Bank of England Preview: Bailey to break Sterling surge with reluctance to raise rates further

- Economists expect the Bank of England to raise rates by 25 bps to 4.50% in May.

- The BoE's forecasts will likely show a reluctant upgrade of inflation projections.

- A lack of aggressive promises to hike rates further may hit the Pound.

Do I really have to? – that seems to be the thought running in the head of Bank of England (BoE) officials when it comes to raising interest rates. Despite stubborn inflation and wage rises, the "Old Lady" has been foreseeing a slowdown. In its upcoming "Super Thursday" event, the BoE will likely increase borrowing costs, but without a hawkish stance, the Pound may sell off.

Here is the preview of the Bank of England "Super Thursday” event on May 11 at 11:00 GMT.

Why the Bank of England is pushed to raise rates

The weather may be cold, but inflation is running hot in the UK: 10.1% in March, significantly above 5% in the US and 6.9% in the Eurozone in the same month. The BoE targets a headline Consumer Price Index (CPI) between 1% and 3%.

Source: FXStreet

Core CPI, which excludes prices of volatile goods, is also too high at 6.2%, showing that not only elevated energy costs are behind prices rises. A labor shortage and union demands have been buoying wage growth.

Salaries, including bonuses, are up 5.9% YoY as of February, and when excluding them, they are at 6.6%, above the level of Core CPI.

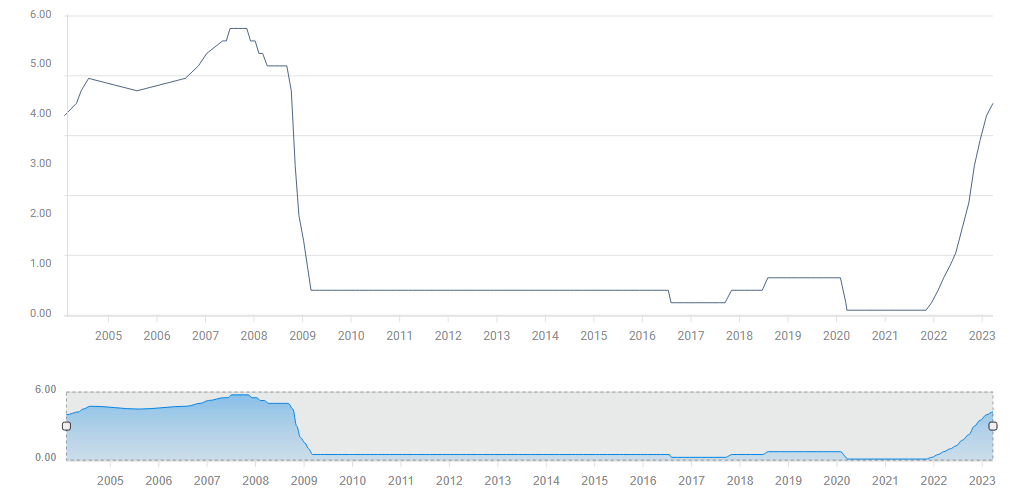

At the same time, the BoE's interest rate stands at 4.25%, so an increase to 4.5% would only be a catching-up exercise with rising prices.

Source: FXStreet

Markets to react to BoE Meeting Minutes, Monetary Policy Report, Bailey's presser

The 25 bps rate hike is priced in – Sterling has already advanced in response to the data. Two factors matter for markets: the voting pattern at the Monetary Policy Committee (MPC), and the bank's quarterly Monetary Policy Report (MPR).

In the BoE's previous rate decision, two members voted to leave borrowing costs unchanged, dissenting against the majority of seven people. If the pattern repeats itself despite upbeat data, the Pound will suffer. Any additional member opting to hold would be even worse.

Sterling would only benefit if at least one of the dissenters switches to align with the majority. An 8:1 vote or 9:0 would be considered a surprising hawkish shift.

What makes "Super Thursday" super is the quarterly report, which includes inflation forecasts. The BoE previously projected a drop in price pressures. It will probably need to revise them upward, but by how much?

If Bank of England Governor Andrew Bailey and his colleagues still predict a steep drop in inflation, the Pound would suffer. It would need to show above-target prices for this year and 2024 for the Pound to rise.

Last but not least, Bailey and several colleagues meet the press at 11:30 GMT, which is the most perilous point for the currency. The governor tends to see the glass half empty. He previously foresaw a recession, suggested workers should refrain from demanding big pay rises, and even cast doubt on further rate hikes.

Goldman Sachs and other commercial banks see UK rates hitting 5%, matching American ones. Bailey may be asked about his outlook for the "terminal" interest rate. While he is unlikely to answer it directly, he could suggest that no additional move is guaranteed. Uncertainty would also weigh on Sterling.

Final thoughts

The British economy is experiencing rapid wage growth and faster inflation – yet the data is priced in and the BoE is reluctant to guarantee additional hikes. Sterling may sell off unless Bailey and his colleagues firmly commit to further hawkish moves.

Pound Sterling FAQs

What is the Pound Sterling?

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data.

Its key trading pairs are GBP/USD, aka ‘Cable’, which < href="https://fxssi.com/the-most-traded-currency-pairs">accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

How do the decisions of the Bank of England impact on the Pound Sterling?

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates.

When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money.

When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

How does economic data influence the value of the Pound?

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP.

A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

How does the Trade Balance impact the Pound?

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.