Fundamental Forecast for Australian Dollar: Neutral

- AUD/USD Remains Resilient In The Face Of Geopolitical Turmoil

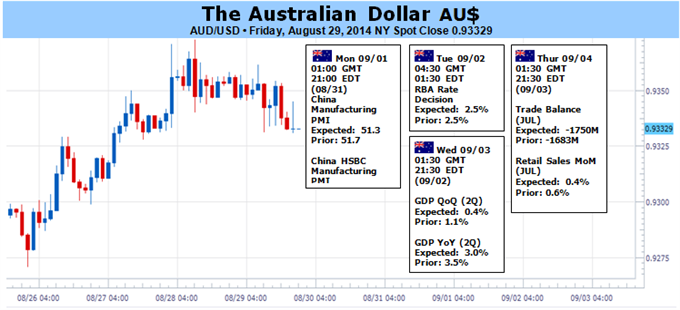

- String of Major Domestic Economic Events On The Radar This Week

- Range May Remain In Play If Fresh Data Fails To Shift RBA Policy Bets

The Australian Dollar is set to finish the week marginally higher as traders look past escalating geopolitical turmoil and return to yield plays. A drought of domestic data is set to give rise to a torrent of top-tier economic events over the coming week. These offer the potential to catalyse significant intraday volatility for the Aussie. Yet an escape from its multi-month range against the greenback may prove difficult without the requisite shift in RBA rhetoric.

Retail sales, PMI and building approvals data are all set to cross the wires throughout the week. On balance leading indicators for the health of the Australian economy have demonstrated resilience in the face of a ‘tough budget’. Another round of encouraging data could offer the Aussie a source of support.

While a less timely indicator, second quarter GDP figures will also likely provide the currency with some guidance. Quarter-on-quarter growth expectations are set relatively low (0.4 percent vs 1.1 percent prior). This may leave some room for an upside surprise which in turn would bolster the local unit.

Traders will also be wary of the potential for another surprise from the trade balance data due on Thursday. This follows the sharp decline witnessed for the June figures. Another significantly lower-than-anticipated reading could yield a knee-jerk sell-off in the currency.

However, the potential for all the aforementioned data to leave a lasting impact on the Aussie rests in the capacity to shape RBA policy bets. This may be somewhat limited in light of Governor Stevens’ recent reiteration of the Board’s preference of a ‘period of stability’ for rates. Another status-quo statement from the central bank on Tuesday could keep the Aussie contained between its 92 to 95 US cent trading band.

Finally, tensions in Eastern Europe are likely to remain on the radar for traders. Yet their influence over the high-yielding currencies appears to have waned. At this stage, it would take a significant escalation and greater international response to cause the required panic amongst traders to leave a dent in the AUD.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.