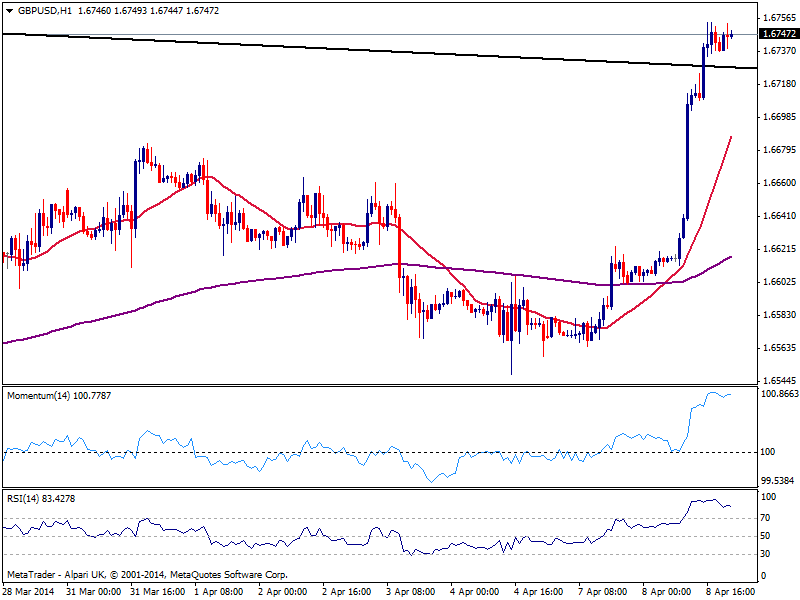

GBP/USD Current price: 1.6747

View Live Chart for the GBP/USD

The GBP/USD finally emerged from its cocoon breaking its range to the upside on another round of UK improved data. Manufacturing and Industrial readings overcame expectations, helping the pair advance beyond the 1.6700 level in the European morning. With no retracements in between, the pair managed to extend up to 1.6754 early US session, breaking above a descendant trend line coming from this year high of 1.6821 and maintaining a strong upward short term tone: the hourly chart shows indicators still aiming higher after partially correcting extreme overbought readings, while 20 SMA stands almost vertical below current price. In the 4 hours chart indicators are giving some signs of exhaustion in overbought territory, yet as long as price holds above 1.6710, the downside will remain limited, with scope to test 1.6820 on a break of mentioned daily high.

Support levels: 1.6710 1.6660 1.6620

Resistance levels: 1.6760 1.6820 1.6860

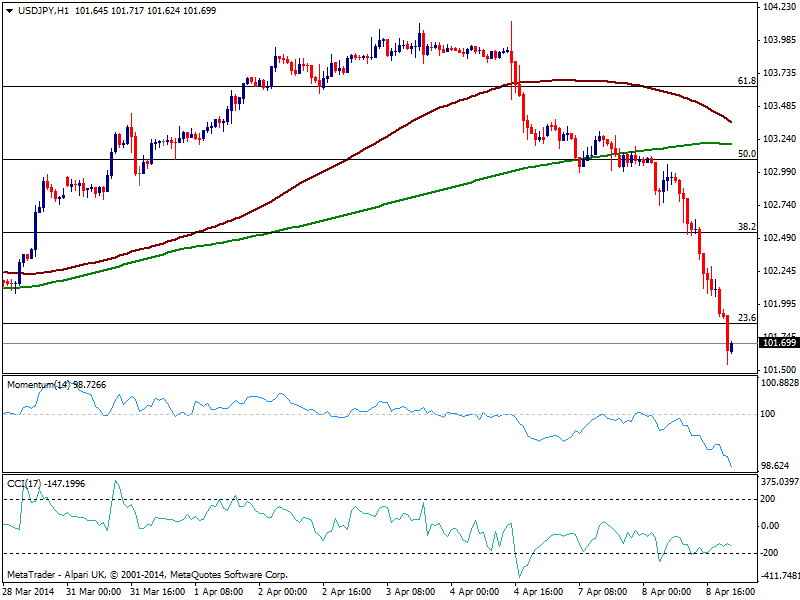

USD/JPY Current price: 101.69

View Live Chart for the USD/JPY

Yen came back was particularly strong against the greenback, with the pair down to 101.54 posting the largest one day lose of the year. Despite the long run, the hourly chart shows momentum maintaining a strong bearish tone and CCI above -200, neither suggesting extreme oversold levels at the time being. In the 4 hours chart the technical picture is also strongly bearish, with 101.20/30 area as next strong support and probable bearish target if the Nikkei bleeds again. A break below this last exposes 100.60/80 area in the short term, in route to 100.00 critical figure.

Support levels: 101.25 100.80 100.35

Resistance levels: 102.20 102.60 103.00

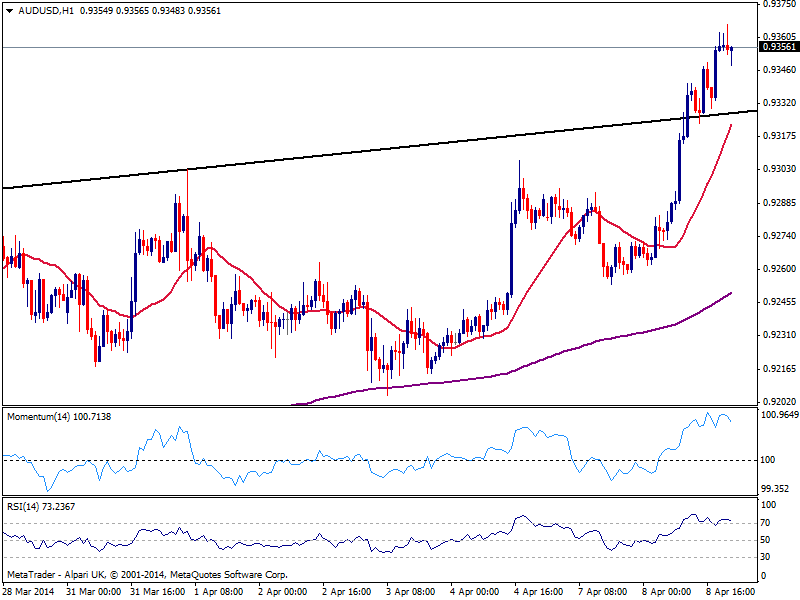

AUD/USD Current price: 0.9355

View Live Chart for the AUD/USD

Trading at fresh 5 months highs, the AUD/USD enters Asian session still buoyed and near the mentioned high of 0.9366. The hourly chart shows indicators saturating flat in overbought territory as price extended its advance, while 20 SMA bullish slope extended up to 0.9330 price zone, now immediate support. In the 4 hours chart indicators stand in overbought territory also, looking slightly exhausted but far from suggesting a reversal. As long as above mentioned support, the pair may continue advancing, eyeing the 0.9445 level, past November 19th daily high. Once above this last, the path is almost clear up to 0.9520, where some profit taking may trigger a bearish correction inside current bullish trend.

Support levels: 0.9330 0.9370 0.9240

Resistance levels: 0.9390 0.9445 0.9485

Updates for Asia on EUR/USD and EUR/JPY

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.