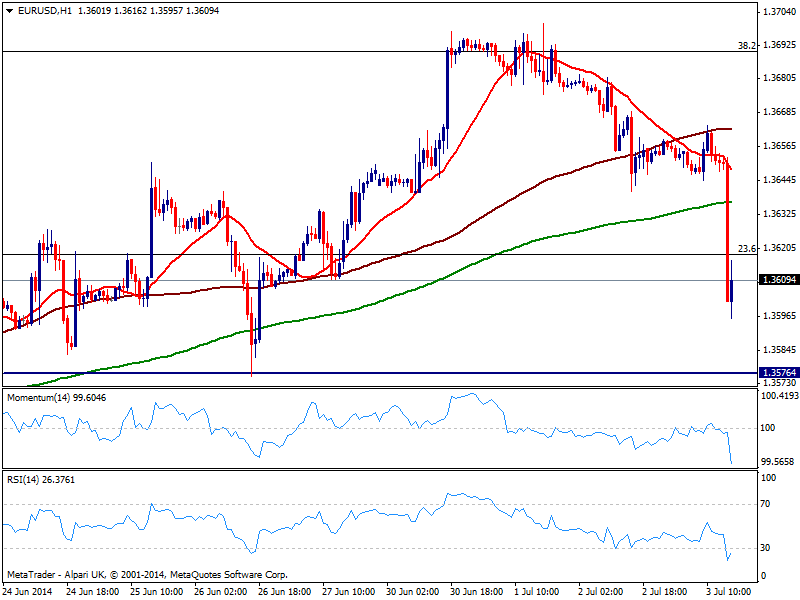

EUR/USD Current price: 1.3610

View Live Chart for the EUR/USD

The EUR/USD fell down to 1.3595 on the back of strong US employment figures and a mild dovish ECB that anyway brought nothing new. Dollar gathered some pace with the news, albeit the greenback strength is not enough as several majors had already reversed course. Technically, the hourly chart shows price capped now below the 23.6% retracement of the 1.40/1.35 daily fall, but recovering from the mentioned low. Indicators maintain a strong bearish tone both in 1 and 4 hours charts yet the downside seems limited to the strong support zone around 1.3570/80. A recovery above 1.3645 on the other hand, should see the pair extending its recovery back where it started.

Support levels: 1.3600 1.3570 1.3530

Resistance levels: 1.3645 1.3675 1.3700

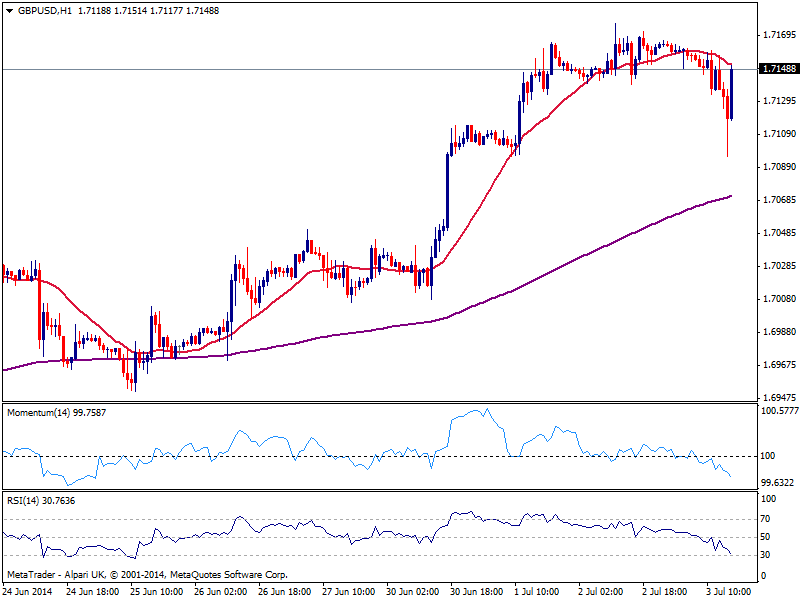

GBP/USD Current price: 1.7148

View Live Chart for the GBP/USD

After a kneejerk to 1.7095, the GBP/USD recovered the ground lost with the news and even extended near the daily high of 1.7166 immediate resistance. The hourly chart shows indicators heading lower below their midlines, still not reflecting the latest recovery, while 20 SMA caps the upside. In the 4 hours chart indicators continue heading lower from overbought readings, but hold above their midlines, as price recovers above its 20 SMA. Pound self strength is even more clear now, and fresh high should not be discarded.

