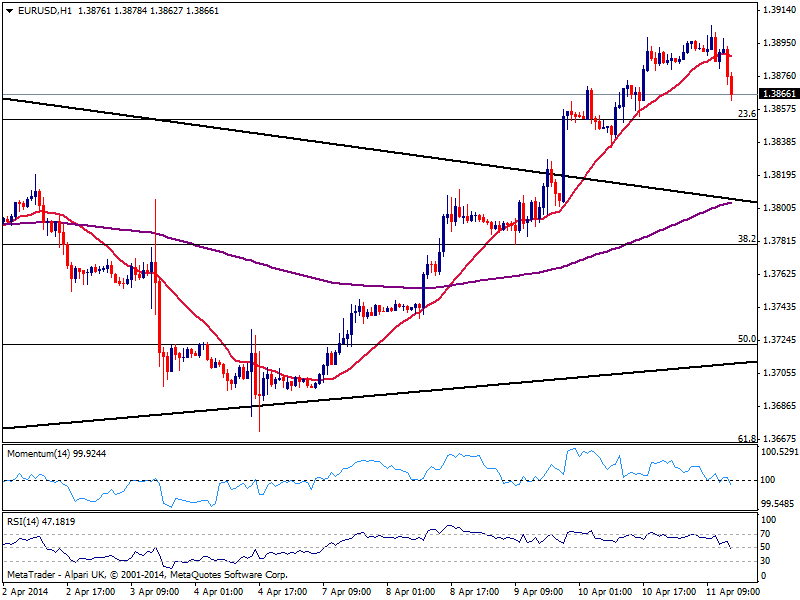

EUR/USD Current price: 1.3866

View Live Chart for the EUR/USD

Market is on its toes this Friday, with dollar firmer after the release of better than expected PPI figures and increasing risk aversion due to escalating Russian/Ukraine conflict. Stocks however are in the eye of the storm as shares all over the world are seeing another day of wild selloff, with US futures trading in deep red and S&P breaking through a critical support level ahead of the opening.

The EUR/USD feels the heat and trades slightly lower intraday after posting a high of 1.3905, with the hourly chart showing an increasing short term bearish potential: price accelerates below its 20 SMA as indicator turn bearish breaking through their midlines. In the 4 hours chart indicators hold in overbought territory, while 20 SMA maintains a strong upward momentum currently around 1.3830 offering short term support: a break below this last should see price extending its downward correction towards 1.3780 strong static support zone.

Support levels: 1.3850 1.3825 1.3780

Resistance levels: 1.3920 1.3965 1.4000

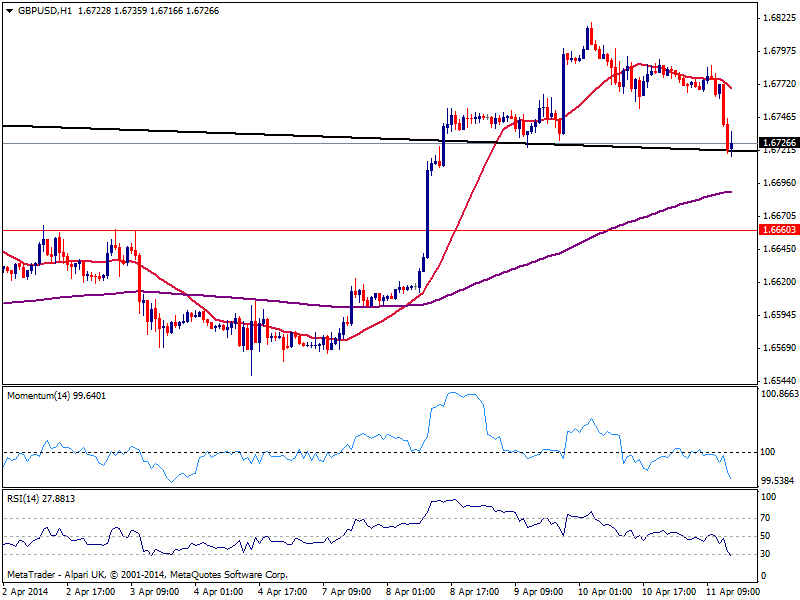

GBP/USD Current price: 1.6726

View Live Chart for the GBP/USD

Pound capitulated finally and trades lower against the greenback, having found short term buyers around 1.6720 for now, yet maintaining a bearish tone according to the hourly chart, as 20 SMA turns lower well above current price while indicators head strongly south in negative territory. In the 4 hours chart indicators had corrected the extreme overbought readings seen during the past updates, and approach their midlines losing bearish potential, while 20 SMA continues heading higher albeit above current price. The picture remains slightly bearish intraday, with a break below the daily low favoring an extension of the bearish correction down to 1.6660.

