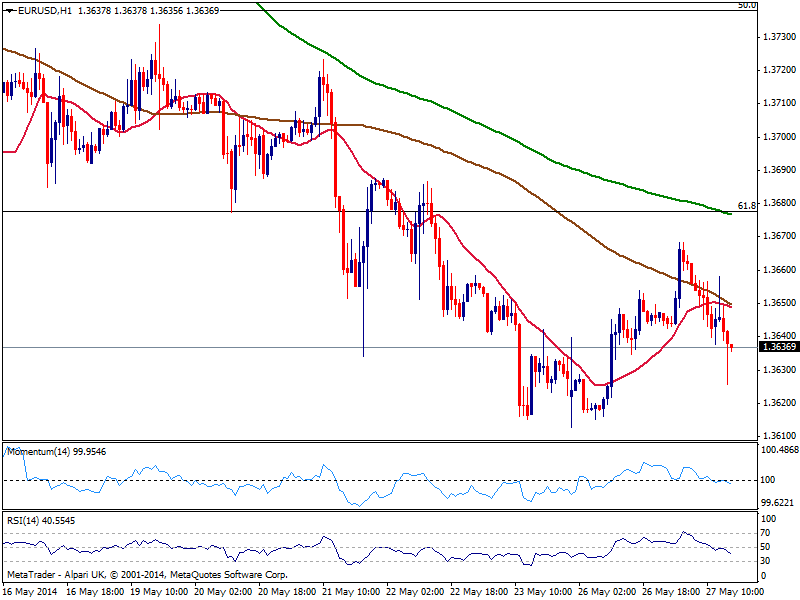

EUR/USD Current price: 1.3636

View Live Chart for the EUR/USD

The EUR/USD posted a daily low of 1.3625 following better than expected and a strong upward revision of previous numbers in US Durable Goods Orders, after being on the winning side for most of the last two sessions. Stocks are strongly up across the world, but gold nose dives below the $1280 mark, keeping the dollar on demand against other currencies. Minor housing data also came out positive, although market players seem to be awaiting for Draghi speech at 13:30 GMT.

As for the EUR/USD hourly chart, price stands below 20 and 100 SMAs, both converging now in the 1.3650 level and offering immediate resistance while indicators aim lower around their midlines, lacking actual strength. In the 4 hours chart a mild bearish tone is also present, with price back below a bearish 20 SMA and indicators heading lower also around their midlines. The lows around 1.3610 are still the level to break to confirm a downward extension, eyeing then 1.3520/40 price zone as next big support.

Support levels: 1.3610 1.3570 1.3535

Resistance levels: 1.3650 1.3680 1.3720

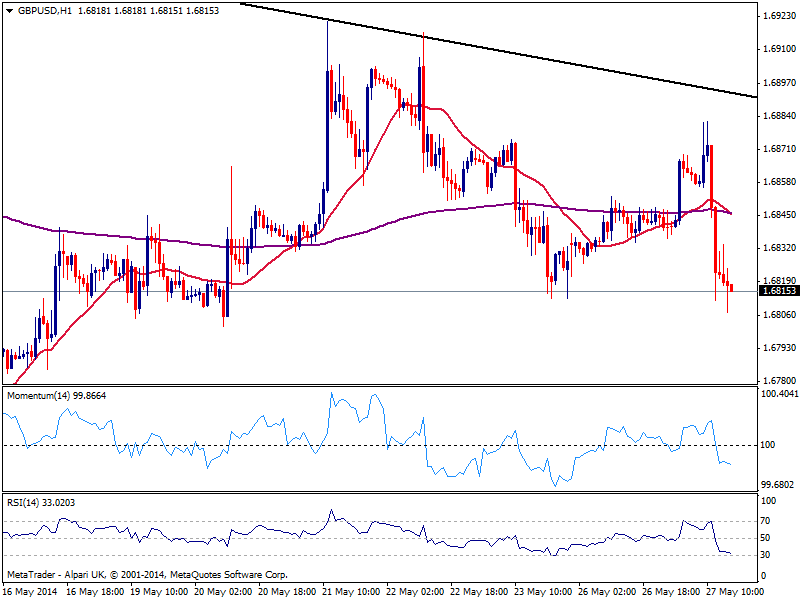

GBP/USD Current price: 1.6815

View Live Chart for the GBP/USD

The GBP/USD trades near past week lows, having suffered a kneejerk after the release of worse than expected mortgage approvals data. The pair is biased lower in the short term, as the hourly chart shows a strong acceleration below 20 SMA, and indicators gaining bearish tone in negative territory. In the 4 hours chart price struggles around a flat 200 EMA, while indicators accelerate lower below their midlines, keeping the pressure to the downside: a break below 1.6801 past week low should anticipated more falls, looking for a test of 1.6730, past May 15th daily low.

