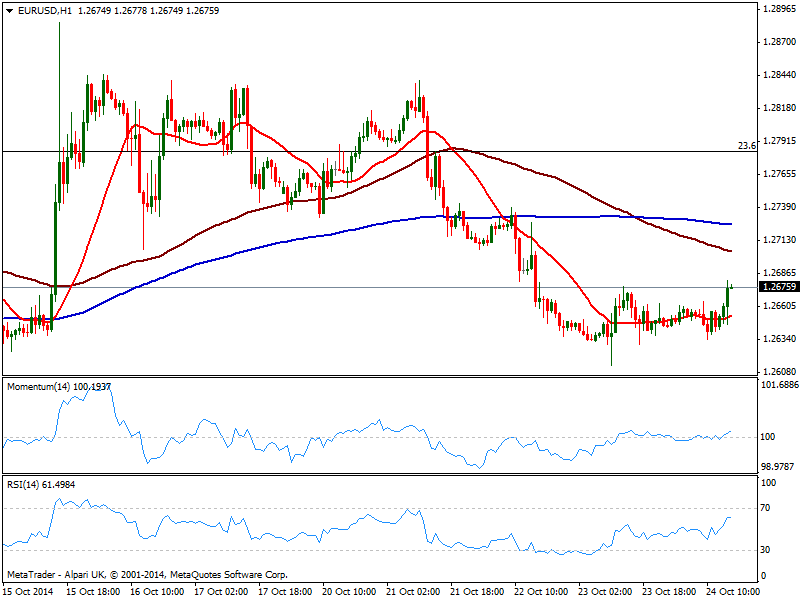

EUR/USD Current price: 1.2670

View Live Chart for the EUR/USD

Dollar is under mild pressure across the board, with the EUR/USD breaking its 30 pips range to the upside on news EU draft doc says 25 banks have shown a capital shortfall in the ECB stress tests. Slightly above expected, the pair lost 30 pips right after the news, but jumped quickly afterwards, as the news seem to have bring some relief over the economic situation in the EZ. Market players have been on hold for most of the day, as the results of the test are expected to be released on Sunday, and with FED meeting next Wednesday, cautious stance imposed. Technically, the lack of movement over the last few hours has left the short term picture for the most flat, as indicators present a quite neutral stance. In the 4 hours chart, a strong resistance area is clear around 1.2685, and it would take a price acceleration above to see the pair gaining further on the day.

Support levels: 1.2620 1.2580 1.2550

Resistance levels: 1.2685 1.2720 1.2750

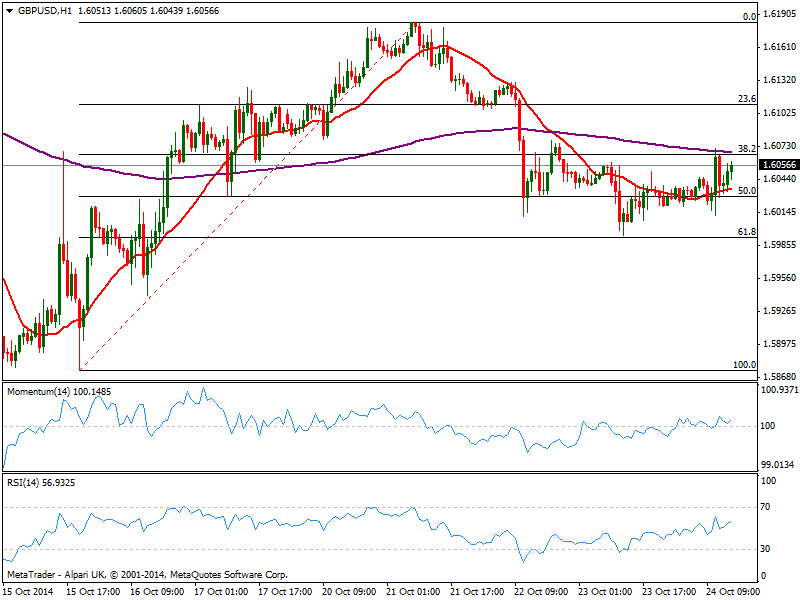

GBP/USD Current price: 1.6056

View Live Chart for the GBP/USD

Pound saw some demand after the release of firm GDP readings for last quarter in the UK which sent GBP/USD up to 1.6071, so far the daily high. The 1 hour chart shows a mild positive tone, but a strong resistance level at mentioned high, the 38.2% retracement of the latest daily bullish run. In the 4 hours chart 20 SMA presents a strong bearish slope and stands also in the 1.6070 level, while indicators head higher still below their midlines: price needs then to advance beyond mentioned high to be able to extend its intraday gains up to the 1.6225 strong static resistance level.

