Gold Price Forecast: Easy money will be turned into gold

- Policymakers keep pumping money into the system, gold will be the most benefited.

- Supply shortage of physical gold is another factor playing in bull’s favour.

- XAU/USD could extend its rally toward the 1,800 price zone in the upcoming days.

After hesitating in the previous week, gold prices soared in these last few days, with spot gold trading as high as $ 1,690.23 a troy ounce, to close the week less than $ 10.00 below this last. The bright metal gained the most on Thursday, following the US Federal Reserve decision to announce another round on massive easing, this time in the form of loans of up to $2.3 trillion.

Following the announcement, US Federal Reserve Chief Powell offered a speech afterwards and reaffirmed that the central bank would continue to use all available tools to support the American economy until it recovers. Concerned about the high levels of unemployment the US may reach, Powell was overall confident that the situation will revert as soon as the pandemic is under control.

Gold futures, in the meantime, reached a 7.5 year high around $1,750.00 a troy ounce after the announcement, as the ongoing pandemic-related crisis, keeps fueling demand for the safe-haven metal. With the world’s economies in pause, fears or recession loom, hence, demand for gold will likely persist.

Excess of liquidity and shortage of physical gold

Meanwhile, gold supply remains subdued. This past week, several Swill refineries re-opened, but global demand keeps rising. And as central banks have turned on the printing machine, much of the excess of liquidity has already a place to go.

The extend of the global economic damage caused by the pandemic is yet to be seen, although nobody doubts it will be long and painful. In this scenario, gold is meant to keep on rallying.

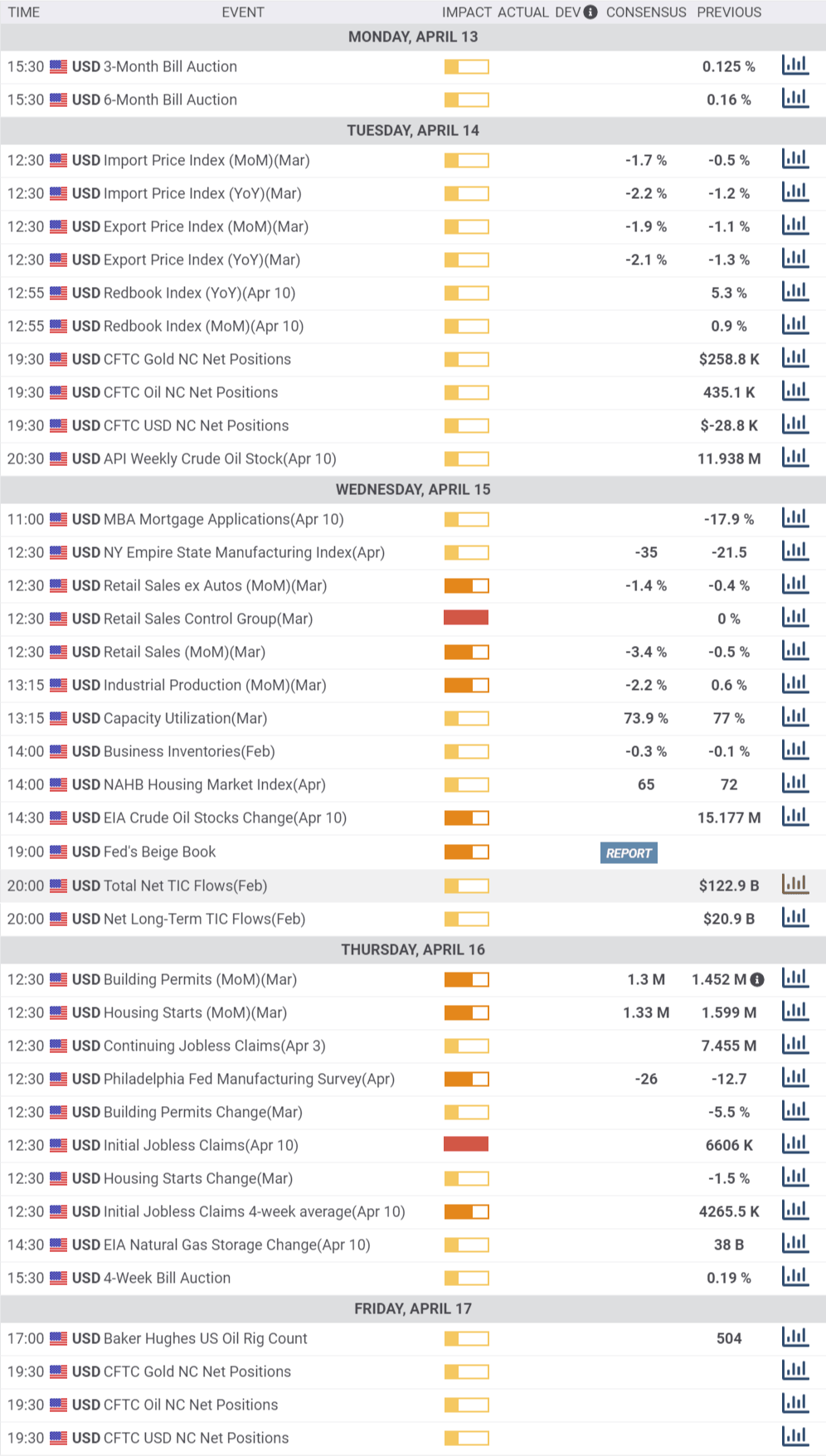

More hints on how the pandemic is hitting the world will be out next week, as the US will report March Retail Sales, and Initial Jobless Claims for the week ended March 3.

