Daily Forecast - 22 January 2015

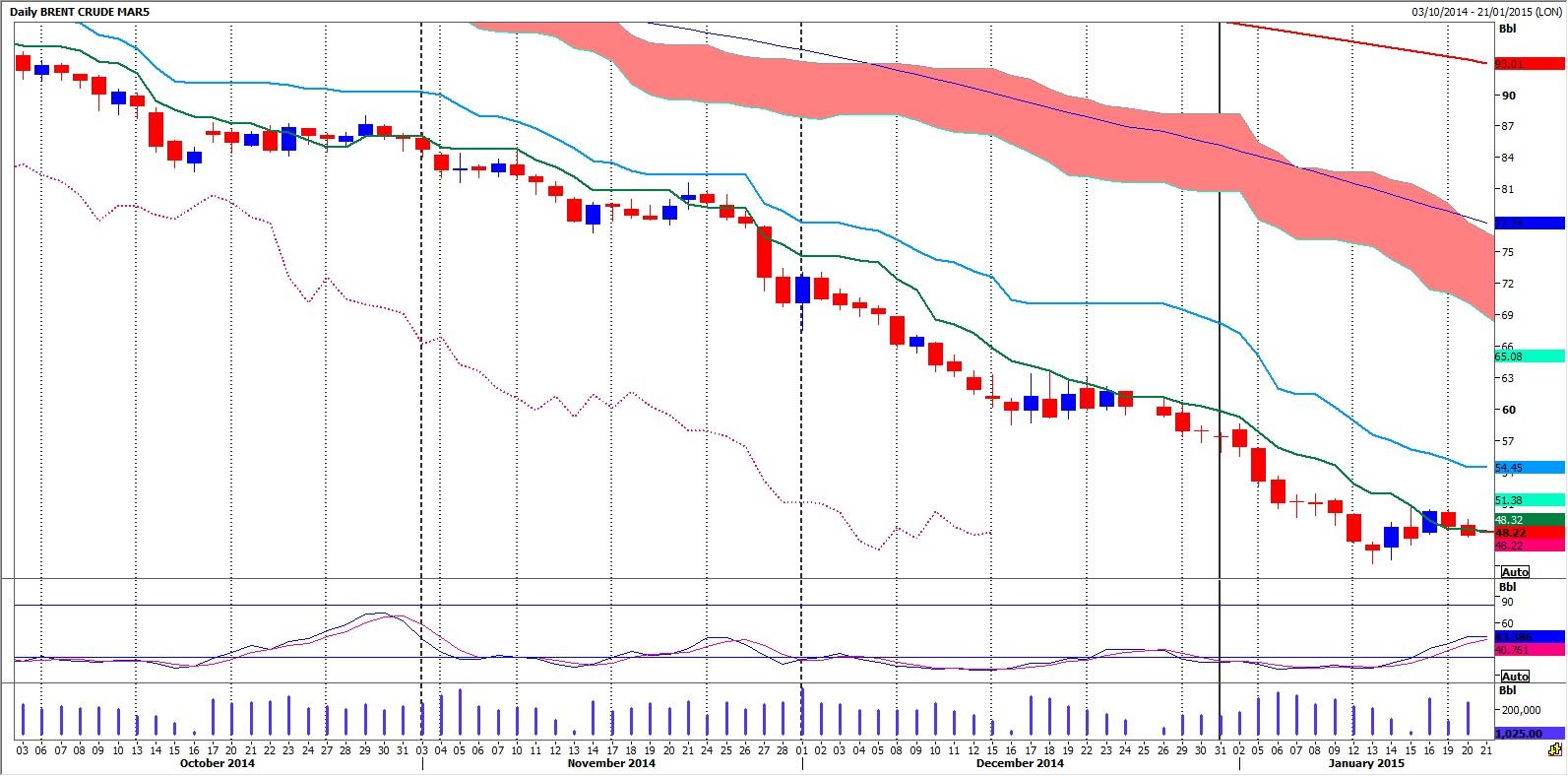

Brent Crude February contract

Brent Crude February same levels apply for today with immediate resistance at 4950/60. A break higher today targets resistance at 5060/5080. We should struggle here, but be aware that another break higher could target 5135/45. If we continue higher this week, look for a good selling opportunity at 5220/5230.

Failure to hold above 4855/65 re- targets 4800/4790. If we continue lower today look for a test of good support at 4730/4725. Try longs with stops below 4700. On a break lower however look for the next downside target and support at 4640/4630. Any longs here need a stop below 4590. Be ready to go with a break lower targeting 4560 then last week's low at 4520.