Support levels: 1.60301.5995 1.5950

Resistance levels: 1.6070 1.6125 1.6160

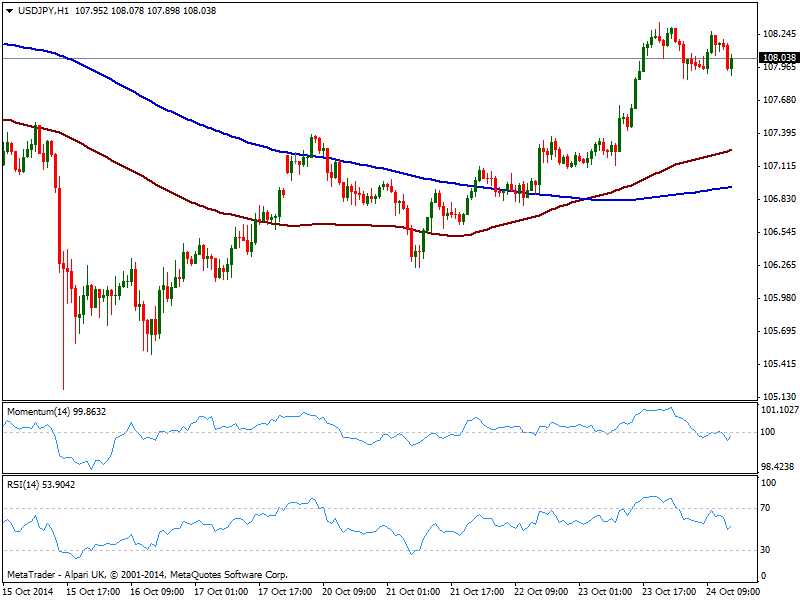

USD/JPY Current price: 108.03

View Live Chart for the USD/JPY

The USD/JPY consolidates its latest gains around the 108.00 figure having found short term buying interest around 107.80 price zone. The 1 hour chart shows 100 SMA advanced further above 200 one, both well below current price, while indicators corrected overbought readings, now aiming back higher around their midlines but not confirming an upward continuation. In the 4 hours chart indicators hold in positive territory but lost the bullish strength and turn slowly south supporting some limited downward correction.

Support levels: 107.80 107.45 107.00

Resistance levels: 108.50 108.90 109.30

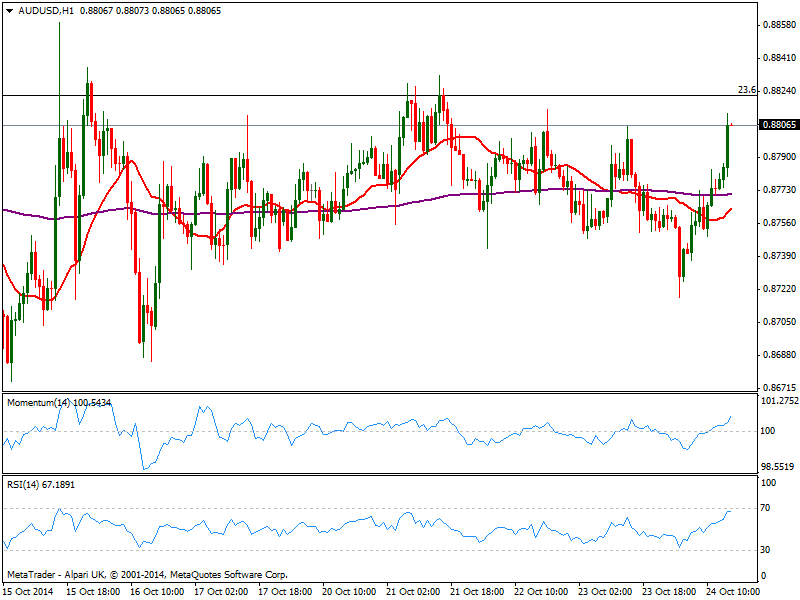

AUD/USD Current price: 0.8805

View Live Chart of the AUD/USD

Australian dollar accelerates higher against the greenback, nearing critical 0.8820 early US session, and with the short term picture showing a stronger upward momentum than in any other high yielder. Despite the short term strength however, the pair remains within range and as long as below mentioned level, chances to the upside remain limited. A break through it on the other hand, should lead to a firmer advance up to 0.8850/60 yet if the level holds, a quick retracement to 0.8770 is then likely.

Support levels: 0.8770 0.8730 0.8690

Resistance levels: 0.8820 0.8860 0.8900

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.