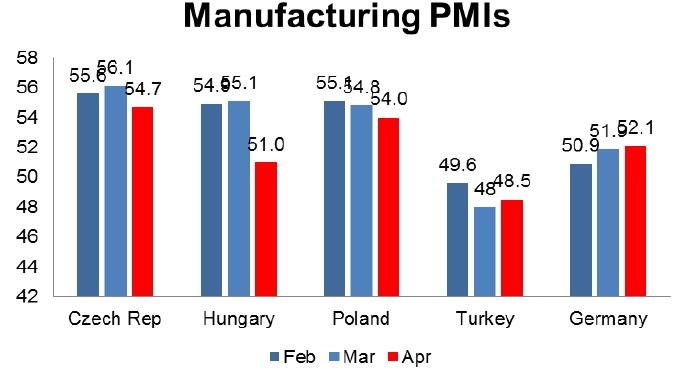

Chart of the Day:

PMIs in CEE decelerate: After quite strong readings in the first quarter, April PMIs mostly disappointed in CEE, with only a slight increase observed in Turkey an exception to otherwise weaker sentiment. The drop in Hungary is the strongest but the index has been very volatile in the past, which softens the assessment of the decline. 1Q15 GDP figures are expected to be robust, but April PMIs and forward looking components of previous German sentiment indicators (Ifo, Zew) suggest a milder growth rate in second quarter GDP in CEE.

Analysts’ View:

HR Macro: March retail trade came in a few notches below both our and market expectations (1.5% y/y and 1.2% y/y, respectively), with consumption growth decelerating to an annual rate of 1.1% (vs. 1.9% y/y the previous month). That said, the positive print was supported by several factors, as the low inflation trajectory and eased personal income taxation continue to underpin the headline figure. On a quarterly basis, the March release contributed to 1Q output of 1.7% y/y, indicating that there is solid momentum so far in 2015. Nevertheless, fragile labour market developments and weak credit activity are still seen limiting stronger consumption gains and weighing on a more tangible contribution to the headline GDP figure. The March data has no impact on our capital market forecasts and we expect yields on7y benchmark CROATEs to drop to 2.8% by year end.

TR Macro: Annual CPI rose to 7.9% in April, disappointing the market once again and core inflation did not fall as much as expected either. Neither the inflation outlook nor market conditions are supportive for monetary easing in the short-term but rate cuts may be possible after the elections. After falling for four consecutive months, the Turkish PMI rose to 48.5 in April from March’s six-year low of 48. Further improvement would be needed to support our 3% growth forecast for 2015. We maintain, however, our 2.65 USD/TRY and 8.5% two-year bond yield forecasts for the year-end.

Traders’ Comments:

CEE Fixed income: CEE sovereign debt was range trading yesterday but the PLN had a strong day just ahead of the MPC meeting, recovering all of Friday’s losses. It was a quiet day overall with the UK on holiday and turnover was thin. Much of the focus is on price developments in the Bund which gapped lower yesterday and then continued to slide over the course of the trading session. Longer dated SLOVGBs have been hardest hit by the sudden jump in German yields but most of the CZGB yield curve has also moved out of negative territory now as well. Overall, local currency government bond yield curves have steepened across CEE as the short end remains well anchored which yesterday’s poor showing in CEE PMIs did nothing to dissipate ahead of a raft of central bank meetings this week.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.