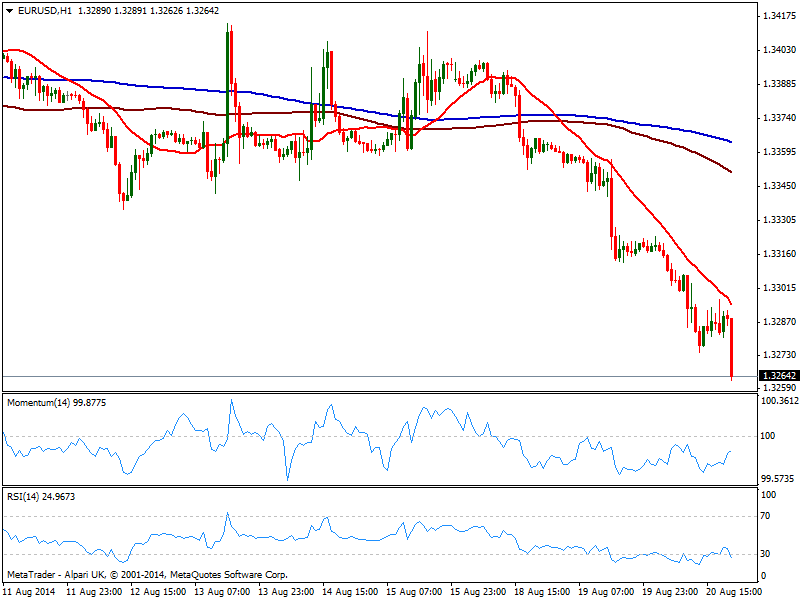

EUR/USD Current price: 1.3264

View Live Chart for the EUR/USD

The American dollar adds another day of gains, advancing after FOMC latest Minutes’ release: many officers said jobs gain might bring a sooner rate hike, giving the greenback a boost late US session, and despite several also pointed out the labor market is far from fully normal. But as the FED comes closer to normalization, higher will go the USD. Earlier on the day, soft European data pushed EUR/USD below the 1.3300 level, and the pair was unable to recover above it, now extending its decline to fresh year lows below 1.3270. The hourly chart shows 20 SMA with a steady bearish slope right above current price, while indicators hold in negative territory, lacking directional strength at the time being not yet reflecting latest slide. In the 4 hours chart however, indicators are biased lower despite in oversold levels, supporting a continuation of the dominant bearish trend.

