Chart of the Day:

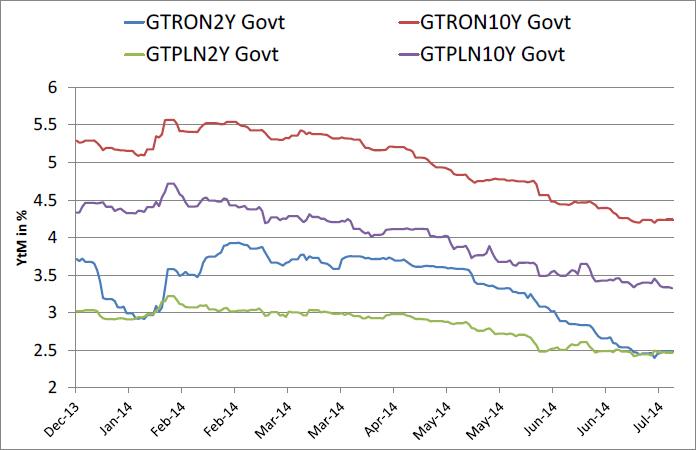

ROMGBs vs POLGBs: The 10y2y Spread in Poland has fallen from 155 bps to 85 bps ytd. In ROMGBs it has risen from 120 bps in May to roughly 180 bps currently. The respective 2y bonds offer the same yield but 10y bonds are roughly 100 bps apart. So is there relative value in 10y ROMGBs? The currencies have displayed a similar performance this year (appreciating slightly vs EUR) but key rates are 100 bps higher in Romania and the NBP is resisting calls to cut further given central bank expectations of a rise in inflation to 1.4% next year whilst the NBR is cutting reserve requirements as CPI continues it’s decent to record low inflation rates. 2y ROMGBs are telling us, the NBR has more cutting to do.

Analysts’ Views:

HU Macro: The GKI-Erste business and consumer confidence index slid to a 6-month low, reaching -3.9 points in July. (In June, the index was still -1.0.) The decline is solely attributable to the decrease of the business confidence indicator, while the index of consumers remained roughly the same for the third consecutive month. As the decline is due to the deterioration in business expectations and not due to the worsening of consumer confidence, the index likely reflects the weakening of industrial expectations already seen for some months now in region-wide (and German) purchasing manager indicators. We think that the central bank will likely find the arguments to slash the policy rate further at tomorrow’s rate-setting meeting, at which the rate can be cut by another 10bp. Our market forecasts remain unaffected by today’s release.

Traders’ Comments:

CEE Fixed Income: Whilst Croatian Eurobonds are under a bit of pressure preceding the expected rating downgrade, domestic bonds are still well bid and the premium on EUR linked domestic bonds vs EUR denominated Eurobonds is shrinking. The spread between Croati22 € and local Eur22s has tightened to only 15 bps from almost 50 bps just one month ago. Serbian paper was under selling pressure last week with yields rising 20 - 25bps on the Eurobonds. The longer end was under the most pressure with Serbia21s now offered at 5.15% (+25bps w/w) but we now expect to see more buyers given that it is hard to find bonds in our region yielding more than 5.00%. Today Romania will re-tap the 7Y residual maturity bond DBN032 with a RON 300 m planned issue amount. Our guidance is for a yield of 3.92% +/- 5 bps.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.