AUD/USD Weekly Forecast: Unreliably optimistic Australian data hides a nearby crisis

- Australian employment and inflation figures beat expectations in December.

- The focus now shifts to the US Federal Reserve and upcoming rate hikes in the US.

- AUD/USD may shortly resume its long term decline, according to technical readings.

The AUD/USD pair is trading below 0.7200 heading into the close, unchanged for the week. The pair peaked at 0.7276 on Thursday, helped by encouraging Australian data that, nevertheless, fell short of overshadowing the greenback’s renewed bout of demand.

Risk aversion and soaring yields

Risk-related sentiment was sour throughout the week, as market participants became increasingly concerned about slowing economic progress in a rising inflation scenario, or stagflation. Global indexes came under pressure, with Wall Street finishing the week with substantial losses. Gold prices, on the other hand, jumped to fresh two-month highs, retaining gains at the end of the week as per trading at around $1,840 a troy ounce.

Finally, government bond yields soared, unusual behaviour in a climate of risk-off, but quite a normal one since 2021, as stagflation spreads globally. The economic recovery slowed amid the spread of Omicron, while employment figures began to disappoint for the same reason. Price pressures remained unchanged, with most developed countries seeing inflation reach multi-decade highs.

Australian data released these days hides the fact the country is also heading into stagflation, just because it took longer to put the machine in motion. Australia has had lockdowns through most of 2021 and has only just begun reopenings by the end of the year. That’s why it is experiencing a “boom,” with outstanding job creation in November, followed by an upbeat December report released this week. The country added 64.8K positions in the month, more than doubling the market’s expectations. The Unemployment Rate contracted to 4.2%, much better than the 4.5% expected, while the Participation Rate remained steady at 66.1%.

Additionally, January Consumer Inflation Expectations contracted to 4.4% from 4.8% previously, not bad news at all. However, it is yet to be seen if the country will be able to sustain steady job creation and inflation within decent levels.

Busy calendar ahead

As opposed to what was seen in the last few days, the upcoming week will be a busy one in terms of macroeconomic releases. On Monday, it will be the turn of the preliminary estimates of January PMIs for both economies, while Australia will release December NAB’s Business Confidence and the Q4 Consumer Price Index on Tuesday. Later in the week, the country will offer the December Westpac Leading Index and the Q4 Producer Price Index.

The US Federal Reserve will announce its decision on monetary policy on January 26. No action is expected at this time, although market participants are hoping for clearer hints about upcoming rate hikes. Investors are pricing in a first rate hike for March 2022 and at least three hikes through the year. Also, the country will publish the first estimate of Q4 Gross Domestic Product, foreseen at 5.8% QoQ, and December Durable Goods Orders. At the end of the week, the US will release the Core Personal Expenditures Price Index, the Fed’s favourite inflation measure.

AUD/USD technical outlook

The weekly chart for the AUD/USD pair shows that it remains trapped between directionless moving averages, with a bearish 20 SMA capping the upside. The Momentum indicator is heading south within negative levels, while the RSI indicator is consolidating around 45, skewing the risk to the downside. Additionally, the pair is battling around the 38.2% retracement of its 0.7555/0.6992 decline.

The daily chart offers a neutral-to-bearish stance. A mildly bearish 100 SMA is converging with the 50% retracement of the mentioned decline at 0.7275 providing resistance, while the pair is trading below a flat 20 SMA. In the meantime, technical indicators seesaw around their midlines, lacking directional strength.

Bulls may take over on a break above the aforementioned 0.7275 level, with the next relevant level at 0.7340, the 61.8% retracement of the same slide. Beyond the latter, the pair may extend its rally up to the 0.7400 region. Below 0.7130, the risk should turn to the downside, with scope for a test of the 0.7000 threshold.

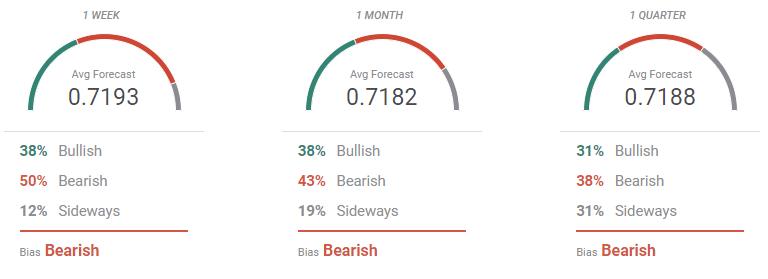

AUD/USD sentiment poll

The FXStreet Forecast Poll hints at further declines for AUD/USD. Bears are a majority in the three time-frame under study, although they decrease as time goes by, and only in the weekly view they reach 50% of the polled experts. On average, the pair is seen stable at around 0.7190 in the next three months.

The Overview chart replicates the neutral stance, although the near-term moving average ticks lower, which may spur some selling next week and see some long-term position readjustments in the next one. Worth noting that in the quarterly perspective, the number of those looking for lower lows sub-0.7000 continues to rise.

Related Forecasts:

EUR/USD Weekly Forecast: Federal Reserve between a rock and a hard place

Gold Weekly Forecast: XAU/USD could turn south on a hawkish Fed surprise

GBP/USD Weekly Forecast: Sterling set rebound with help from the Fed, ignoring Boris' travails

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.