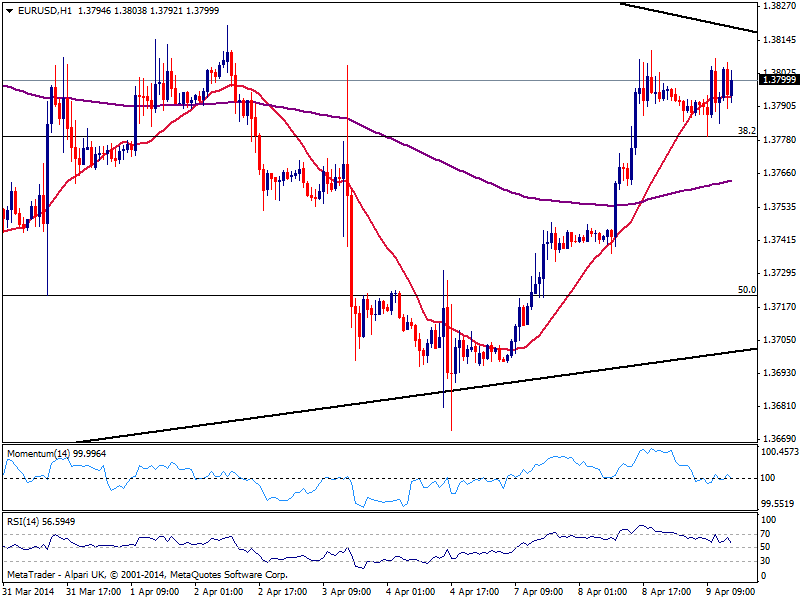

EUR/USD Current price: 1.3799

View Live Chart for the EUR/USD

The EUR/USD stands around the 1.3800 level since early Asian session opening, confined to a 30 pips range ahead of FOMC Minutes in the US afternoon. With little indications on upcoming movements coming from technical readings, the hourly chart shows at least the pair found buyers around the 1.3780 static Fibonacci support, yet remains below the descendant trend line coming from 1.3966, today around 1.3825. In the meantime, stocks halted last days’ bleeding and post some shy intraday gains ahead of US opening. Nevertheless, the market will likely wait for the Federal Reserve, expected to maintain the tone of previous meetings. If that’s the case and we continue to lack a certain date for rate hikes, the pair may finally break higher and extend towards the 1.3880 price zone.

Support levels: 1.3780 1.3750 1.3720

Resistance levels: 1.3825 1.3875 1.3910

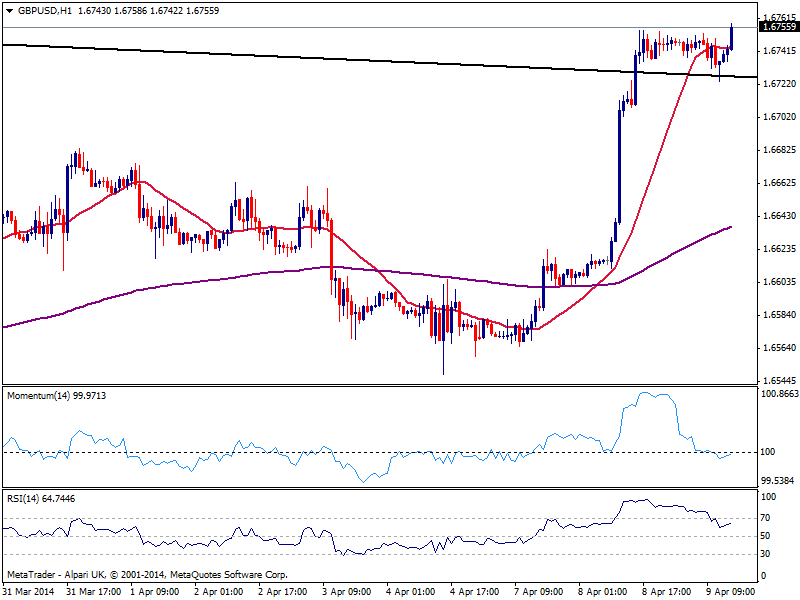

GBP/USD Current price: 1.6755

View Live Chart for the GBP/USD

The GBP/USD stands a few pips above yesterday’s high, having held above the descendant trend line broke yesterday, offering now support around 1.6720. The hourly chart shows indicators corrected extreme overbought readings and head slightly higher, while price stands above a flat 20 SMA. In the 4 hours chart indicators remain in overbought territory, looking a bit exhausted as 20 SMA maintains a strong bullish slope below current price. As per price behavior, current levels suggest there’s still room to the upside towards 1.6821 this year high.

