U.S. stocks fell sharply lower for the second day in a row. Major averages have now hit monthly lows as investors took in what President Obama said about the ongoing stalemate in Washington DC.

Obama is claiming he has not seen any decent proposals from the Republicans and both sides are very far apart in any compromise. He told the House Speaker (John Boehner (R)) to “stop the excuses” and take a vote in the House on the current budget. “…Let us end the shutdown now,” Obama said in his statement. He feels there are enough votes to pass the budget now without strings. He is urging Congress to pass the budget the Senate has already agreed on.

Boehner is will to negotiate budget issues with no conditions with President Obama. He is not going to draw any “lines in the sand.” Obama responded that he will not talk till they raised the debt ceiling.

Stalemate. Who will blink first?

Currently, it is not a high probability the U.S. will default but the chances are not zero either. If it happens, it will be short. However, the damage will be done and investor confidence in the U.S. Treasury market will be shaken.

In other, and good news, Janet Yellen has been nominated to be the next Chair of the Federal Reserves. She shares the same dovish views that Bernanke had and should be welcomed by the Senate and investors.

STOCKS

The DJIA lost nearly 160 points or just over one percent to close at 14,776.53. The Blue Chip Index has now lost six percent since hitting its high at 15,709.58 nearly a month ago. The S&P 500 lost 20.67 points to finish the day at 1,655.45. The Nasdaq Composite fell two percent or 75.54 points to close at 3,694.83.

The Japanese benchmark has erased earlier losses to trade above 13,900. It had lost once percent in early trading. Traders are waiting for the minutes from the last bank of Japan policy meeting looking for signs of future monetary policy. The Shanghai Composite saw a choppy day but closed flat. This comes the day after its one percent rally from yesterday. South Korea is closed for a holiday. The S&P/ASX in Australia is up marginally after hitting 5,118 earlier. That was a second straight monthly low.

CURRENCIES

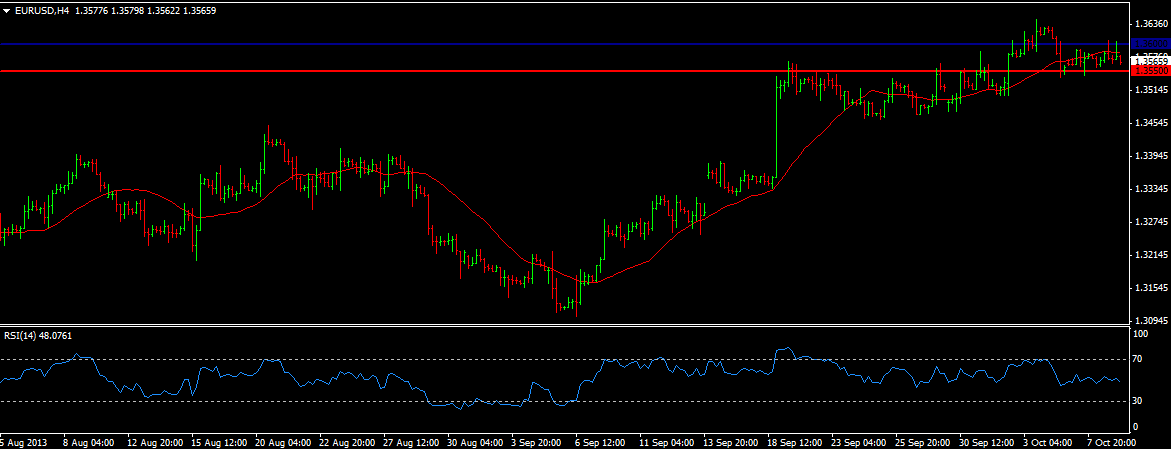

The EUR/USD (1.3565) is having a hard time going above the resistance at 1.3600. It also appears the support at 1.3550 is holding well as we are range bound for now.

EURUSD 9OCT

The USD/JPY (97.330) bounced back from 96.7880. We have strong resistance at this level now and risk a dip back to 95.60 if it does not break. AUD/USD (0.9428) has moved a little higher since the news of Janet Yellen being nominated for Fed Chair. We could aim for 0.9600 now but need to close above 0.9479 before that will happen.

COMMODITIES

WTI Crude (103.48) moved higher today and is testing the resistance at 104.00. A break above that tests 105.00 then 105.95. Brent (110.03) is above the resistance at 110.00 and can aim for 112.00 if it closes above that level.

Gold (1316.90) has fallen from 1325.00. We need to go above 1325 to test 1350 and higher.

TODAY’S OUTLOOK

Investors will cheer, somewhat, the news of Janet Yellen as nominee for the Fed Chair, but with the debt ceiling approaching the cheer will be short lived.

We are waiting on the Bank of Japan to release its minutes for last month. Later in the day the U.S. will release last month’s FOMC minutes. We also get some data as Mortgage applications are released, wholesale trade and oil inventories.

BinaryOptionStrategy does not accept any liability for loss or damage as a result of reliance on the information contained within this website; this includes education material, price quotes and charts, and analysis.Please be aware of the risks associated with trading the financial markets; never invest more money than you can risk losing. The risks involved in trading binary options are high and may not be suitable for all investors Binary Option Strategy doesn't retain responsibility for any trading losses you might face as a result of using the data hosted on this site.The data and quotes contained in this website are not provided by exchanges but rather by market makers. So prices may be different from exchange prices and may not be accurate to real time trading prices. They are supplied as a guide to trading rather than for trading purposes

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.