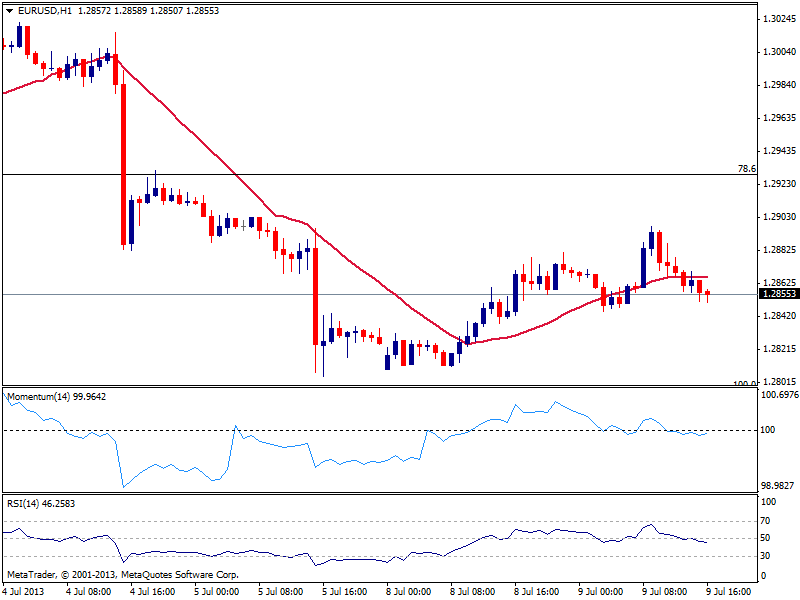

EUR/USD Current price: 1.2855

View Live Chart for the EUR/USD

The EUR/USD approached 1.2900 on the back of positive mood early European opening, easing back to its comfort zone near 1.2850. Summer in the north hemisphere is already taking its toll on volume that remains pretty low when there are no headlines to rock majors. As for the short term the hourly chart maintains a neutral stance, with indicators mostly flat, although a slightly bearish tone is present. Recent low around 1.2840 remains as immediate short term support ahead of key 1.2795.

Support levels: 1.2840 1.2795 1.2745

Resistance levels: 1.2880 1.2925 1.2960

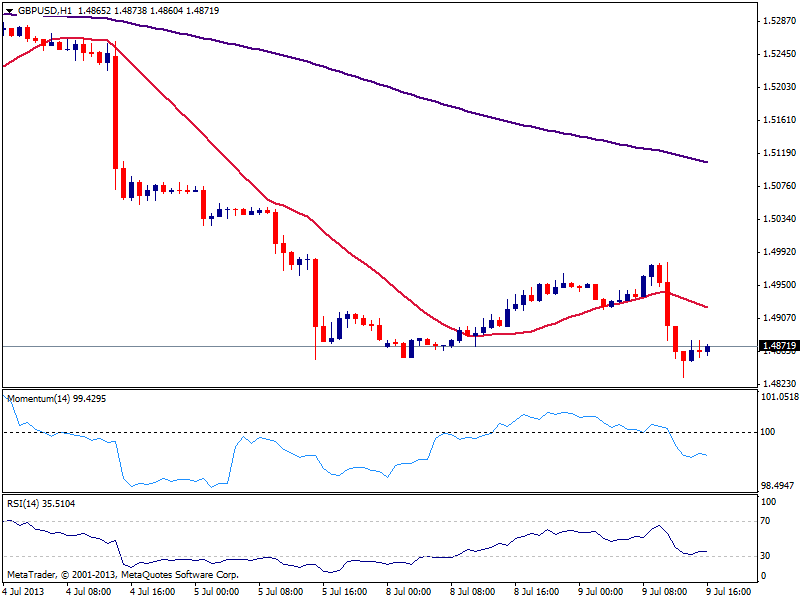

GBP/USD Current price: 1.4871

View Live Chart for the GBP/USD

Pound nose dived to 1.4832 against the dollar on worse than expected UK data, bouncing from its yearly low ahead of US opening, but maintaining a strong bearish tone according to charts: in the 1 hour one, price is back below its 20 SMA as indicators head south in negative territory, while in the 4 hours one 20 SMA capped the upside earlier today and maintains the strong bearish slope now around 1.4950 offering dynamic resistance. Overall, the downside is favor with a break of the mentioned low, with scope the to approach the 1.4720 area, next strong support.