Support levels: 1.3250 1.3210 1.3170

Resistance levels: 1.3300 1.3330 1.3370

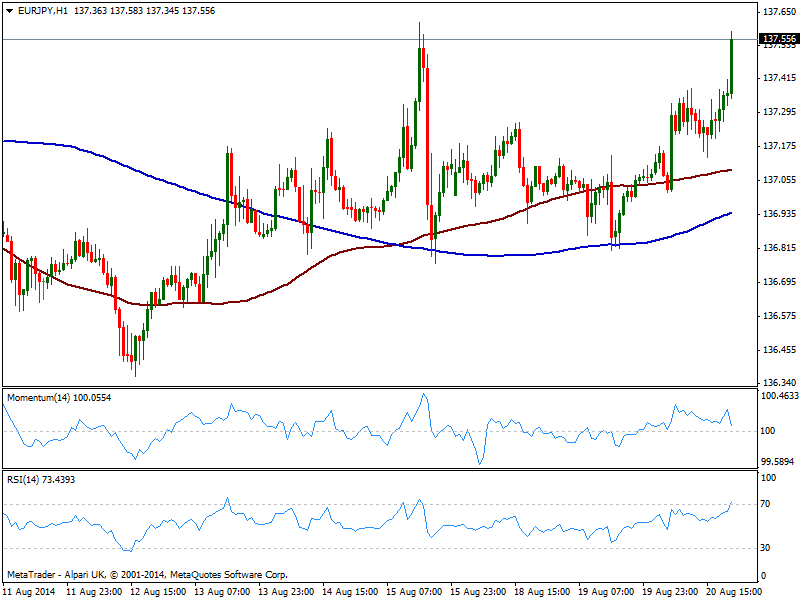

EUR/JPY Current price: 137.54

View Live Chart for the EUR/JPY

Yen weakness outstands on Wednesday despite the uneventful action in stocks markets, with most of US indexes hovering around their opening levels. Some news coming from Japan suggests the country is considering adding 1T of stimulus, which should continue to undermine any possible yen strength, something yet to be confirmed. The EUR/JPY however, quickly approaches the 137.60 level with the news, with the hourly chart showing a mild positive tone coming from technical readings, as price advances above flat moving averages, while indicators stand in positive territory, not yet reflecting latest advance. In the 4 hours chart technical readings present also a bullish tone yet gains should remain limited if EUR continues weakening across the board.

Support levels: 137.30 136.80 136.40

Resistance levels: 137.60 138.00 138.40

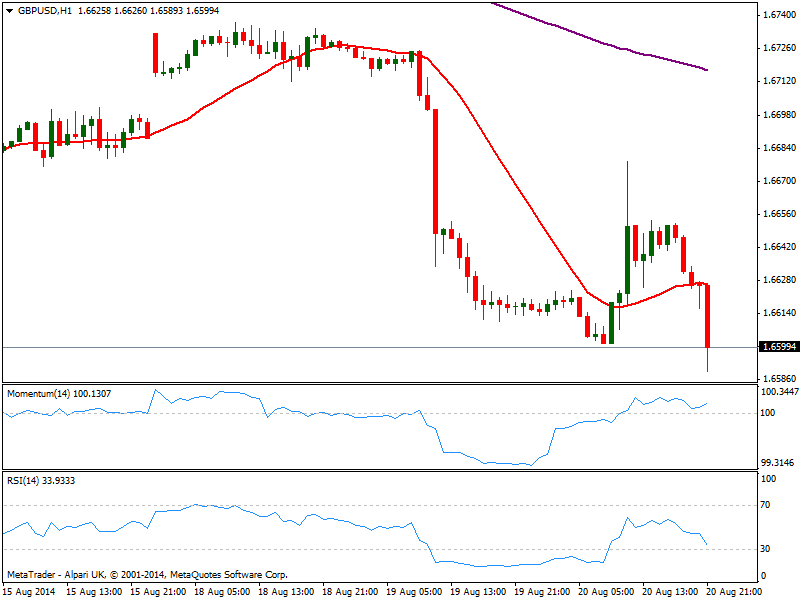

GBP/USD Current price: 1.6599

View Live Chart for the GBP/USD

The GBP/USD struggles to hold above the 1.6600 level, having posted so far a daily low of 1.6589. The pair saw a spark of upward momentum early Europe, when BoE’s Minutes showed 2 of the 9 voting members went for a rate hike as soon as this month. Nevertheless, the pair stalled at 1.6678 before reversing, with the 1 hour chart now showing price below its 20 SMA, momentum aiming higher in neutral territory and RSI gaining strong bearish tone into negative territory, keeping the pressure to the downside. In the 4 hours chart technical readings present a cleared bearish tone, with indicators turning strongly south after correcting oversold conditions.

