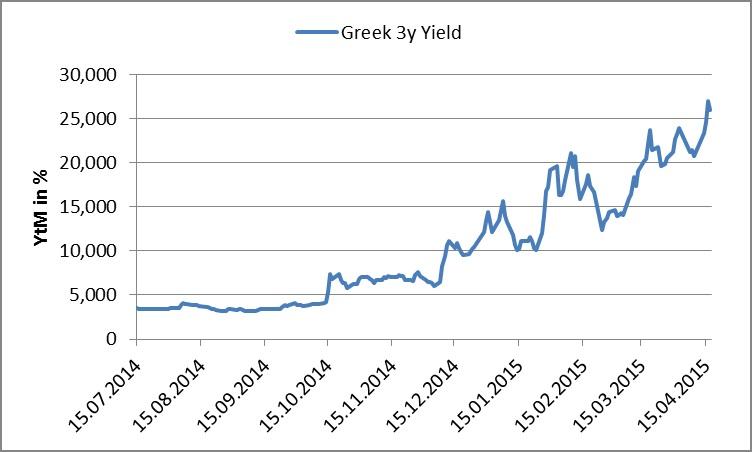

Chart of the Day:

Greek Bond Sell Off: The difference in fortunes couldn’t be more dramatic. While the yield on the Bund fell to a record low below 8 bps, it is bond prices and not yields that are making record lows in Greece.

Analysts’ View:

RO Bonds: The MinFin sold bonds maturing in Feb-25 worth RON 200 mn as planned, at an average yield of 3.20%. Total demand was RON 539.8 mn. The announcement about the cut in the VAT for food to 9% beginning with June (from 24% at present) was received as neutral to slightly positive by investors and last Friday S&P confirmed Romania’s rating at BBB- with a stable outlook. In our view, better revenue collection to the state budget and consolidation of economic growth at higher levels are of key importance for preserving foreign investors’ confidence after the fiscal easing. We maintain our 5-year ROMGB yield forecast at 2.3% for the remainder of this year.

PL Macro: The labour market data should confirm improved conditions, as employment and wages are expected to grow (consensus at 1.2% y/y and 3.4% y/y, respectively). Such a development is supportive of private consumption, which we expect to be a major positive contributor to economic growth in 1Q15. Although the data should confirm the pretty optimistic outlook for the economy, it is going to be mostly neutral for markets. We expect the zloty to remain strong (4.02 vs. the EUR at the end of 1H15) and 10Y yields to move toward 2.1% at the end of the quarter.

Traders’ Comments:

CEE Fixed income: Price action on CEE fixed income was once again very muted as the tug-of-war between QE and a Grexident leaves yields largely unchanged but spreads to Bunds wider. 10y yield spreads are at or close to the widest levels since 3 months in Turkey, Hungary, Romania, Poland, Bulgaria & the Czech Republic. Slovenia and Slovakia which share the Euro with Germany are at or below the average of the last 3 months. Slovenia is also a direct beneficiary from QE as its bonds are eligible for the ECB bond buying programme.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.