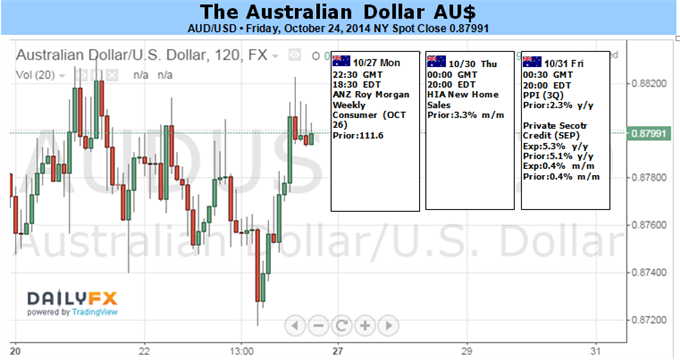

Fundamental Forecast for Australian Dollar: Neutral

- AUD/USD Remains Range-Bound Despite Plenty Of Intraday Volatility

- Void of Major Domestic Data To Leave Steadfast RBA Policy Bets Intact

- Volatility Swell and US-Centric Event Risk To Offer AUD/USD Guidance

The Australian Dollar witnessed another week of wild intraday swings that seemingly found little follow-through. Traders looked past another status-quo set of RBA Meeting Minutes that reinforced the prospect of a “period of stability” for rates. Further, CPI figures remained contained within the central banks’ target range, doing little to alter steadfast policy expectations. Similarly, top-tier data from regional powerhouse, China, failed to deliver lasting cues for the currency.

A light domestic economic docket over the coming week is likely to leave RBA policy bets well-anchored and see the Aussie take its cues from elsewhere. While the AUD’s yield advantage has remained robust, its appeal has waned due to elevated volatility levels. This in turn is likely to cap carry trade demand for the currency even alongside broader improvements in risk sentiment.

The catalyst for the next break lower for AUD/USD is likely to emerge from the US Dollar side of the equation. The upcoming FOMC decision may offer the spark needed if the statement offers a more hawkish lean that focuses on labor market improvements, rather than subdued inflation.

Speculators remain net short the pair according to the latest COT figures. Yet positioning is roughly half what was witnessed in mid-2013, suggesting the short trade is far from being “crowded”.

Downside risks remain centered on the 2014 lows near 0.8660, which if broken on a ‘daily close’ basis could pave the way for a descent on 0.8320 - the July 2010 low.For more on the US Dollar side of the equation read the weekly forecast here.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.