While it will be an ‘uncertain Summer’ post the Brexit vote, we think that the likelihood that little will get done, in terms of negotiations of the UK’s exit from the EU, until October means that volatility could quieten down and commodity currencies experience some near-term upside on the back of carry trade demand.

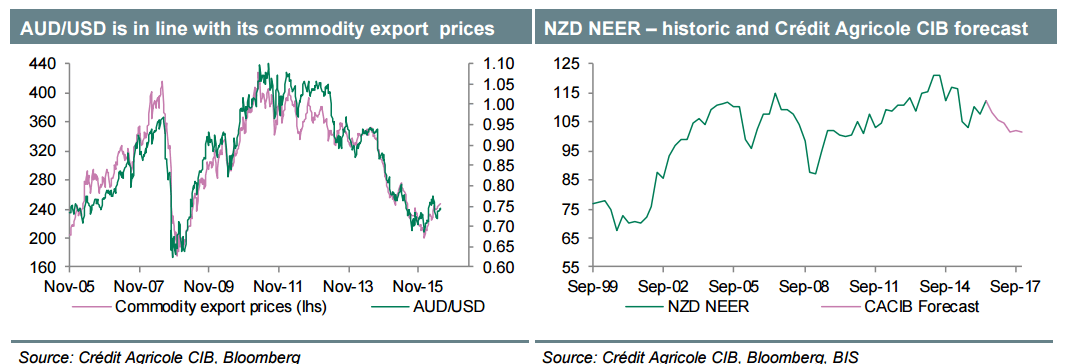

However, we see that the AUD is currently close to its long-term fundamental value and that a rally without the justification of improved outlooks for global growth, commodity prices or the Australian economy would push it into overvalued territory.

This overvaluation would be corrected in the medium-term by any of:

1. The RBA being forced to cut rates significantly, by further than what we expect, ie, two to three more rate cuts rather than just one; 2. A fresh round of risk-off trading on the back of fresh Brexit news; 3. A return to negative sentiment toward China’s growth outlook; and/or 4. The FOMC continuing with its rate normalisation cycle, albeit at a slower pace. Importantly, these events are not mutually exclusive, in our view.

Crédit Agricole CIB’s forecast is for Chinese growth to continue at 6-7%, which would be a benign outcome for Australia’s export commodity prices. So we think that the other three sources of a downward correction in the AUD are more likely, Among these three a return to FOMC rate normalisation is the more probable source of AUD weakness in the medium term, in our view. The Antipodeans’ exposure to Brexit fallout is indirect via its impact on Chinese growth, given China’s strong trade and investment links with the EU. And reduced demand by SWFs for GBP as a reserve currency could lead to more reserve allocations toward AUD and CAD; not so much the illiquid NZD.

We think that Summer-time rallies in the AUD/USD back above 0.7600 should be sold into. The exception to this would be if the incumbent Liberal/National Party Coalition were successful in gaining a majority in both the House of Representatives and Senate in the general election on 2 July. In that case, we would set our sell levels higher and on the way to 0.78.

'This content has been provided under specific arrangement with eFXnews.'

eFXnews is a financial news and information service. Articles and other information distributed in this service and published on this site are provided in general terms and do not take account of or address any individual user's position. To the extent that some of these articles include suggestions as to various possible investment strategies which users might consider, they do so in only general terms without reference to the personal factors which should determine any user's investment decisions to buy or sell a specific security or currency.

The service and the content of this site are provided and distributed on the basis of “AS IS” without warranties of any kind either, express or implied, including without limitations, warranties of title or implied warranties of merchantability or fitness for a particular purpose. eFXnews and its employees, officers, directors, agents, and licensors do not also warrant the accuracy, completeness or timeliness of the information in any of the articles and other information distributed in this service and included on this site, and eFXnews hereby disclaims any such express or implied warranties; and, you hereby acknowledge that use of the service and the content of this site is at you sole risk.

In no event shall eFXnews and its employees, officers, directors, agents, and licensors will be liable to you or any third party or anyone else for any decision made or action taken by you in your reliance on any strategy and/or advice included in any article and other information distributed in this service and published in this site.

Recommended Content

Editors’ Picks

AUD/USD weakens further as US Treasury yields boost US Dollar

The Australian Dollar extended its losses against the US Dollar for the second straight day, as higher US Treasury bond yields underpinned the Greenback. On Wednesday, the AUD/USD lost 0.26% as market participants turned risk-averse. As the Asian session begins, the pair trades around 0.6577.

EUR/USD stuck near midrange ahead of thin Thursday session

EUR/USD is reverting to the near-term mean, stuck near 1.0750 and stuck firmly in the week’s opening trading range. Markets will be on the lookout for speeches from ECB policymakers, but officials are broadly expected to avoid rocking the boat amidst holiday-constrained market flows.

Gold price drops amid higher US yields awaiting next week's US inflation

Gold remained at familiar levels on Wednesday, trading near $2,312 amid rising US Treasury yields and a strong US dollar. Traders await unemployment claims on Thursday, followed by Friday's University of Michigan Consumer Sentiment survey.

Bitcoin price drops, but holders with 100 to 1000 BTC continue to buy up

Bitcoin price action continues to show a lack of participation from new traders, steadily grinding south in the one-day timeframe, while the one-week period shows a horizontal chop. Meanwhile, data shows that some holder segments continue to buy up.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.