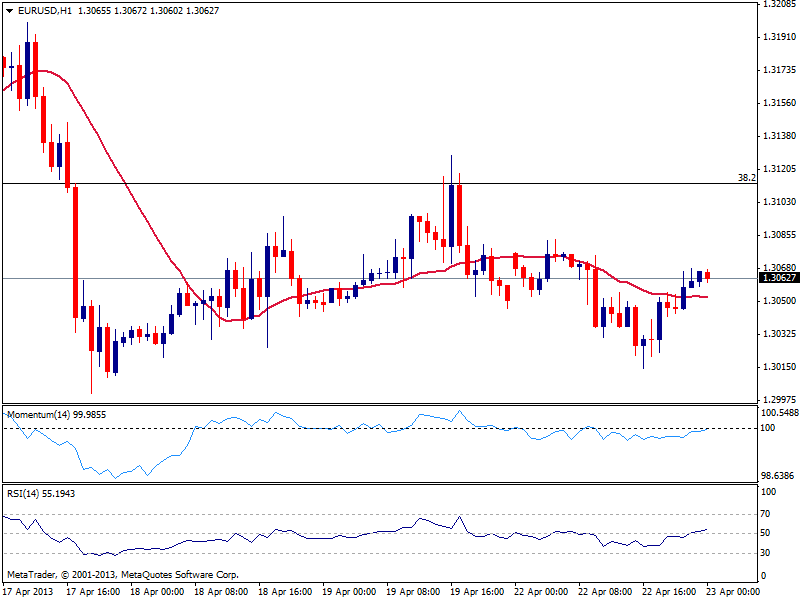

EUR/USD Current price: 1.3062

View Live Chart for the EUR/USD

The EUR/USD bounced once again from the base of its range, having been as low as 1.3016 early US session, as risk aversion dominated boards. Stocks recovery mid American session saw the pair recover up to current levels, still limited in the short term by 1.3070 static resistance zone. The hourly chart shows little upward momentum at the time being, with price above 20 SMA and indicators flat around their midlines, while in the 4 hours chart technical readings also remain neutral. Range has persisted over the last two weeks, and unless a clear break of the extremes, there’s little to do with the pair at current levels but wait for a clearer view.

Support levels: 1.3040 1.3000 1.2970

Resistance levels: 1.3070 1.3115 1.3150

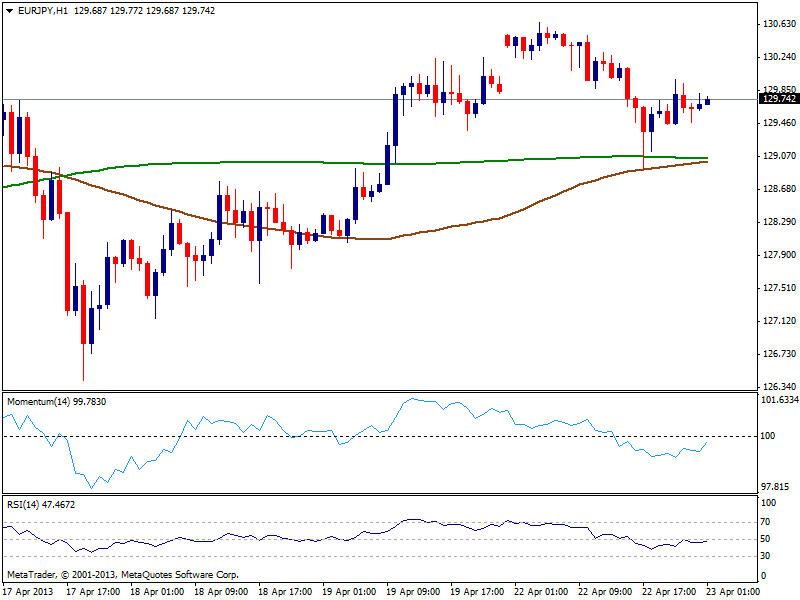

EUR/JPY Current price: 129.69

View Live Chart for the EUR/JPY (select the currency)

Despite early strength, lack of follow trough finally weighted on yen crosses that edged lower on the day. The EUR/JPY has briefly tested levels above 130.60 resistance, but quickly retraced and a lot has to do with USD/JPY being unable to take 100.00. In the hourly chart, price found support around its 100 SMA, now converging with 200 one around 129.00, while indicators are in neutral territory. In the 4 hours chart however, the upside remains favored as a dip below 129.00 triggered a strong bounce, with indicators in positive territory and price above 100 and 200 SMA’s.

Support levels: 129.40 128.80 128.20

Resistance levels: 130.10 130.60 131.10

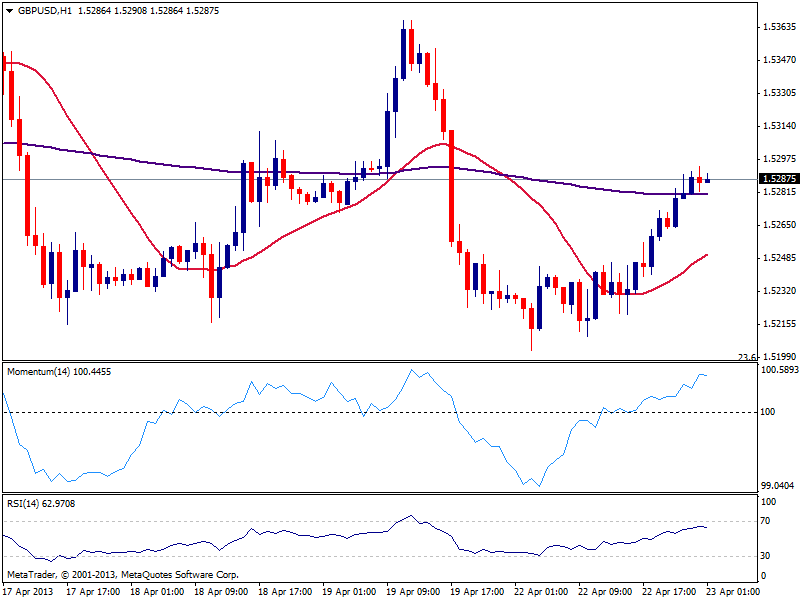

GBP/USD Current price: 1.2588

View Live Chart for the GBP/USD (select the currency)

