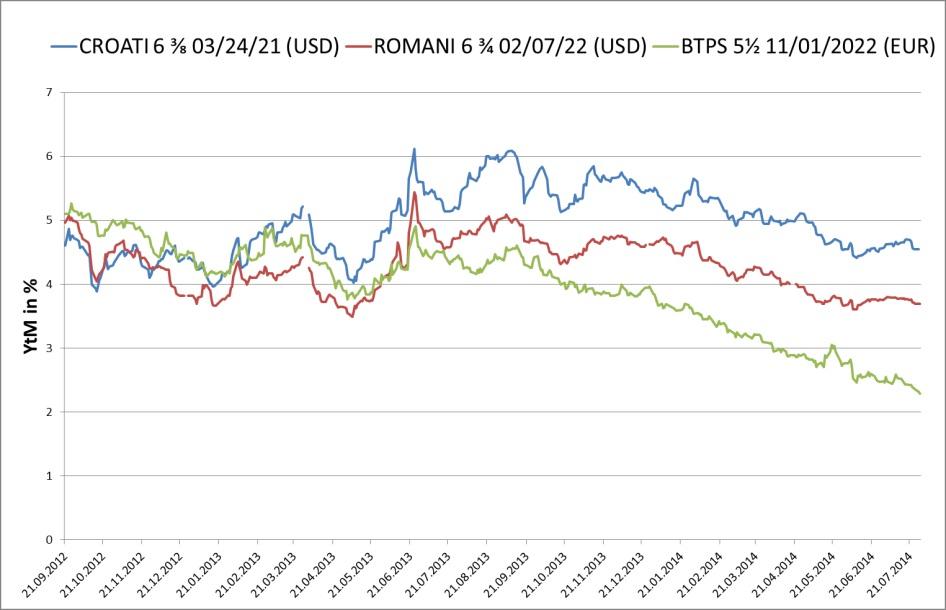

Chart of the Day:

Croatian, Romanian & Italian Bonds: These bonds moved almost in sync for the best part of 6 months from September 2012 to June 2013. Since then, Italy has outperformed. The EURUSD is more or less unchanged over the same period. The yield spread between the BTPS (in EUR) and the ROMANI (in USD) mirrors to a large extent the increase in spread between 10y US Treasuries and German Bunds. Local currency Romanian debt has rallied strongly, especially over the last few weeks folowing its inclusion in the JPM GBI EM Global Diversified Investment Grade Index. If this weeks FOMC meeting and a raft of important US economic indicators, most of all the Non- Farm Payrolls, fail to ignite a wideheld anticipation of a jump in US Treasury yields, then the ROMANI 6.75% 21 may be poised for a leg lower in yield given that the yield on the benchmark 7y UST is 155 bps below Romanian USD denominated debt with a similar maturity.

Analysts’ Views:

RO Bonds: Romania took advantage of strong interest in local debt paper and raised about RON 1.7 bn in two separate auctions. The debt managers sold RON 1 bn in one-year T-bills, while the remaining amount, RON 678 mn, was raised in a new ten-year T-bond issue. The average yields stood at 4.23% for the T-bonds and 1.93% for the T-bills (-59 bps compared to a previous auction held five weeks ago). Low inflation, which renewed expectations of further NBR monetary easing in 2H14, and the latest JP Morgan announcement that it is going to include Romanian bonds in an investment-grade country index, have helped push yields to record lows in recent months. Despite this, we see yields going higher, mainly due to the coming presidential election scheduled for early November and heightened geopolitical tensions in the region. Our 5-year yield call for December 2014 is 4.3%.

CZ Macro: According to their updated economic forecasts, the Ministry of finance expects the 2014 budget deficit to settle at 1.5% of GDP, which is lower than the previous estimate of 1.8%. At the same time, the Ministry increased its GDP forecast from 1.7% to 2.7%, which is close to our own view. The improved deficit outlook and cash management is also reflected in the cancellation of summer T-bill auctions. The decline in the supply on the bond market helps spreads to remain compressed and could even cause a further spread narrowing from current levels. We expect 10Y yields to reach 1.67% at the end of this year, conditional upon an increase in Bund yields.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.