Support levels: 1.6720 1.6660 1.6620

Resistance levels: 1.6760 1.6820 1.6860

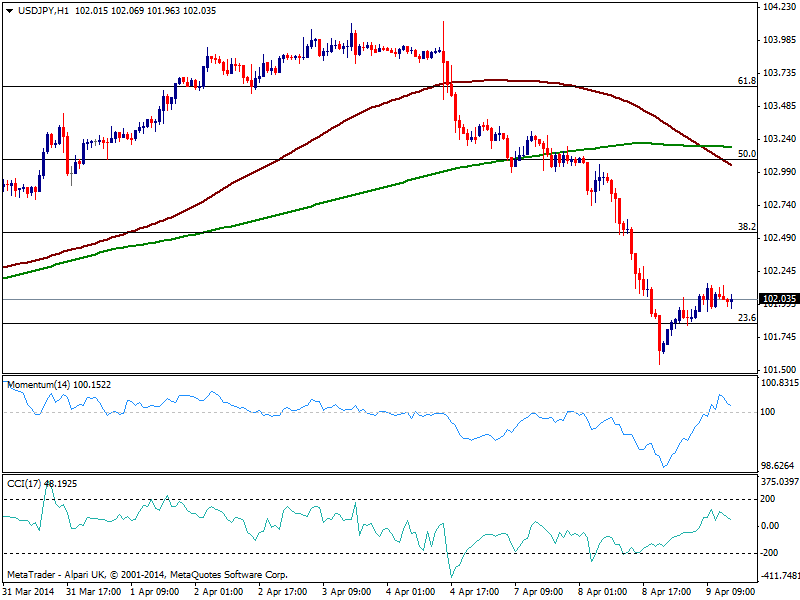

USD/JPY Current price: 102.03

View Live Chart for the USD/JPY

The USD/JPY corrected higher again trading along with Nikkei, albeit the recovery so far has been pretty shallow, with the pair struggling to maintain the 102.00 figure. The hourly chart shows indicators turning south in positive territory, while 100 SMA crosses 200 one to the downside well above current price, suggesting bears maintain the lead. In the 4 hours chart indicators corrected oversold readings, but hold well below their midlines and losing upward potential, which will likely help keep the upside contained.

Support levels: 101.25 100.80 100.35

Resistance levels: 102.20 102.60 103.00

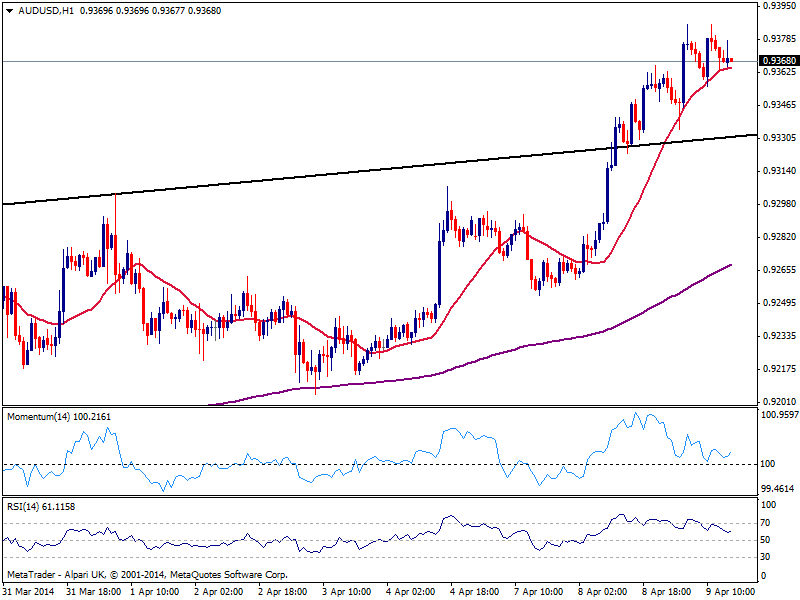

AUD/USD Current price: 0.9367

View Live Chart for the AUD/USD

Aussie took one more step against the greenback over Asian hours, extending up to 0.9386 on improved consumer sentiment and housing data. The AUD/USD hourly chart shows price consolidating above its 20 SMA that turns flat and losses upward potential, while indicators aim slightly higher after correcting overbought readings. In the 4 hours chart the overall bullish trend prevails albeit some downward corrective movement towards 0.9330 support can’t be ruled out.

Support levels: 0.9330 0.9370 0.9240

Resistance levels: 0.9390 0.9445 0.9485

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.