AUD/USD Forecast: Gaining near-term bearish traction

AUD/USD Current Price: 0.7679

- Chinese upbeat Q4 GDP provide temporal support to high-yielding assets.

- A sour market’s mood maintained the greenback strong against the aussie.

- AUD/USD is gaining bearish potential and may accelerate south in the next session.

The AUD/USD pair is heading into the Asian opening trading around 0.7680, posting some modest losses on Monday. Financial markets were slightly optimistic at the beginning of the week, helped by upbeat Chinese data, as the country reported a Q4 annualized Gross Domestic Product of 6.5%. Also, Industrial Production in the country rose 7.3% YoY in December, while Retail Sales were up 4.6%, this last, missing expectations of 5.5%.

The mood deteriorated during the European session, as investors remain concerned about economic progress within the pandemic environment. Australia didn’t publish macroeconomic data, but will release this Tuesday some minor housing figures.

AUD/USD short-term technical outlook

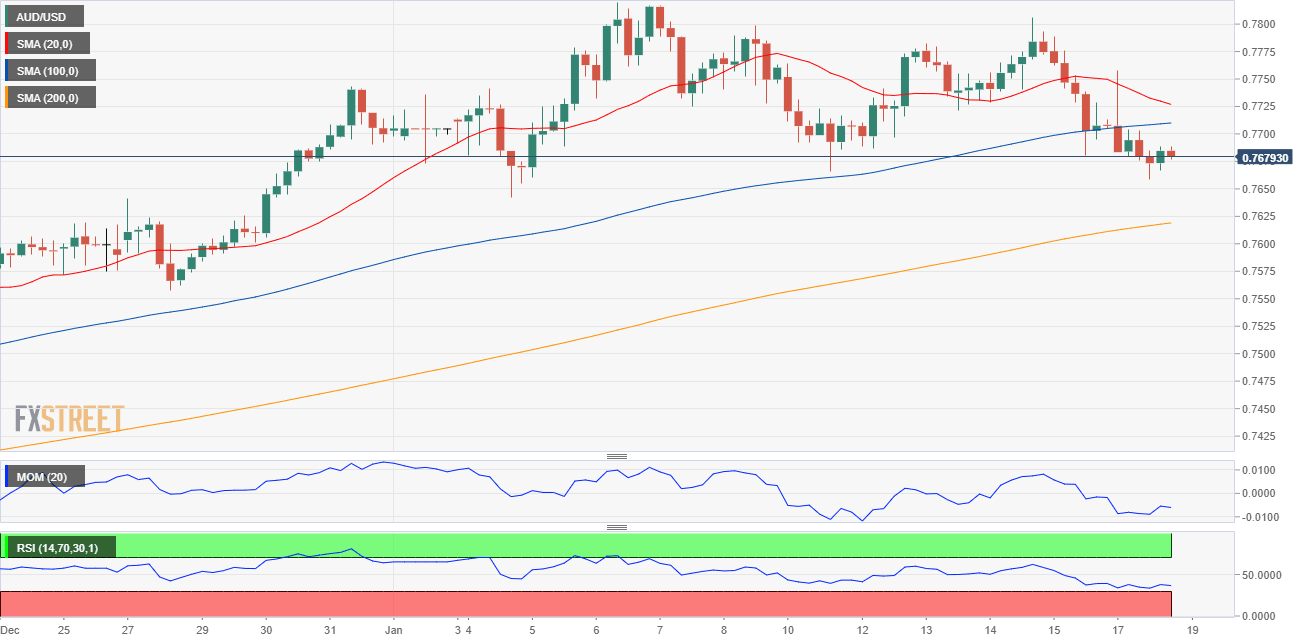

The AUD/USD pair has extended its decline, which increases the risk of a bearish continuation in the upcoming sessions. The 4-hour chart shows that the pair has settled below its 20 and 100 SMAs, with the shorter gaining bearish strength. Technical indicators remain near daily lows within negative levels, lacking directional strength. The slide will likely gain pace on a break below 0.7658, the daily low.

Support levels: 0.7655 0.7620 0.7580

Resistance levels: 0.7720 0.7770 0.7815

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.