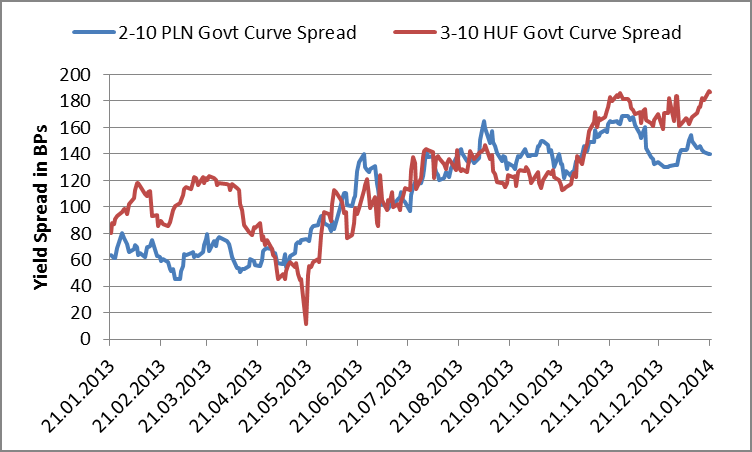

Chart of the Day:

HGB / POLGB Yield Curves: Whilst the MNB prepares to cut once more to shore up a weak Hungarian economy, the NBP is sending signals that it may soon begin raising key rates. The effect of the relatively stronger economy in Poland has not gone unnoticed by investors as the steepening trend in the yield curve starts to turn and longer dated POLGBs outperform similarly dated HGBs.

Analysts’ Views:

HU Rates: We expect the MPC to reduce the policy rate 10 bps to 2.90% today, in line with the council’s more cautious statement published after the latest monetary meeting in December. However, given some rate setters’ dovish comments in the last couple of weeks, reducing the base rate to 2.80% should not come as a major surprise to the market either. Uncertainties surrounding the bottom of the ongoing rate cutting cycle remain and we thus see a downside risk to our forecast of 2.80% as the external market sentiment looks like it will remain supportive for a longer period of time. However, the lower the base rate, the higher the possibility that the forint will weaken considerably in the case of a negative turnaround in global market sentiment. To sum up it, we see upward risk to our EURHUF predictions (currently 300 Q114, 299 Q214 298 Q314 & 297 Q414).

RO T-bonds: The MinFin managed to raise more money than the initial target at yesterday’s T-bond auction maturing in November 2018 (RON 714 mn vs. RON 500 mn). The average yield went down sharply to 4.15%, compared to 4.9% at a similar auction held in early December 2013. Investors put in bids totaling RON 1.9 bn (bid-to-cover: 2.6). After Romania tapped the US market with 10- and 30-year bonds worth USD 2 bn in January, a government official said that the treasury managers were going to issue another bond in the global markets before the end of 1H14. On the secondary market, we see 5-year Tbond yields at 4.30% in March and 4.8% in December 2014.

Traders’ comments:

CEE Fixed Income: Industrial Output & PPI figures are expected to confirm the goldilocks growth without inflation scenario in Poland today, creating perfect conditions for cash corporates. Small wonder then that P4 Sp. z o.o., Poland’s fourth-largest mobile-phone operator, announced its intention to sell a total EUR 870 mn of various bonds just as borrowing costs for high-yield issuers fall to a record low. In the government bond space, ROMGBs continue to roar ahead. The 5y auction met with strong demand yesterday with the average accepted yield coming in 5 bps below expectations at 4.15%, enabling the MoF to issue RON 700 m, 40% more than planned.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.