AUD/USD Forecast: Next on the upside comes 0.6650

- AUD/USD left behind Friday’s pullback and regained 0.6600.

- Further downside pressure hit the Greenback on Monday.

- Further gains are likely while above the 200-day SMA.

Renewed selling pressure in the US Dollar (USD) supported the rebound in risk-linked assets, prompting AUD/USD to climb back above the 0.6600 mark at the beginning of a new trading week.

Meanwhile, the Greenback kicked off the week on the backfoot amidst rising prudence ahead of the release of US inflation readings tracked by the Producer Prices (PPI) on Tuesday and Consumer Price Index (CPI) on Wednesday. In addition, falling US yields contributed to the corrective downturn in the USD Index (DXY) against the backdrop of an economic environment consistent with the anticipated start of the Fed's easing program, likely around September.

Back to the domestic background, an extra increase in copper prices and a mild uptick in iron ore prices also contributed to sustain the upside impetus around the Australian dollar on Monday.

Shifting attention to monetary policy, the Reserve Bank of Australia (RBA) chose to leave its interest rate unchanged at 4.35% during its meeting on May 7. Additionally, the bank reiterated its neutral policy stance, indicating flexibility in its approach. Furthermore, the RBA updated its economic forecasts, projecting higher inflation rates up to Q2 2025, mainly due to ongoing service price inflation. However, the bank anticipates inflation to return to the target range of 2%–3% by the latter part of 2025, reaching the midpoint by 2026.

During the subsequent press briefing, Governor Michele Bullock maintained a balanced view. Regarding interest rates, she indicated the board's consideration of potential rate hikes at the current meeting, stating, "we might have to raise, we might not."

Presently, the swaps market has largely discounted the likelihood of further rate hikes in the next six months, with a decline expected in the following six months.

Additionally, both the RBA and the Federal Reserve are expected to implement their easing measures later than many other G10 counterparts.

Considering the Fed's commitment to monetary policy tightening and the potential for RBA easing later in the year, sustained advances in AUD/USD are anticipated to be restricted.

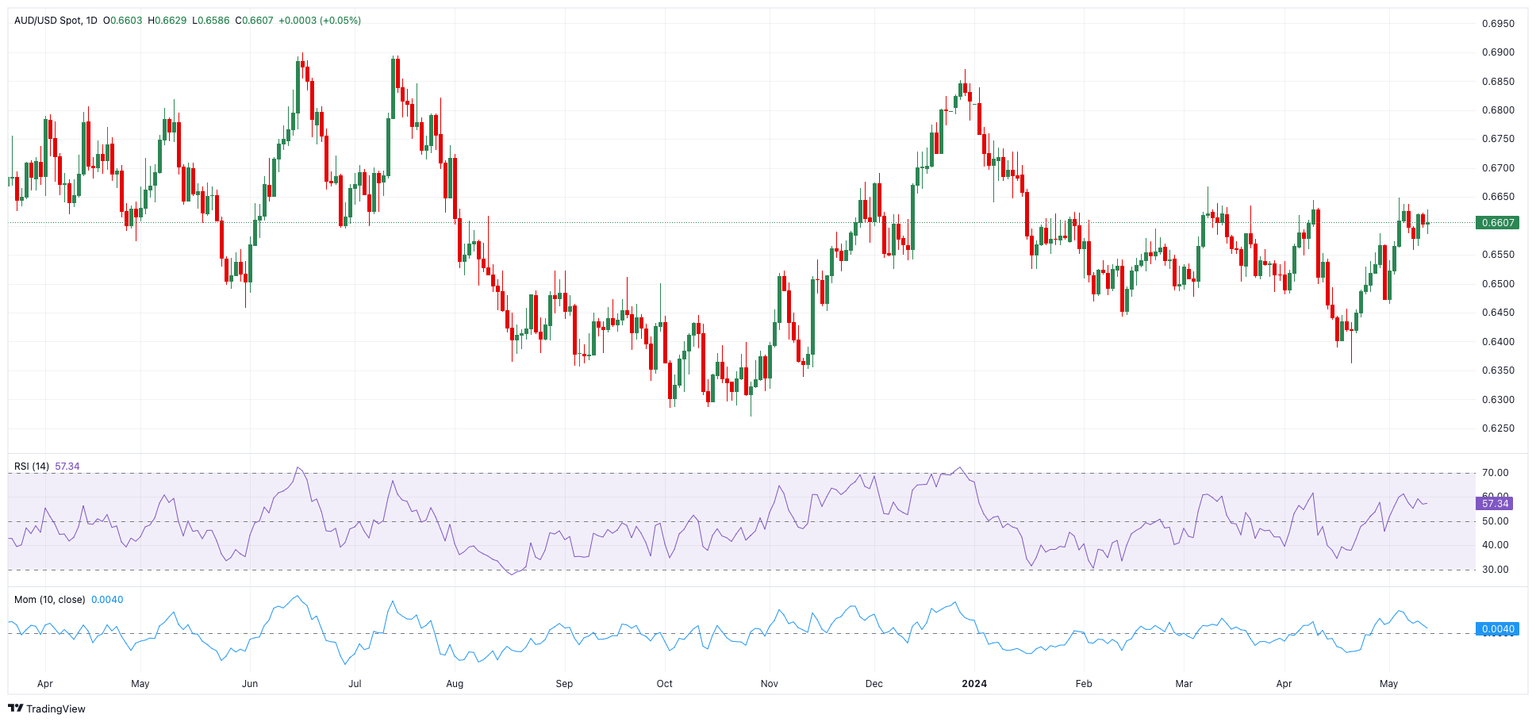

AUD/USD daily chart

AUD/USD short-term technical outlook

Extra gains may bring the AUD/USD to revisit its May high of 0.6647 (May 3), prior to the March top of 0.6667 (March 8) and the December 2023 peak of 0.6871.

Meanwhile, if bears take control, there is temporary contention at the 100-day and 55-day SMAs at 0.6572 and 0.6539, respectively, before the more relevant 200-day SMA at 0.6520, all before falling to the May low of 0.6465 and the 2024 bottom of 0.6362 (April 19).

Looking at the bigger picture, as long as spot trades above the 200-day SMA, additional gains should follow.

On the four-hour chart, buying momentum appears to have regained traction. However, early resistance occurs at 0.6647 before 0.6667. On the downside, 0.6585 provides immediate support, ahead of 0.6557 and the 100-SMA at 0.6542. The RSI retreated to 54.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.