- Canada eyes Net Change in Employment of 100K in August.

- BOC stands pat, warns 4th covid wave could hamper recovery.

- A big blowout on the employment data is needed to rescue CAD bulls.

With the Bank of Canada (BOC) sitting tight on its monetary policy settings, WTI prices holding the lower ground and COVID-19- induced economic risks lurking, will USD/CAD extend its recent uptrend?

The Canadian employment sector is seen extending its recovery momentum in August after showing considerable improvement in July when the services sector contributed largely to the employment gains.

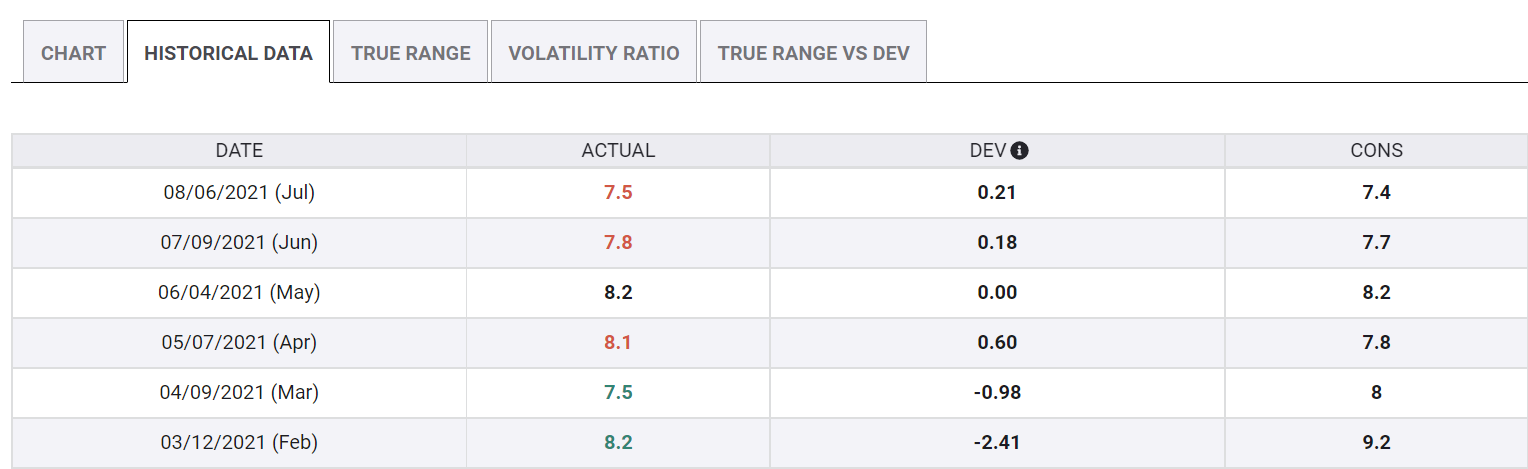

Statistics Canada is due to be published the August labor market report on Friday at 1230GMT. The North American economy is expected to witness a jobs growth of 100K in August as against a gain of 94K and 231K reported in July and June respectively. Although the economy continues with jobs creation, it is well short of the growth seen in the previous two months. The Unemployment Rate is seen falling further to 7.3% in August vs. July’s 7.5%. In July, the jobless rate missed expectations of 7.4%.

Source: FXStreet

A disappointment in the Canadian employment figures cannot be ruled out amid the third wave of the COVID-19 pandemic-led restrictions in the country. While the US NFP data also missed expectations by a wide margin, arriving at 235K in August vs. 750K expected.

Restaurants, retailers and hospitality companies have all reported that hiring has been difficult because Canadians are seeking more stable employment, jobs they can complete from home and assurances that their workplaces won't be temporarily closed if another wave of the virus arrives.

Despite rising inflation, broad economic indicators continue to suggest an uneven economic recovery, especially after the latest GDP reading showed an economic contraction of 1.1% on a quarterly basis in the second quarter.

Against that backdrop and uncertainty around the election in October, the Bank of Canada (BOC) maintained its key interest rate at 0.25% alongside tapering, warning the fourth wave of the pandemic and supply bottlenecks could weigh on the economic recovery.

USD/CAD Probable Scenarios

Heading into Friday’s Canadian jobs data release, the US dollar’s rebound to weekly highs is seen fizzling out while WTI remains in a consolidative mode around $69 after pulling back from monthly tops of $70.61.

USD/CAD’s technical chart points to additional upside, suggesting that the Canadian jobs data could likely come in as a disappointment and/or the US dollar could resume its ongoing upbeat momentum amid the downbeat market mood. The dynamics in oil prices will be eyed as well.

USD/CAD: Four-hour chart

Should the dollar’s strength dominate, USD/CAD could see a fresh upswing towards the post-BOC highs of 1.2762. The pain in the Canadian dollar could be exacerbated if the jobs data fall short of the market’s expectations. The bulls could then seek a retest of the 1.2800 level.

However, if Canada’s labor market data blows past expectations, then it could offer some reprieve to the CAD bulls, fuelling a drop towards the demand area around 1.2590. That zone is the confluence of the 200 and 50-Simple Moving Averages (SMA) on the four-hour time frame. The Relative Strength Index (RSI) has inched lower from the overbought territory, currently sitting at 69.60, suggesting that there is room to rise for the major.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.