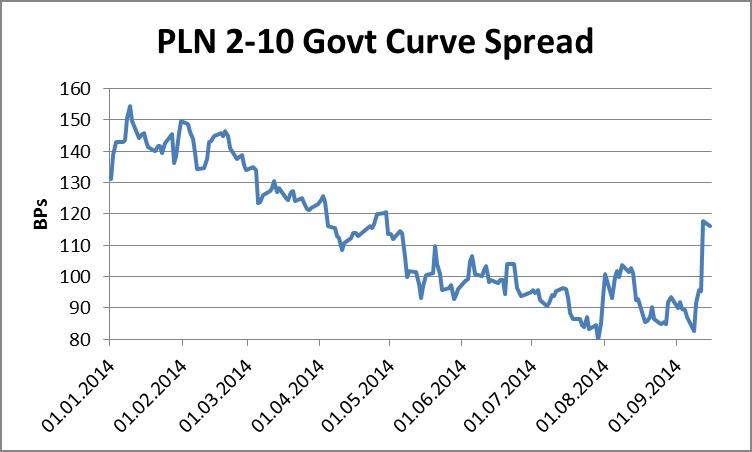

Chart of the Day:

Bear Steepening: Since the ECB unexpectedly cut rates at the start of September to what is effectively the zero-bound, market fantasy for lower yields on long dated bonds has receded and we are seeing a move towards bear steepening.

Analysts’ Views:

PL Macro: Data on the current account and inflation rate open this week of macro releases in Poland. We expect to see a deficit on the current account and a negative inflation figure. The CPI index should remain the center of attention and we expect it to come in at -0.2% y/y in August. As the MPC is broadly expected to deliver a rate cut in October, any negative surprise may only strengthen expectations for an overall move greater than 50 bps and keep yields low, at close to 3% by the end of the year.

HU FX: The central bank announced at the weekend that it is ready to provide FX liquidity for the banking sector when the conversion from FX loans to HUF loans takes place in the near future. The conversion should not come in a single step, the central bank announced. The current level of international reserves, roughly at EUR 36 bn, exceeds Hungary’s external debt that is scheduled to mature in the next 12 months (roughly EUR 28 – 29 bn). The drain on the level of funds related to the conversion will be around EUR 8 bn. We continue to see the EURHUF exchange rate at around 310-311 in the upcoming quarters.

Traders’ Comments

CEE Fixed Income: The Scottish referendum is an incalculable uncertainty with the potential to send global markets into a tailspin. With 1/10th of potential voters still undecided, it is impossible to say which way the vote will go. The vote on Thursday will be watched very closely. If the Scots vote for separation then other regional separatists in Europe will feel emboldened (i.e. in Catalonia) which would have negative implications for Spanish bonds and the Euro with negative knock-on effects for the Eurozone periphery as a whole and, by extension, CEE. The effectiveness of ECB plans to provide more monetary stimulus to the Eurozone economy is already being questioned and we have witnessed a shift in focus to the potential for a tightening of US monetary policy. The FOMC will convene on Wednesday. The chances are high that CEE fixed income will follow US bonds as the Fed dictates the course of global monetary conditions.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.