AUD/USD Current price: 0.7057

- Despite broad dollar's weakness, equities' collapse favors the greenback against the Aussie.

- Thin market conditions to prevail until the first week of January.

The AUD/USD pair trades measly 40 pips above its yearly low of 0.7020, as despite broad dollar's weakness, the Aussie is being dragged by commodities and equities, which trade also at early lows, with US oil barely holding above $45.00 a barrel and US indexes at levels last seen in October 2017. The Australian currency has been hit in the second half of the year by increased concerns about an economic downturn in China and the rest of the world.

The pair flirted with the mentioned yearly low Friday, as worse-than-expected US data sent Wall Street's nose-diving. A modest bounce has occurred with the weekly opening, albeit the advance is being capped by the sour tone of equities. Several markets are closed and the US ones are due to an early close for the Christmas holiday, with little to be expected today. Meanwhile, US Treasury Secretary Mnuchin called top executives from the six largest US banks to discuss liquidity, which triggered a modest bounce in US equities ahead of the opening. Still, with the US government shutdown and latest data, chances are skewed to the downside both, for Wall Street and AUD/USD.

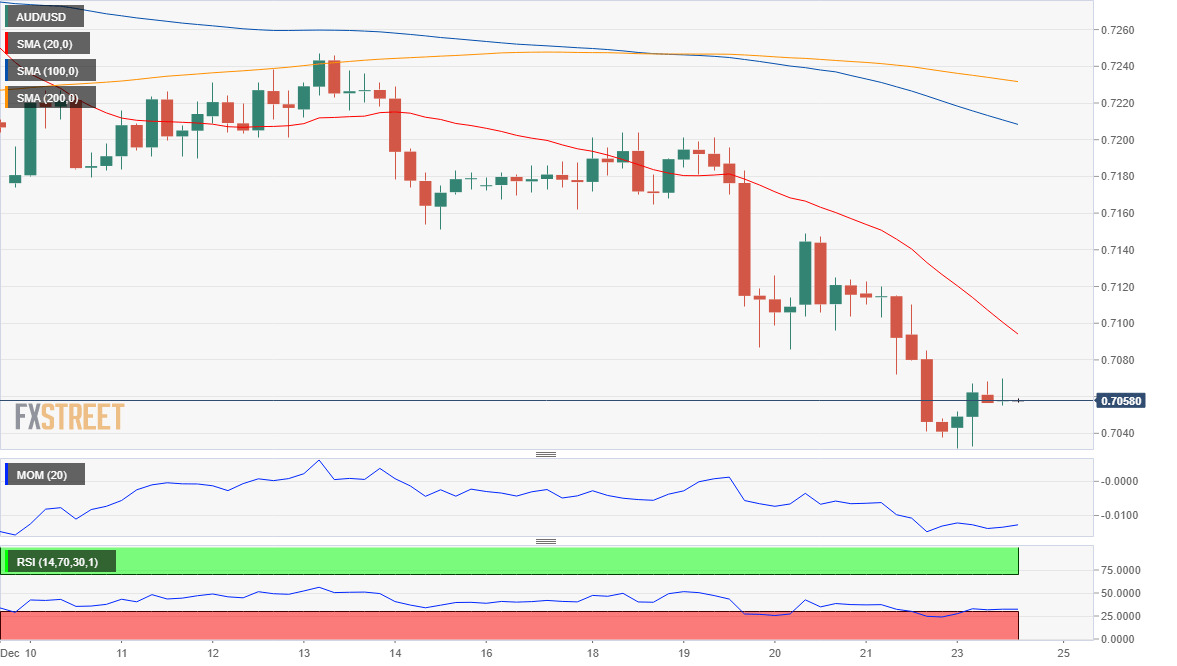

The bearish stance prevails for the AUD/USD pair according to the 4 hours chart, as the pair is developing well below moving averages, with the 20 and 100 SMA converging with downward slopes around 0.7215. Technical indicators in the mentioned time frame have barely bounced from oversold readings, without enough strength to confirm an upcoming bullish move. The immediate resistance comes at 0.7080, with chances of a recovery up to 0.7130 on a break above it. Below the mentioned yearly low, a break below 0.7000 seems likely.

Support levels: 0.7140 0.7110 0.7080

Resistance levels: 0.7175 0.7220 0.7250

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.