Support levels: 1.4830 1.4790 1.4735

Resistance levels: 1.4910 1.4950 1.4990

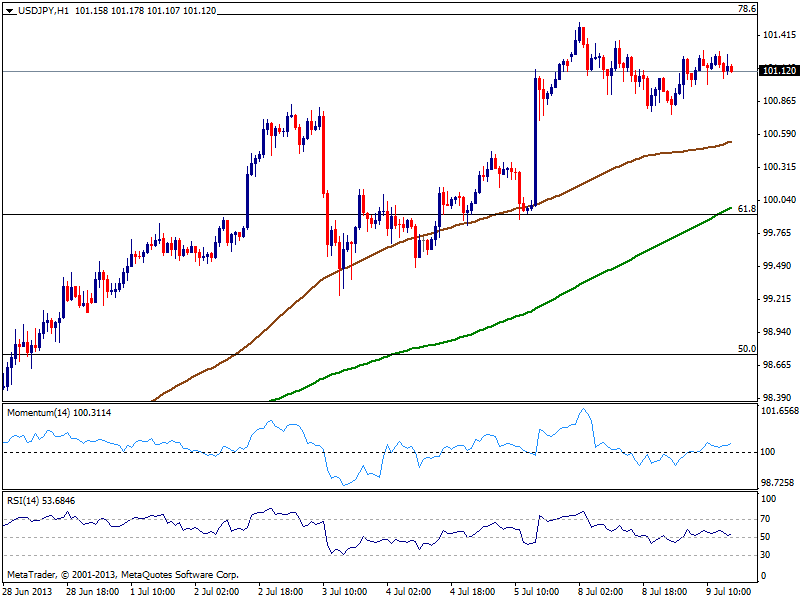

USD/JPY Current price: 101.12

View Live Chart for the USD/JPY

The USD/JPY trades in a tight range, unable to move away from the 101.00 level, with a slightly positive tone in the hourly chart as technical indicators hold in positive territory, while moving averages stand below current price. 200 SMA however, approaches to 100 one which for now just reflects the range; however, further approaches will increase the danger of a bearish movement, that will also find confirmation in the break of recent lows around 100.70.

Support levels: 100.70 100.30 99.90

Resistance levels: 101.20 101.60 102.00

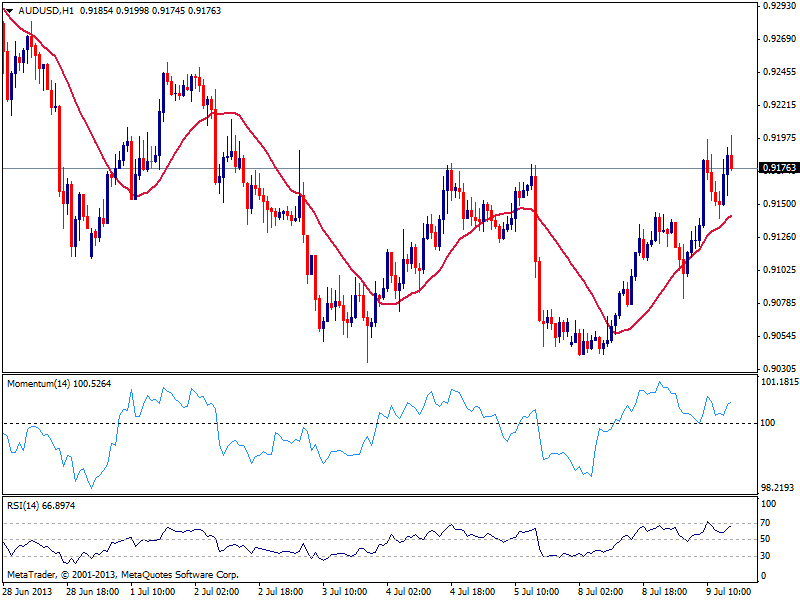

AUD/USD: Current price: 0.9176

View Live Chart for the AUD/USD

Despite quite positive intraday, the AUD/USD is still unable to overcome sellers around 0.9200 that capped the upside already twice today. Still, the hourly chart shows indicators heading north above their midlines as price stands above a bullish 20 SMA, currently around 0.9140 and offering short term support. In the 4 hours chart indicators present a nice upward momentum, supporting a continuation on a price acceleration above 0.9210 resistance.

Support levels: 0.9140 0.9100 0.9050

Resistance levels: 0.9210 0.9250 0.9290

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

High hopes rouse for TON coin with Pantera as its latest investor

Ton blockchain could see more growth in the coming months after investment firm Pantera Capital announced a recent investment in the Layer-one blockchain, as disclosed in a blog post on Thursday.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.