Pound advanced fast with dollar weakness, and the GBP/USD reached 1.5294, entering Asian session near the level, and looking slightly overbought according to the hourly chart. In the 4 hours chart, price has overcome 20 SMA and 200 EMA, both around 1.5260 and immediate short term support, although indicators remain around their midlines, showing not much upward strength. Price needs to break and consolidate above 1.5300, to be able to recover the upside, with next big target around 1.5410/20 price zone, 38.2% retracement of its latest daily fall.

Support levels: 1.5260 1.5225 1.5190

Resistance levels: 1.5295 1.5330 1.5360

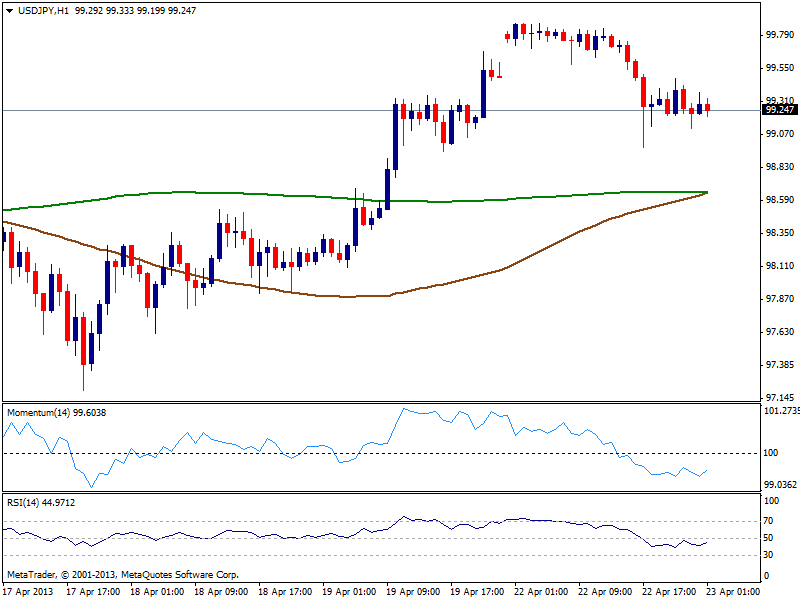

USD/JPY Current price: 99.24

View Live Chart for the USD/JPY (select the currency)

The USD/JPY failed again to break the 100.00 level, and turned short term bearish, although holding so far above 98.97 daily low. The hourly chart shows moving averages converging around 98.60, while indicators aim to recover the lost ground, still in negative territory. Bigger time frames show indicators easing towards their midlines, but current movement remains corrective; a break below mentioned 98.60 area, may see further slides as short term stops will be triggered, eyeing then the 98.10/30 price zone.

Support levels: 99.00 98.60 98.20

Resistance levels: 100.00 100.35 100.80

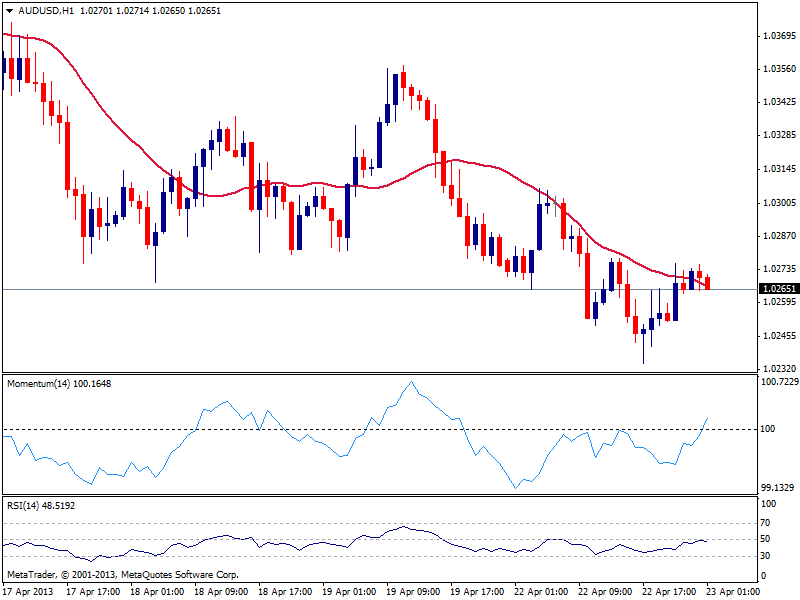

AUD/USD: Current price: 1.0265

View Live Chart for the AUD/USD (select the currency)

AUD/USD posted a fresh 5-week low of 1.0234 before bouncing on stocks recovery, but remains under pressure as latest recovery was capped below 1.0280 price zone. The hourly chart shows price struggling around a bearish 20 SMA but momentum heading higher in positive territory; still to confirm an upward extension, price needs to regain mentioned resistance. In the 4 hours chart the bearish tone has eased, as indicators turn flat in negative territory, yet technical readings are far from suggesting more gains.

Support levels: 1.0220 1.0180 1.0130

Resistance levels: 1.0280 1.0300 1.0335

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.