EUR/USD Current price: 1.3466

View Live Chart for the EUR/USD

The EUR/USD trades a couple pips above a fresh year low posted early US session, at 1.3458. The movement came after the release of US CPI, mostly in line with expectation except from core readings that grew less than expected: dollar lost some ground against most rivals after the news, albeit the EUR was unable to regain the 1.3500 level and remained under pressure.

The lack of follow through is quite notorious, but the bearish pressure undeniable: the hourly chart shows indicators turning flat in extreme oversold readings, far from suggesting an upward correction, while moving averages stand well above current price, with 20 SMA presenting a strong bearish slope and acting as dynamic resistance around 1.3500. In the 4 hours chart technical readings present a strong bearish momentum, with immediate support now at 1.3440: further declines below this last should lead to a continued slide towards the 1.3280/1.3300 area for the upcoming days.

Support levels: 1.3440 1.3410 1.3380

Resistance levels: 1.3500 1.3535 1.3570

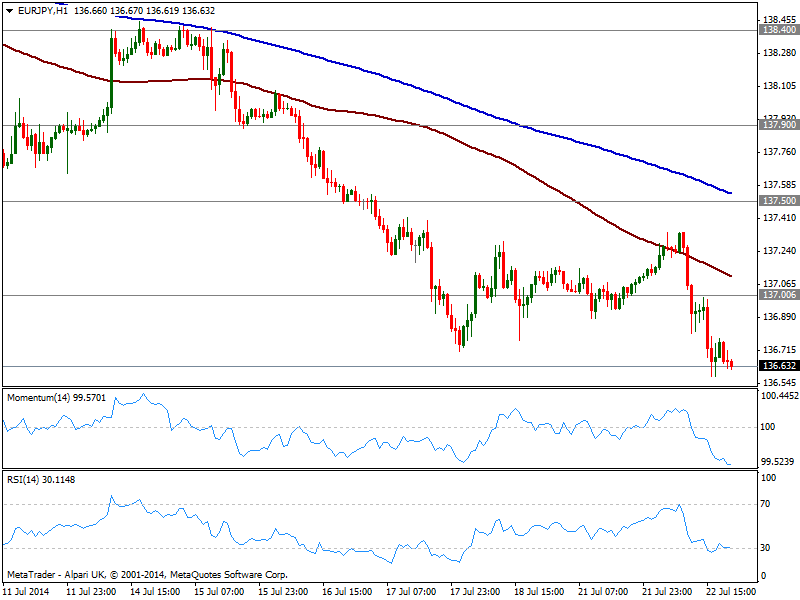

EUR/JPY Current price: 136.63

View Live Chart for the EUR/JPY

US stocks edged higher this Tuesday, with S&P reaching a new all time high before pulling back some on the back of healthy company earnings giving yen some intraday support: the EUR/JPY drifted lower, posting a daily low of 136.58 where it stands as a new day starts. The hourly chart shows price failed to overcome its 100 SMA on an early attempt of recovery, while indicators maintain a clear bearish momentum that supports the downside. In the 4 hours chart indicators head south below their midlines, also keeping the risk to the downside in the pair: further slides point to a probable test of 136.20 in the short term, in route to fresh year lows.

Support levels: 136.60 136.20 135.75

Resistance levels: 137.00 137.50 137.90

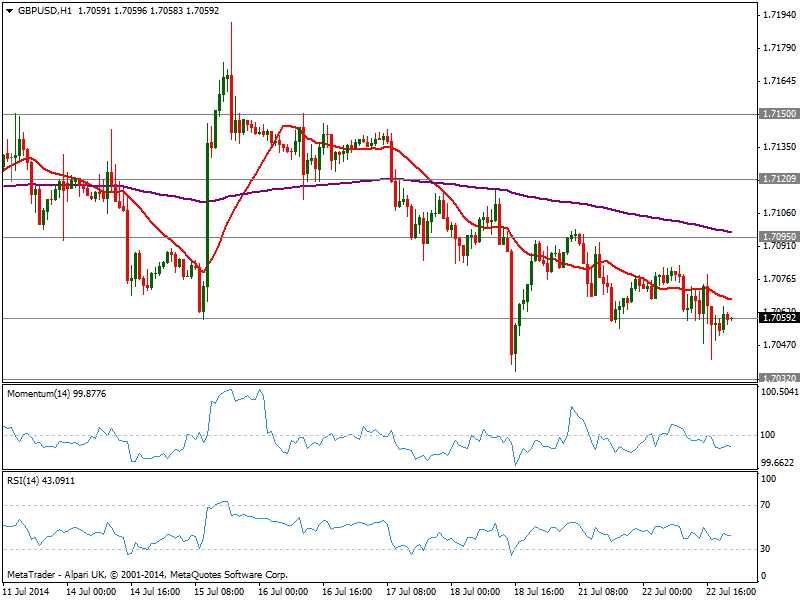

GBP/USD Current price: 1.7059

View Live Chart for the GBP/USD

The GBP/USD traded lower in range, contained ahead of Wednesday UK data including BOE Minutes and a Carney speech. Nevertheless, the pair has extended its weekly decline to a low of 1.7040, and spikes were short of 1.7100, while the hourly chart presents a bearish bias, all of which supports some upcoming declines. In the 4 hours chart technical indicators present a mild bearish tone, as per heading lower below their midlines, with 200 EMA and last week low around 1.7030 acting as critical support for the upcoming hours.

