Friday is another holiday. Traders will now start to take positions for next Monday.

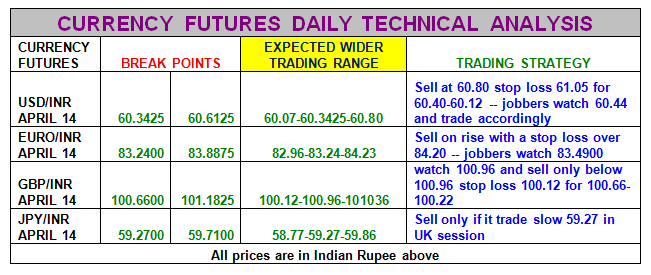

Usd/inr April 2014: It needs to fall below 60.3775 or break 60.6225 for direction. Overalll usd/inr will find sellers on rise as long as it does not break 60.80.

Euro/inr April 2014: Support is at 83.3450 with 83.98 as the key resistance. There will be another wave of selling only below 83.3450. Overall till April future close, we prefer a sell on rise strategy as long as euro/inr does not break 85.23.

Gbp/Inr April 2014: It needs to trade over 100.89 to prevent a fall to 10.66 and 100.12.

Jpy/Inr April 2014: Resistance is at 59.71 and there will be sellers on rise as long as jpy/inr does not break 59.71 with 59.21 as key support

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.