Support levels: 1.7130 1.7095 1.7060

Resistance levels: 1.7180 1.7220 1.7250

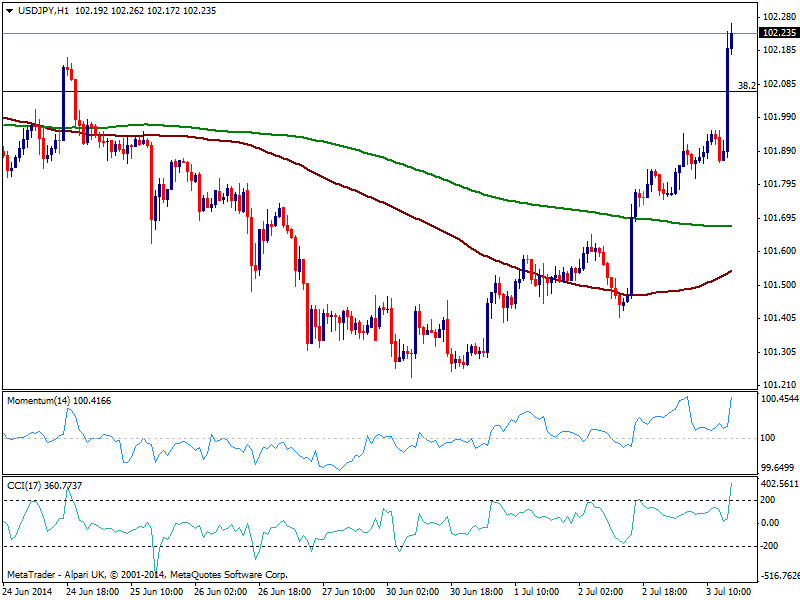

USD/JPY Current price: 102.24

View Live Chart for the USD/JPY

The USD/JPY advances beyond the 102.00 mark as strong employment figures combine with US indexes soaring to record highs: DJIA stands above 17,000 first time ever. Technically, the bullish momentum remains strong in the short term, while price stands above its 100 DMA around 102.20, first time in over 2 weeks. If the level holds, there’s scope for a continuation up to 102.80, where the pair will have to face a descendant trend line and a congestion zone of intraday highs.

Support levels: 102.20 101.90 101.60

Resistance levels: 102.35 102.80 103.10

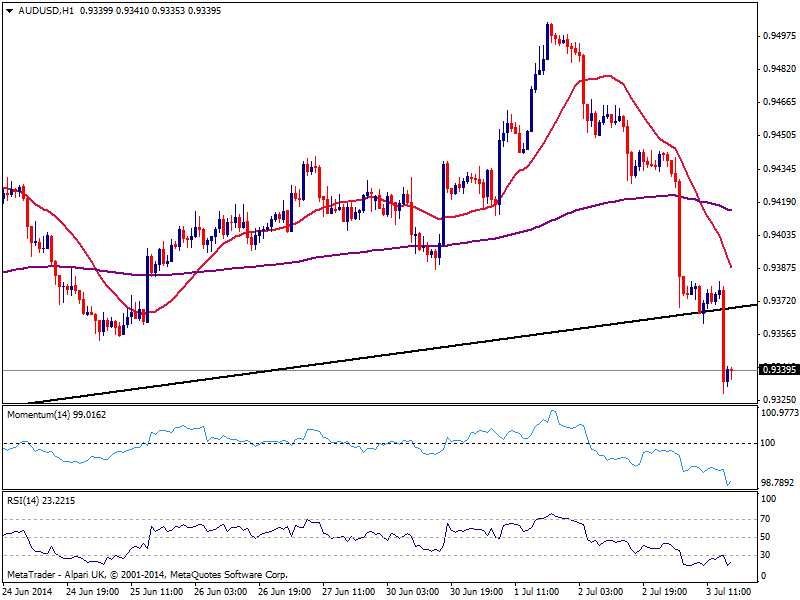

AUD/USD Current price: 0.9339

View Live Chart for the AUD/USD

Australian dollar has a really bad day after RBA Governor Stevens down talked the currency early Asia, with the AUD/USD also hit by US employment figures. The pair tests 0.9330 support area, maintaining a strong bearish tone despite indicators in oversold territory in the hourly chart. The level however has proved strong in the past, so a price acceleration below it is required to confirm further falls ahead. In the meantime, immediate resistance stands at 0.9370 and risk will remain to the downside as long as below it.

Support levels: 0.9330 0.9300 0.9260

Resistance levels: 0.9360 0.9420 0.9460

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.