Support levels: 1.7030 1.6985 1.6950

Resistance levels: 1.7095 1.7120 1.7150

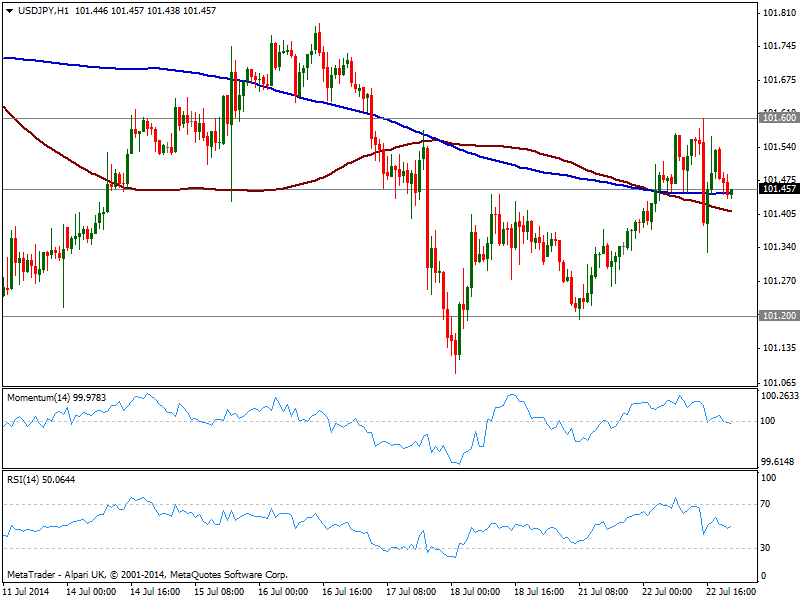

USD/JPY Current price: 101.46

View Live Chart for the USD/JPY

USD/JPY recovery stalled at critical 101.60 static resistance level, but the pair managed anyway to close the day with some mild gains. The hourly chart shows price right above its moving averages, but indicators turning lower around their midlines, still quite neutral. In the 4 hours chart price remained capped by its 100 SMA while indicators stand also in neutral territory, flat around their midlines.

Support levels: 101.20 101.05 100.70

Resistance levels: 101.60 101.95 102.35

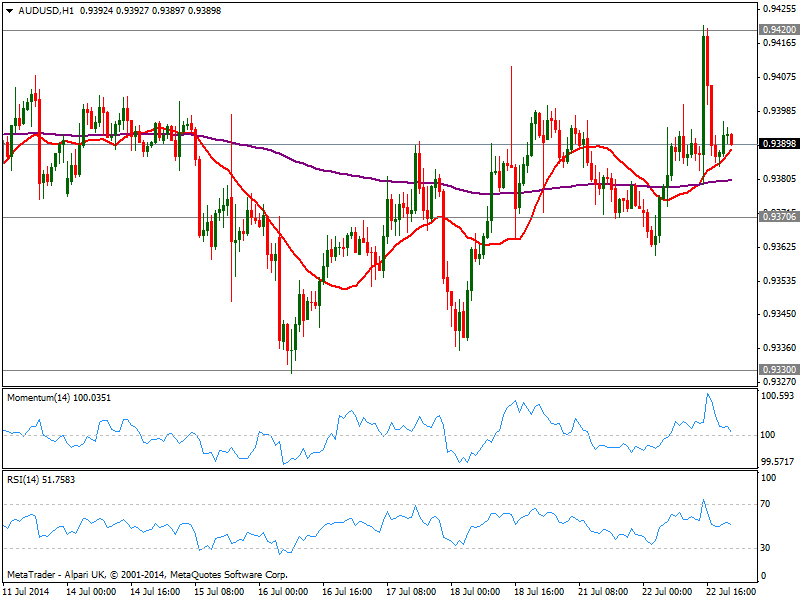

AUD/USD Current price: 0.9389

View Live Chart for the AUD/USD

The AUD/USD surged up to 0.9421 before selling interest pushed price back below the 0.9400 mark. Slightly higher, the pair trades still within range and far from establishing a clear direction. With Australian inflation readings ahead, the pair however may become more interesting in Asian hours, as CPI divergences should trigger some action either side of the board: below 0.9370, the pair may extend its decline down to 0.9330 critical midterm support, while above 0.9420, immediate target stands at 0.9460. Technically, the 1 hour chart shows price holding above a bullish 20 SMA as indicators erased all of its overbought conditions and stand right above their midlines, while the 4 hours chart shows a similar picture.

Support levels: 0.9370 0.9330 0.9300

Resistance levels: 0.9420 0.9460 0.9500

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.