Support levels: 1.6810 1.6770 1.6730

Resistance levels: 1.6840 1.6885 1.6920

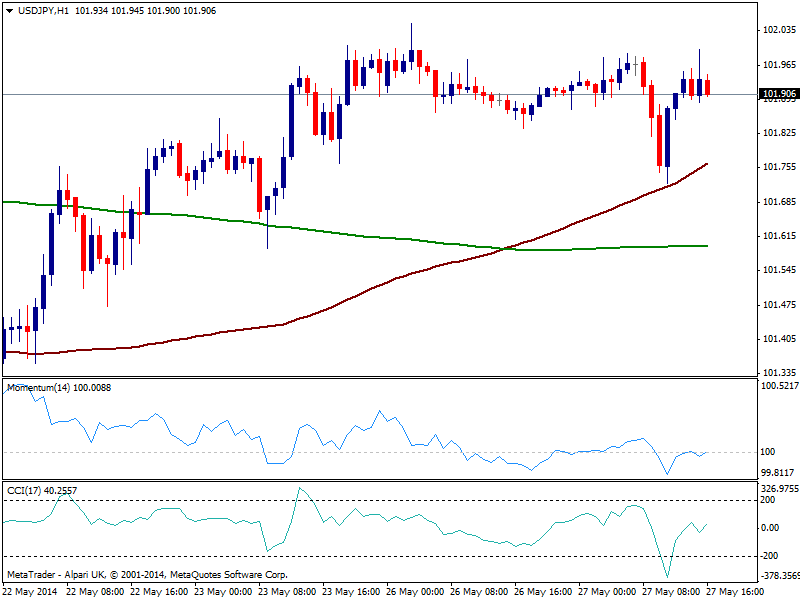

USD/JPY Current price: 101.90

View Live Chart for the USD/JPY

The USD/JPY keeps hovering right below the 102.00 level, unable to break higher but with limited retracements after a couple of intraday tests. The hourly chart shows latest deep found support in a bullish 100 SMA, currently offering short term support around 101.70, while indicators aim higher, albeit momentum presents a quite neutral stance. In the 4 hours chart the technical picture is bullish, yet as commented on previous updates, steady gains above the critical figure are required to confirm a new leg up.

Support levels: 101.60 101.20 100.70

Resistance levels: 102.00 102.35 102.70

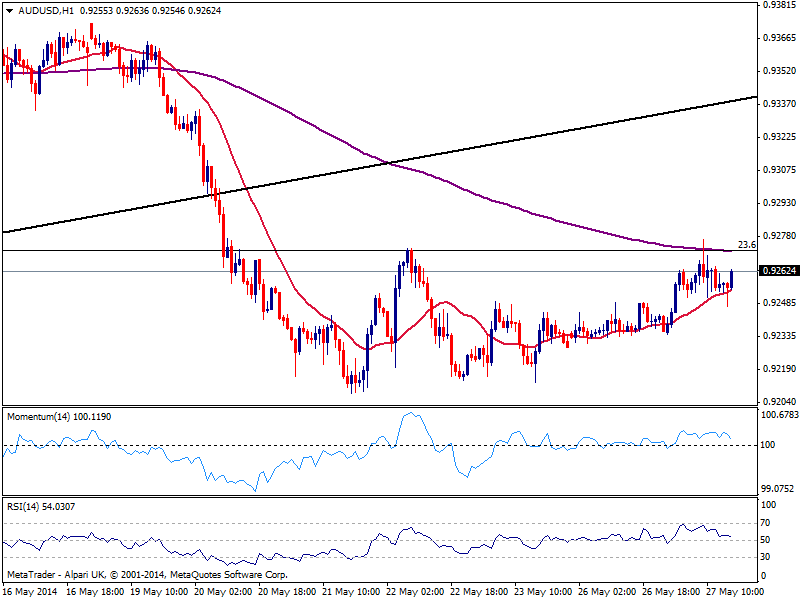

AUD/USD Current price: 0.9261

View Live Chart for the AUD/USD

Australian dollar is proving strong this Tuesday, as per its latest recovery up to current levels against the greenback. Despite the strong selloff in gold, the AUD/USD recovered from a session low of 0.9246 and approaches 0.9270 price zone, immediate Fibonacci resistance. The hourly chart shows price bouncing from a slightly bullish 20 SMA but indicators losing upward potential still above their midlines. In the 4 hours chart the picture is quite alike, with the positive tone lacking momentum at the time being.

Support levels: 0.9200 0.9170 0.9135

Resistance levels: 0.9240 0.9270 0.9310

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0850 ahead of Fedspeak

EUR/USD stays under modest bearish pressure and trades in negative territory slightly below 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD stays under modest bearish pressure near 1.2650

GBP/USD edges lower toward 1.2650 after posting marginal losses on Thursday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to gain traction. Fed policymakers are scheduled to speak later in the day.

Gold holds steady above $2,380, Fed speakers in focus

Gold trades with a positive bias on Friday and holds above $2,380. The benchmark 10-year US Treasury bond yield stays flat near 4.4% following Thursday's rebound, allowing XAU/USD to keep its footing ahead of speeches from Fed officials.

XRP steadies at $0.51 as Ripple plans to expand XRP Ledger, custody services in Africa

Ripple hovers close to $0.51 on Friday, above the psychologically important $0.50 level, as traders await the court ruling of the lawsuit against the US SEC and amid new commitments from the firm to expand its services in Africa.

Disputes and De-risking: US-China trade dispute changes trade flows

The bilateral trade dispute between the US and China is entering a new round and is leading to renewed discussions about the deglobalisation of global trade in goods.