Support levels: 1.6580 1.6545 1.6510

Resistance levels: 1.6630 16680 1.6710

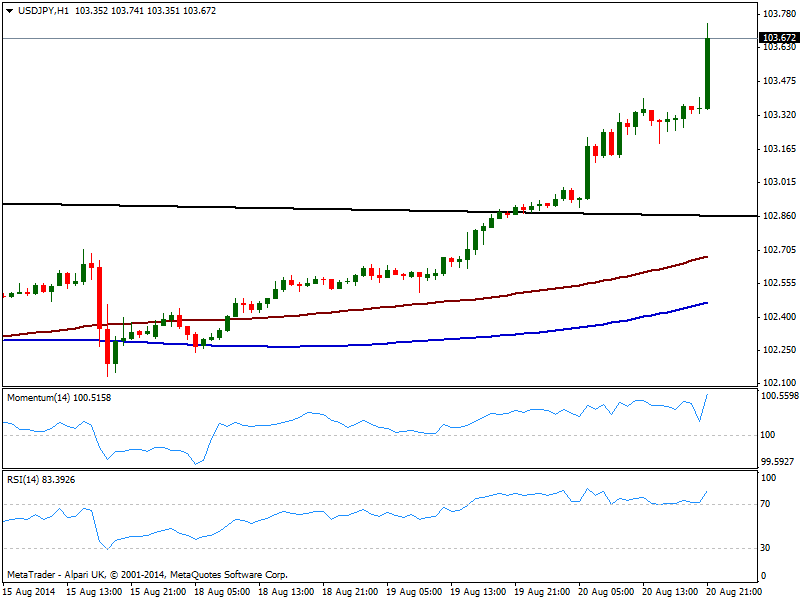

USD/JPY Current price: 103.70

View Live Chart for the USD/JPY

The USD/JPY reached 103.74 levels not seen since April this year, maintaining the positive tone seen on previous updates. Technically, the hourly chart shows a strong upward tone coming from indicators, albeit some consolidation below 103.70/80 may be seen before a new leg higher. In the 4 hours chart indicators aim strongly up despite in extreme overbought levels, supporting also some follow through in price for the upcoming sessions.

Support levels: 103.40 103.20 102.80

Resistance levels: 103.75 104.10 104.45

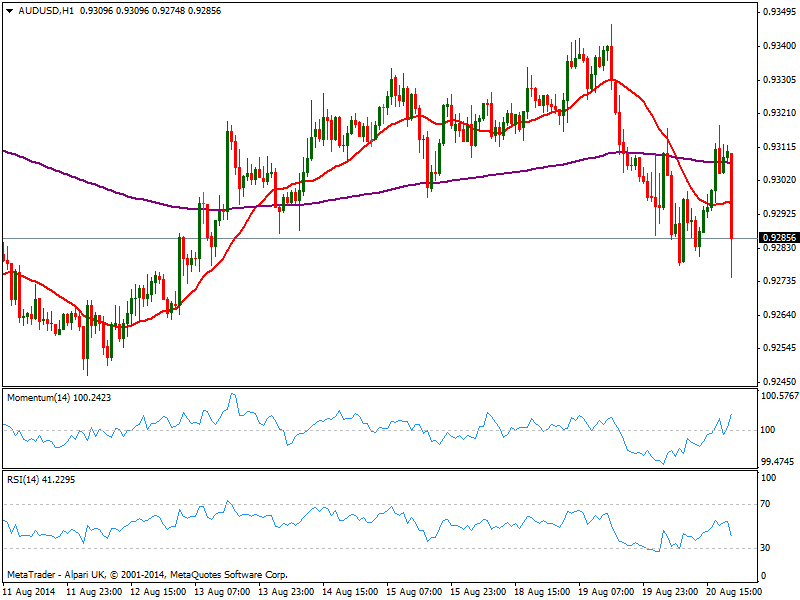

AUD/USD Current price: 0.9285

View Live Chart for the AUD/USD Aussie latest attempt of recovery against the greenback failed to hold above 0.9300: the pair is back under pressure, with price now breaking below its 20 SMA and indicators turning lower within mid range. In the 4 hours chart 20 SMA maintains a strong bearish slope and caps the upside around 0.9310, while indicators turned lower in negative territory, pointing for a continued slide that will likely extend on a strong break below 0.9250/60 strong static support zone.

Aussie latest attempt of recovery against the greenback failed to hold above 0.9300: the pair is back under pressure, with price now breaking below its 20 SMA and indicators turning lower within mid range. In the 4 hours chart 20 SMA maintains a strong bearish slope and caps the upside around 0.9310, while indicators turned lower in negative territory, pointing for a continued slide that will likely extend on a strong break below 0.9250/60 strong static support zone.Support levels: 0.9260 0.9220 0.9180

Resistance levels: 0.9330 0.9370 0.9410

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.