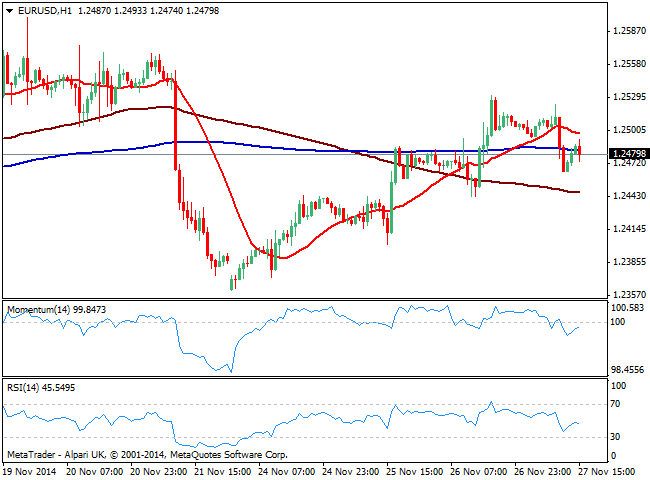

EUR/USD Current price: 1.2479

View Live Chart for the EUR/USD

The EUR/USD pair lost the 1.2500 level during the European session, following mixed releases in the EZ, among which the most relevant resulted to be Draghi’s words before the finish parliament, pointing out QE is indeed available, albeit latest measures still need time to work out: in plain english, no action expected for next week coming from the ECB. German inflation readings also disappointed, printing 0.00% monthly basis, and diluting partially latest optimism regarding the economy. With the US closed today on Thanksgiving, there’s little to expect from majors during the rest of the day. Short term, the EUR/USD 1 hour chart shows price below its 20 SMA and indicators directionless below their midlines, while the 4 hours chart maintains the mild positive tone, with price recovering from a daily low of 1.2464 and above a bullish 20 SMA as indicators hold also lacking directional strength, above their midlines.

Support levels: 1.2440 1.2400 1.2360

Resistance levels: 1.2520 1.2555 1.2600

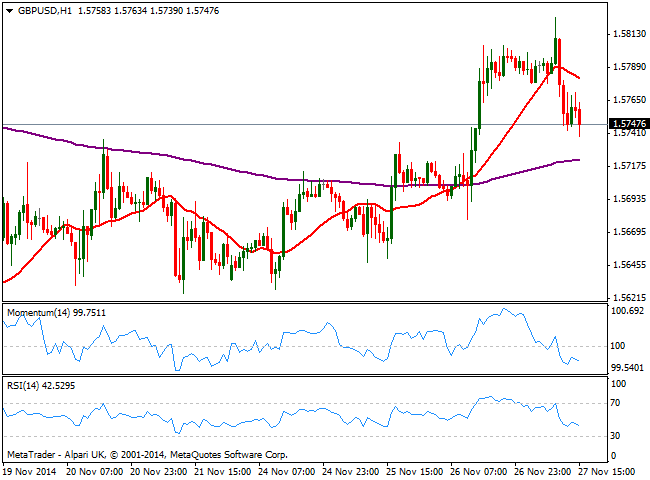

GBP/USD Current price: 1.5746

View Live Chart for the GBP/USD

The GBP/USD pair eased from a fresh 11-day high of 1.5825, now pressuring the top of these last 2-week range around 1.5740. With no local data, Pound slide has been attributed to dollar short term momentum after Draghi’s words. Technically, the 1 hour chart shows an increasing bearish potential, with price below its 20 SMA and indicators heading lower well below their midlines. In the 4 hours chart 20 SMA maintains its bullish slope currently around 1.5710, while indicators stand flat in positive territory. Further declines below 1.5740 should deny chances of a firmer advance rather than suggest a continued slide for today.

Support levels: 1.5740 1.5700 1.5660

Resistance levels: 1.5770 1.5825 1.5860

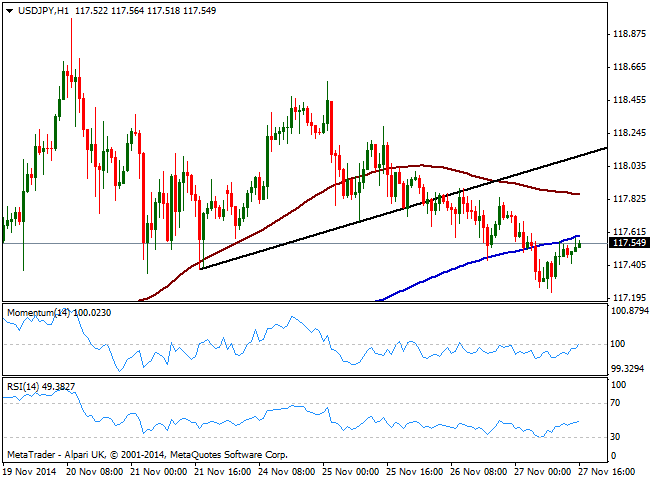

USD/JPY Current price: 117.54

View Live Chart for the USD/JPY

Yen advanced against the greenback, dragging USD/JPY to a daily low of 117.23, from where the pair bounced during the European morning. Still subdued, the 1 hour chart shows price now below 200 SMA while indicators aim higher below their midlines, limiting the upside. In the 4 hours chart indicators head lower having been rejected from their midlines, which maintains the bearish bias alive.

Support levels: 117.35 117.00 116.65

Resistance levels: 117.95 118.40 118.90

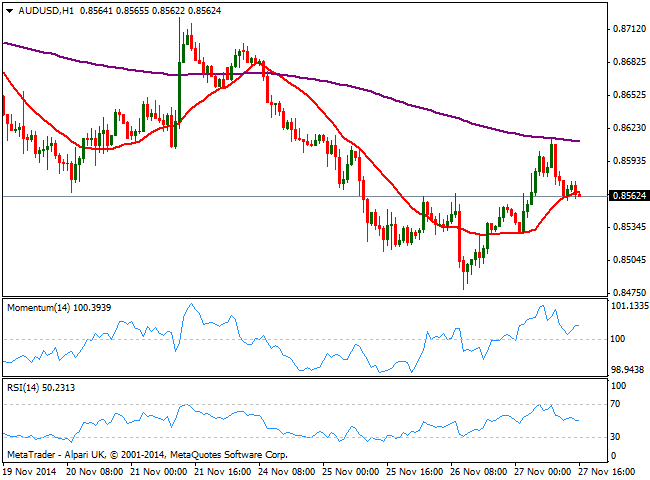

AUD/USD Current price: 0.8562

View Live Chart of the AUD/USD

Australian dollar recovered over Asian hours, reaching 0.8614 against the greenback, as local Private Capital Expenditures beat expectations, yet the dominant trend prevailed and sellers took their chances: the pair trades back in its mid 0.85, with the 1 hour chart showing price now hovering around a flat 20 SMA and indicators diverging from each other above their midlines. In the 4 hours chart however, indicators barely corrected oversold readings and turned back south in negative territory, while 20 SMA maintains its bearish slope, supporting the dominant bearish trend.

Support levels: 0.8530 0.8500 0.8470

Resistance levels: 0.8580 0.8620 0.8645

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.