Headlines

Zloty hit a one-month low

Regional PMIs in focus this week

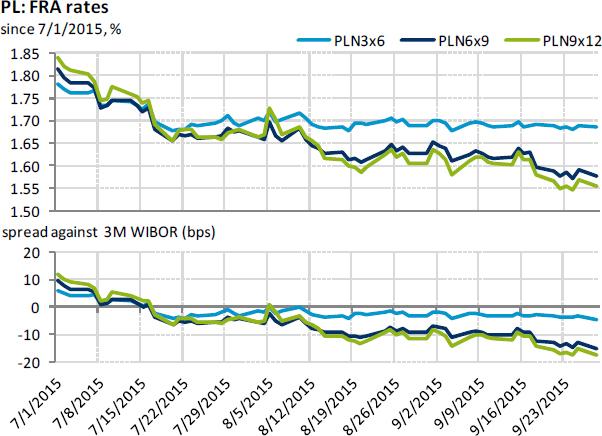

While the Czech koruna was eventually little changed on Monday amid a relatively thin (holiday) trade, the zloty weakened by about 0.3 % and hit a onemonth low against the euro as world stock indices kept sliding and overall global market sentiment remained negative. Moreover, the Polish fixed-income market has begun to bet on a rate cut (see the chart below).

Regarding the rest of this week, regional eye-catcher is a release of manufacturing PMI figures for September. The Polish index is likely to draw the most attention. Let us recall that the index fell sharply in August and hit an eleven-month low. While industrial production itself keeps relatively robust pace of growth of about 5 % year-on-year, market bets on further monetary policy easing could heighten should the index disappoint. Please note that bets on a rate cut increased in the last couple of weeks and markets see solid chance of lowering of official interest rates even in six months horizon. We, however, keep our base case and expect stable rates in the months and quarters to come.

| Currencies | % chng | |

| EUR/CZK | 27.23 | 0.0 |

| EUR/HUF | 314.8 | 0.1 |

| EUR/PLN | 4.24 | 0.5 |

| EUR/USD | 1.12 | 0.4 |

| EUR/CHF | 1.09 | -0.1 |

| FRA 3x6 | % | bps chng |

| CZK | 0.90 | 0 |

| HUF | 1.33 | 0 |

| PLN | 1.70 | 2 |

| EUR | -0.03 | 1 |

| GB | % | bps chng |

| Czech Rep. 10Y | 0.74 | 3 |

| Hungary 10Y | 3.39 | -1 |

| Poland 10Y | 2.83 | -3 |

| Slovakia 10Y | 0.90 | -4 |

| CDS 5Y | % | bps chng |

| Czech Rep. | 49 | 0 |

| Hungary | 162 | 0 |

| Poland | 74 | 0 |

| Slovakia | 50 | 0 |

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.