Spot Gold Technical Outlook

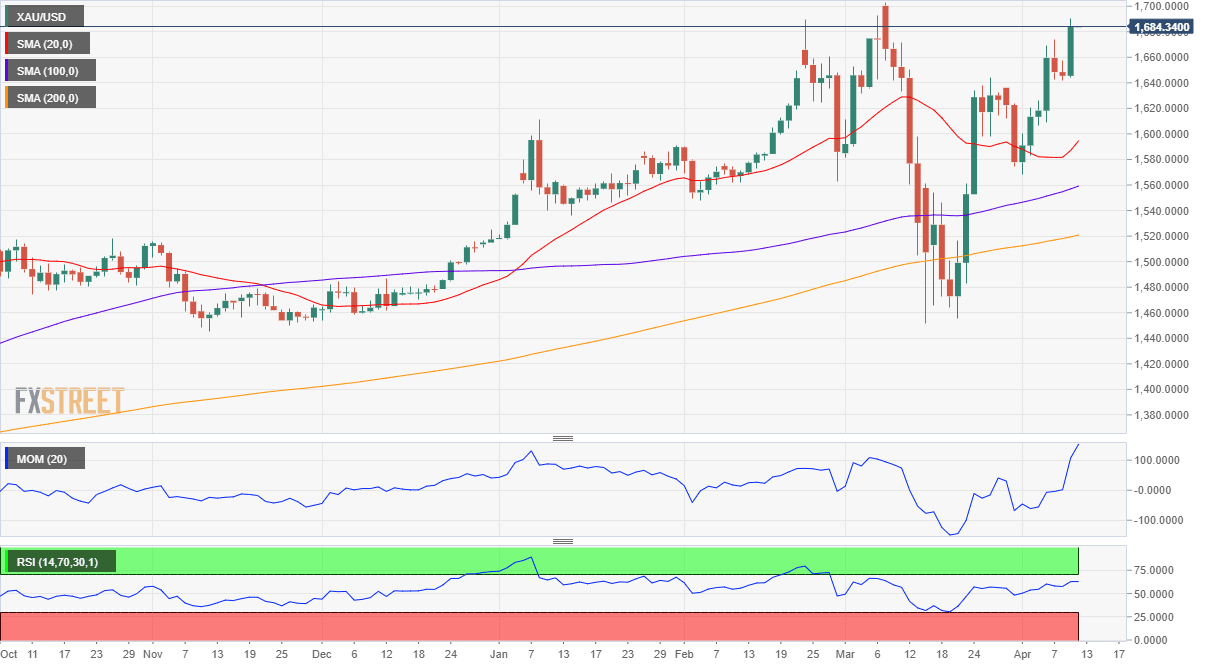

Trading at around 1,680, spot gold is close to the multi-year high set early Mach at 1.703.18. The commodity is bullish, with technicals aligned with fundamentals.

The weekly chart shows that it bottomed at around the 61.8% retracement of its latest weekly slump, at 1,606.60. It has continued to develop far above all of its moving averages, with the 20 SMA accelerating north. Technical indicators have resumed their advances within positive levels, although they lack enough strength to confirm a steeper advance.

In the daily chart, the Momentum indicator is partially losing its bullish strength in overbought levels, while the RSI maintains its strength upward at around 63. The 20 DMA has turned back north, although it’s barely picking up after trending lower for the past 5-weeks. Anyway, the larger moving averages maintain their bullish slopes.

The weekly high at 1,690 is the immediate resistance ahead of 1,703. Beyond this last, 1,795.80, the high from October 2012, comes at sight. Supports for the upcoming days come at 1,661 and the 1,640 price zone.

Gold Sentiment Poll

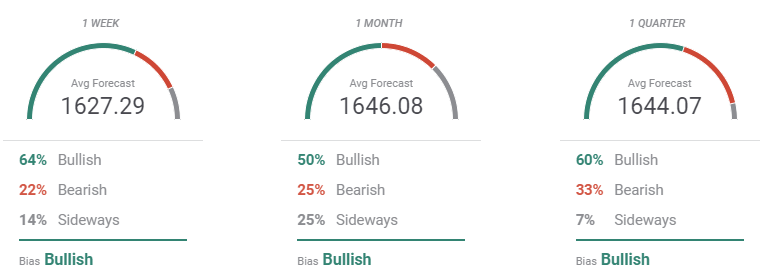

The FXStreet Forecast Poll shows that bulls are a majority in all the time-frame under study, with bears between 22% and 33% throughout the quarter. On average, however, the bright metal is seen trading around 1,650.

Moving averages in the Overview chart maintain their bullish slopes in the 1-week and 1-month views, but the MA flattens in the longer perspective, probably as a result of the ongoing uncertainty rather than because speculation the metal may have reached a top. Furthermore, this same chart shows that most targets accumulate around 1,700, with a few exceptionally low targets distorting the average.

Related Forecasts:

EUR/USD Forecast: Financial rescue keeps rising, crisis remains the same

GBP/USD Forecast: Has coronavirus peaked? That is the question in the US, the UK, and for Johnson

AUD/USD Forecast: Can optimism prevail? Australia's jobs report, Chinese GDP, US coronavirus eyed

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.