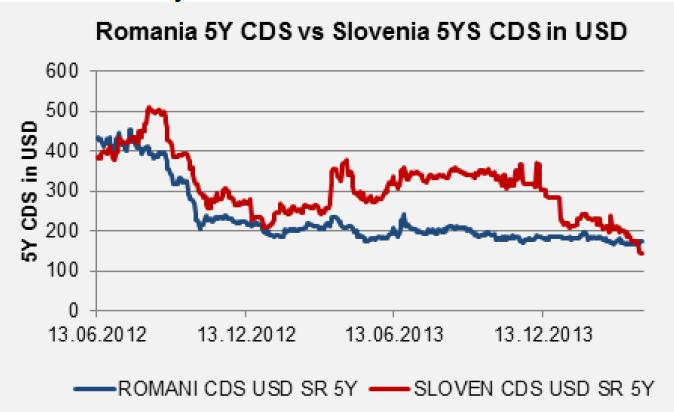

Chart of the Day:

Slovenia: The credit risk premium on Slovenian CDS has fallen below Romania for the first time since mid-2012, as investors display an increasing willingness to fund countries that were on the brink of default not long ago.

Analysts’ Views:

CZ Bonds: According to the MoF, the central government’s debt-to-GDP ratio declined from 43.3% to 43.1% in 1Q14 as the budget surplus went up by CZK 30bn y/y (0.7% of GDP) from CZK 14bn in 1Q13. While the sum of total central government expenditures remained roughly the same in 1Q14 y/y, the surplus rose largely due to an annual increase in VAT and excise tax collection. These Recent figures give a strong reason to hope that the MoF will use the additional liquidity to decrease the issuance activity of new debt, as the total amount of liquid state financial assets adds up to more than CZK 160bn (4.1% of GDP) with available cash resources representing the majority of reserves. Recent developments pose a downward risks to both our general government debt forecast (48.3% of GDP) and the budget balance assumptions (2.6% of GDP) as it cannot be ruled out that the general government debt-to-GDP ratio will even decline for the second consecutive year in 2014 (currently at 46%). Despite the weak supply prospects, we expect some rise in yields until this by year-end (10Y yields are assumed at to reach 2.37% at end-2014).

PL Macro: The current account deficit narrowed to EUR -572mn in February, due to the surplus on the trade balance and the positive balance on current transfers. In the upcoming months, however, we may see some widening, helped by improving domestic demand and accelerating import dynamics. The recovery of the economy should have an impact on the budget deficit as well. As Finance Minister Szczurek commented, the general government deficit should be well below 3.9% of GDP this year (excluding the impact of the pension reform) and below 2.8% next year. Poland should, therefore, meet the EC criteria and exit the EDP next year. Overall, the improvement in the economic situation should support the zloty’s appreciation toward 4.14 (EURPLN) by the end of 2Q14 and further to 4.04 by the end of the year.

Traders’ Comments:

CEE Fixed Income: It looks like we won’t be short of potential market moving events this week with tensions rising in Ukraine, Chinese GDP, EZ inflation, a raft of economic data in Poland and a number of Fed speakers all queuing up to hit the wires ahead of Good Friday.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.