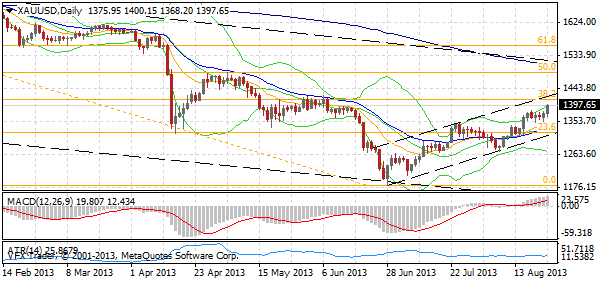

Gold surged on Friday night to $1396 oz. after the release of some very poor housing data from the US. New home sales were expected to fall in July but only 1.4% so the 13.4% drop was a huge miss and we saw the US dollar and other markets react instantaneously.

Gold is now just $17 away from the $1413 target I set a little while back but inexplicably I have managed to get myself caught short which is kind of weird and disappointing but I'll just have to dig my way out of the posi over the next week or so.

On Friday the weak housing data knocked the US dollar for six against the Euro (1.3380) which spiked but then drifted over over subsequent hours. Sterling (1.5573) did likewise but got hammered into the close and the Yen (USDJPY, 98.67) gained as well before the US dollar strengthened into the end of the week. For the Aussie Dollar it was a 40 point bounce into resistance at 0.9030/40 before it drifted off to close at 0.9025 where it is this morning.

It is going to be interesting this week for Gold and FX over the past week we saw both Euro and GBP reverse off some key levels as well and USDJPY is very close to a topside break - perhaps durable goods tonight are going to surprise to the topside.

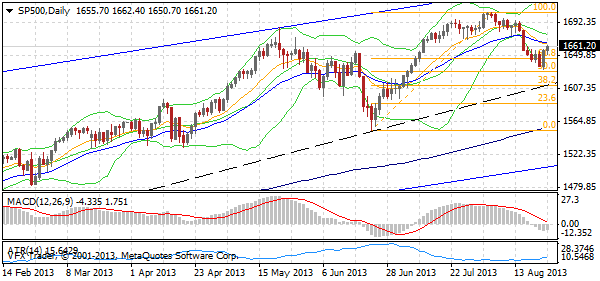

Anyway recapping Friday trade and the weaker data helped both bonds and stocks rally in the US. 10's closed at 2.81% while the Dow was up 0.32%, the Nasdaq up 0.53% while the S&P 500 rose back to 1664 up 7 points or 0.42%. In Europe the FTSE was 0.70% higher, the DAX rose 0.23%, CAC 0.24% while Milan and Madrid were up 0.19% and 0.66% respectively.

As noted above on Commodity markets Gold spiked as well on the broad US dollar weakness after the housing data closing at $1396 up 1.84%. Silver's spectacular move continued up another 3% while Oil also rose on the weaker USD up 1.32% to $106.32. The Ags were at it again with volatility the order of the day - Corn rose 1.64%, Wheat 0.63% and Soybeans were 3.2% higher. I'm guessing margin calls have increased on these futures.

Markets are in a state of flux at the moment and it is clear that even though the stock market is still doing reasonably well bearishness has grown and I saw on MArket watch this morning that the AAII survey showed mega-bearishness again. It is kind of strange but I guess the key to all of this is the Taper and the bond markets reaction to same.

My personal view is that it is becoming even more difficult for stocks to push much through these recent heady levels but then again that seems to be conventional wisdom which is never a good feeling to be part of.

As you can see in the chart the 50% retracement of the recent rally pulled up the selling last week but a move back to this level and the 1610/20 seems on the cards if the S&P 500 can't get through 1665/70 early in the week.

Data

On the data front there is some important things this week non more so than the Ifo data in Germany tomorrow night and US GDP data on Thursday. Today however sees the release of Trade data in New Zealand, Singaporean industrial production, a Bank Holiday in the UK and Durable Goods and Dallas Fed manufacturing in the US.

Have a good one

Greg

Risk Warning: Trading Forex and Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. The FSG and PDS for these products is available from GO Markets Pty Ltd and should be considered before deciding to enter into any Derivative transactions. AFSL 254963. ABN 85 081 864 039.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.