Support levels: 1.6720 1.6660 1.6625

Resistance levels: 1.6755 1.6820 1.6860

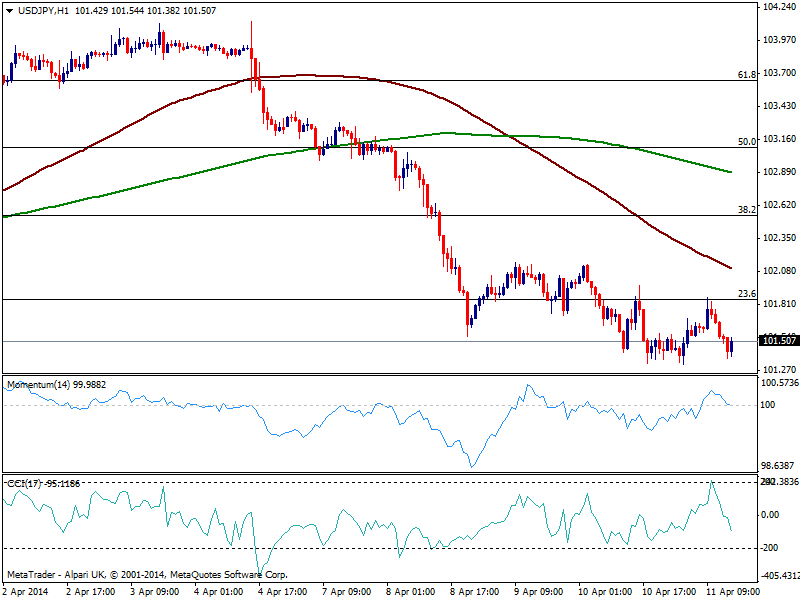

USD/JPY Current price: 101.50

View Live Chart for the USD/JPY

Yen maintains its dominant strength against the greenback, trading near the lows set in the 101.30 price zone. The hourly chart presents a clear bearish tone, with price being capped by a Fibonacci retracement around 101.90, 100 SMA accelerating lower and indicators heading south in negative territory. In the 4 hours chart the technical picture is also bearish, with momentum retracing from its midline after correcting oversold readings. A break below 101.20 however, is required to confirm a bearish acceleration eyeing 100.70 next.

Support levels: 101.20 100.70 100.30

Resistance levels: 101.90 102.35 102.60

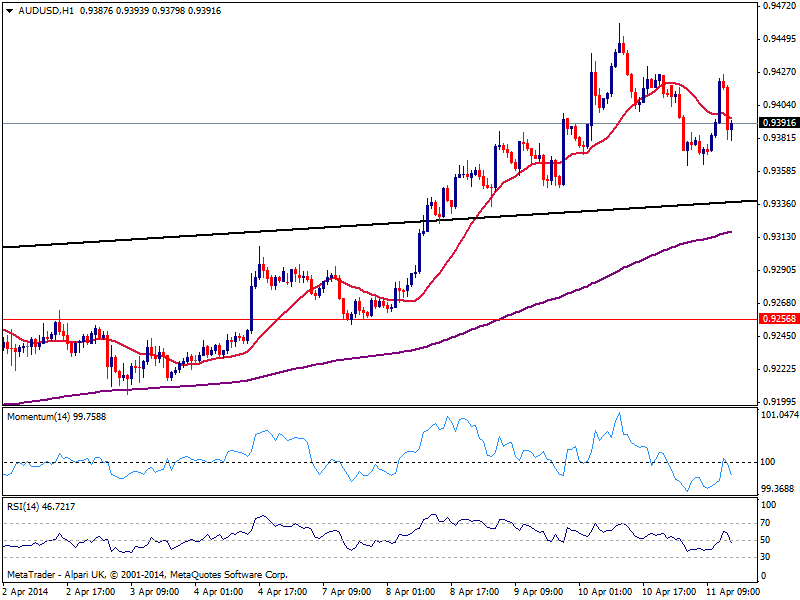

AUD/USD Current price: 0.9391

View Live Chart for the AUD/USD

The AUD/USD traded pretty steadied finding intraday support around 0.9360, and presenting slightly bearish tone ahead of the US opening: price is being capped by a bearish 20 SMA while indicators head lower around their midlines. In the 4 hours chart however, technical readings maintain a strong positive tone with price bouncing from a bullish 20 SMA and indicators bouncing from their midlines. Nevertheless, bulls remain in control unless price manages to break below 0.9320 strong static support zone.

Support levels: 0.9360 0.9320 0.9290

Resistance levels: 0.9410 0.9445 0.9485

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.