AUD/USD Price Forecast: Recovery appears only temporary

- AUD/USD failed to sustain a brief move above the 0.6200 level.

- The US Dollar weakened further on another tariff story, US data.

- The Westpac Consumer Confidence Index receded a tad in January.

The US Dollar (USD) added to Monday’s losses, pushing the US Dollar Index (DXY) to the low-109.00s on turnaround Tuesday. Meanwhile, the Australian Dollar (AUD) extended its positive start to the week and flirted once again with the 0.6200 neighbourhood.

Why is the Aussie under pressure?

The Australian Dollar has been struggling against a strengthening US Dollar, which has been on a roll since October, fueled by the so-called "Trump trade." This surge in USD strength has left the Aussie on the defensive.

Adding to its challenges, the Reserve Bank of Australia (RBA) has hinted at a potential interest rate cut. Minutes from the RBA's December meeting suggest that while the current monetary policy is still seen as appropriate, the bank is open to a rate cut as early as February if economic data supports it. Markets now see a 62% chance of such a move, a dovish contrast to the Federal Reserve's cautious stance on easing policy.

Broader market risk aversion and ongoing concerns about China’s economic slowdown—critical for Australia’s export-driven economy—are further weighing on the Aussie.

Domestic data adds to the weakness

The Australian Dollar is also grappling with disappointing domestic economic data. Recent GDP figures for the third quarter (July–September) showed the economy grew just 0.3% quarter-on-quarter and 0.8% year-on-year, both missing expectations. This sluggish growth has dampened confidence in Australia’s economic outlook.

In the same line, Consumer Confidence in Australia eased to 92.1 in January, according to Westpac, slightly below December’s 92.8.

Additionally, the muted price action in both copper prices and iron ore prices offered little support for the AUD on Tuesday. While commodity markets showed some strength earlier this year, these gains have failed to translate into sustained support for the currency. Meanwhile, uncertainty about China's stimulus measures and a stable Chinese Yuan have added to the AUD’s struggles.

RBA’s signals keep markets guessing

At its December meeting, the RBA kept interest rates unchanged at 4.35%, as expected. However, it surprised markets by signalling the possibility of a rate cut in February, shifting from a previously neutral tone. The central bank now believes inflation is moving closer to its target, stating that “some of the upside risks to inflation appear to have eased.”

RBA Governor Michele Bullock struck a cautious tone, emphasising that the Board hasn’t committed to any specific policy moves and will base its decisions on future economic developments.

Challenges and opportunities for AUD/USD

The AUD/USD pair faces tough headwinds, including persistent US inflation, a resilient US Dollar, the RBA’s dovish stance, and China’s economic slowdown. However, a potential pivot by the Federal Reserve toward fewer rate cuts could offer some breathing room for the Aussie.

For now, the Australian Dollar remains on the back foot, facing significant domestic and global pressures.

Technical Analysis: What the charts say

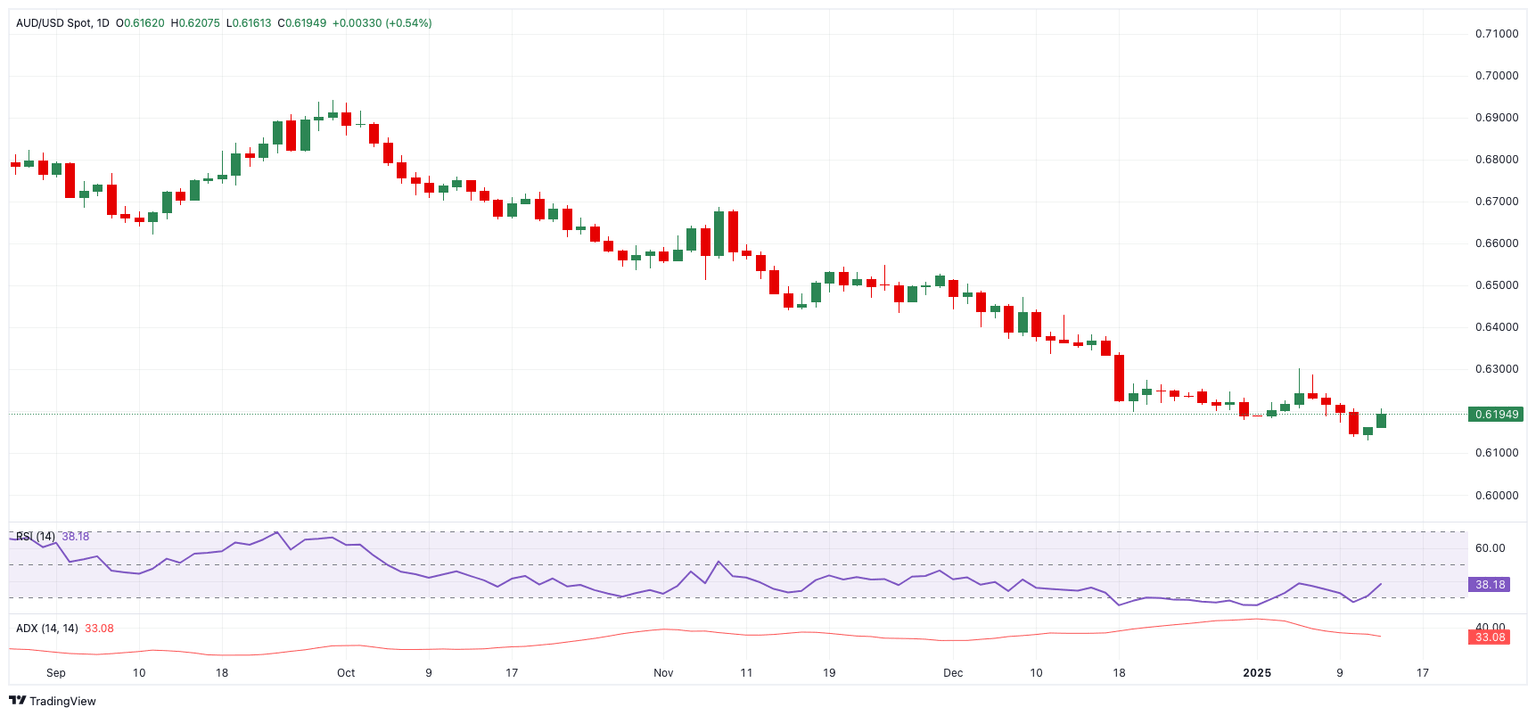

The AUD/USD remains weak, with the next critical support level at the 2025 low of 0.6130 (January 13). A break below this could open the door to the 0.6000 threshold, with the April 2020 low of 0.5980 as a potential downside target. On the upside, resistance lies at the 2025 high of 0.6301 (January 6), followed by the transitory 55-day SMA at 0.6401 and the weekly high of 0.6549 (November 25).

Momentum indicators suggest mixed signals. The Relative Strength Index (RSI) has rebounded from oversold levels and is now testing the 35 area, pointing to some short-term optimism. Meanwhile, the Average Directional Index (ADX) above 37 reflects a strong trend direction.

AUD/USD daily chart

Key Events to Watch This Week

Key data points for the Australian economy are on the horizon. The final building permits figures for November are due soon, followed by the all-important Australian labour market report on January 16. Later in the week, consumer inflation expectations will also draw attention.

Outlook: Tough Road Ahead for the Aussie

The Australian Dollar remains caught between domestic challenges and global uncertainties. While there’s some potential for recovery, much depends on upcoming data from Australia, the US, and China, as well as the RBA’s policy decisions. For now, caution remains the dominant sentiment.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.