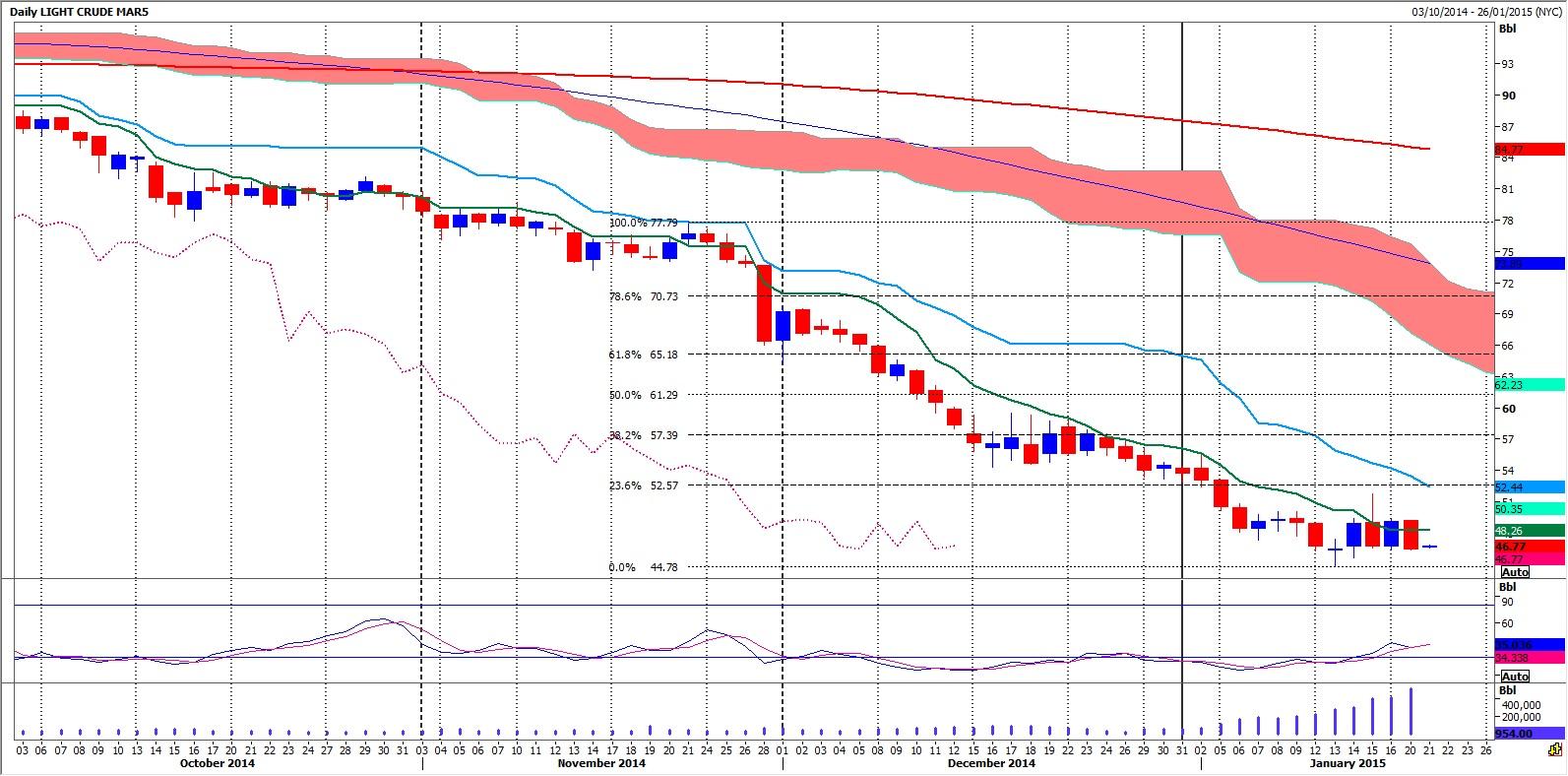

WTI Crude March contract

WTI Crude March support at 4 day lows of 4655/4634 but below here targets 4565 then last week's low at 4478. Obviously a break lower would be negative and signal the resumption of the longer-term Bear trend to target 4420 then 4385/80.

Immediate resistance at 4714/45 but above here we could make it as far as 4820/30. Any further gains in this range trading market meet strong resistance from recent highs at 4920/4940 and any shorts here will need a stop above 4990. A break higher to target 5090. If this does not hold a move higher we could target last week's high at 5170/75. Any further gains offer an excellent selling opportunity at 5245/55 with stops above 5300.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

High hopes rouse for TON coin with Pantera as its latest investor

Ton blockchain could see more growth in the coming months after investment firm Pantera Capital announced a recent investment in the Layer-one blockchain, as disclosed in a blog post on Thursday.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.