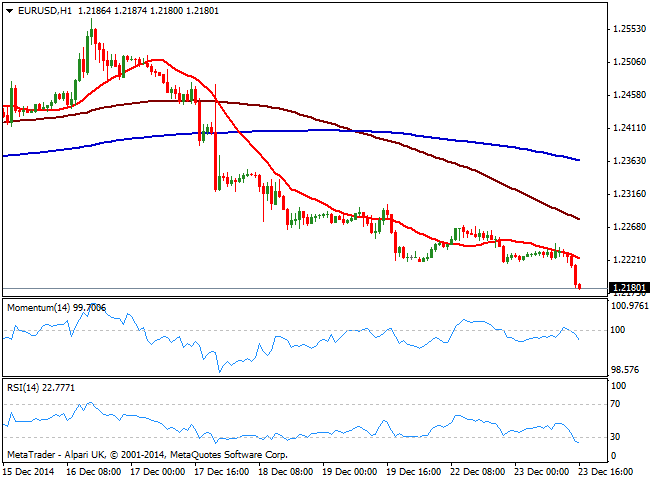

EUR/USD Current price: 1.2180

View Live Chart for the EUR/USD

The EUR/USD pair sunk to fresh year lows below 1.2180 on the back of impressive US GDP readings, up to 5% in the final revision of the Q3, the best reading in over a decade. With further US data yet to be released, local indexes futures soared to record highs ahead of the opening, also supporting the dollar’s advance. Overall, the dollar bullish trend remains firms in place despite the low intraday volumes, and the EUR/USD 1 hour chart supports further declines as the price is extending below a bearish 20 SMA and indicators heading south below their midlines. In the 4 hours chart indicators had turned back south deep in negative territory, with RSI extending its decline around 25. Upcoming US housing and consumption readings hold the key to fresh lows, as if the numbers continue to be encouraging, the slide can extend down to 1.2150.

Support levels: 1.2150 1.2120 1.2085

Resistance levels: 1.2220 1.2245 1.2280

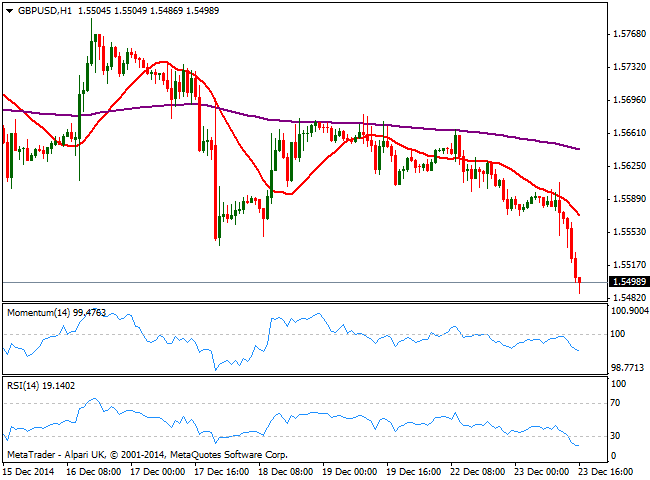

GBP/USD Current price: 1.5498

View Live Chart for the GBP/USD

The Cable got a double GDP hit, with the UK release early Europe showing growth shrunk to 2.6% yearly basis and the third quarter GDP printing 0.7%, and USD one rising to an 11-year high of 5%. The pair trades below the 1.5500 level for the first time since August 2013, and the 1 hour chart presents a strong bearish momentum coming from technical readings, with RSI at 18 and 20 SMA accelerating its bearish decline. In the 4 hours chart technical indicators are biased lower deep into negative territory, all of which supports further declines.

Support levels: 1.5585 1.5540 1.5500

Resistance levels: 1.5525 1.5665 1.5700

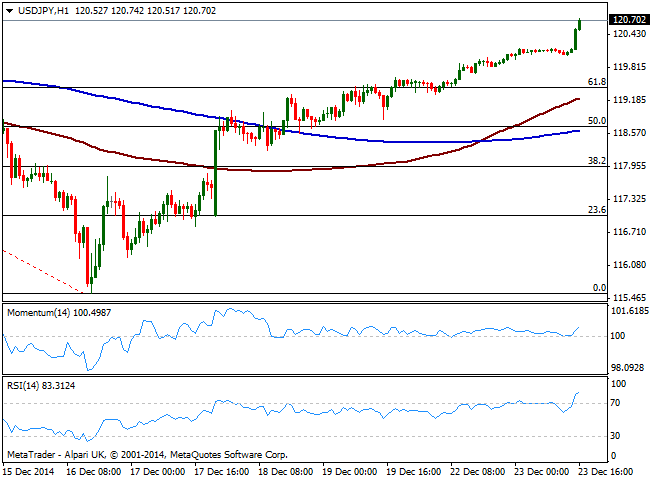

USD/JPY Current price: 120.72

View Live Chart for the USD/JPY

The USD/JPY pair extends its advance after the news, approaching the 121.00 figure first time in 2 weeks. The 1 hour chart shows indicators heading north in positive territory, with 100 SMA extending above 200 one, both below current levels. In the 4 hours chart momentum aims higher above 101 whilst RSI advances above 70, supporting further short term advances, particularly if upcoming US data up beats.

Support levels: 120.45 120.00 119.65

Resistance levels: 120.85 121.10 121.40

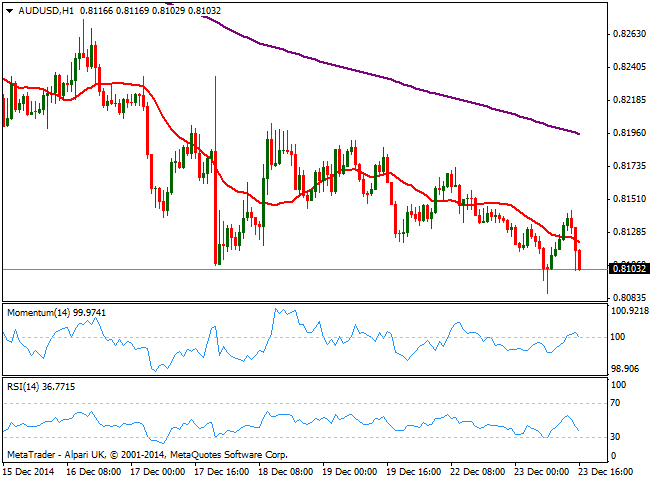

AUD/USD Current price: 0.8103

View Live Chart of the AUD/USD

The AUD/USD pressures the 0.8100 level after posting a fresh multiyear low of 0.8087 during the last Asian session. Having found sellers in the 0.8140 price zone, the 1 hour chart shows that the price is developing again below its 20 SMA whilst indicators turned lower, albeit momentum still lacks strength. In the 4 hours chart the pair maintains the bearish tone seen on previous updates, with 20 SMA acting as intraday resistance around mentioned high and indicators heading strongly south in negative territory, supporting further declines.

Support levels: 0.8090 0.8060 0.8025

Resistance levels: 0.8140 0.8170 0.8200

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.