The ruling party of PM Abe won a majority in the weekend elections, but not the landslide that many had predicted. USD/JPY is trying to figure out how to react to what should be a bullish event but with a market already sitting on substantial long positions.

A decision by the Federal Reserve to review its 2003 ruling allowing banks to trade in physical commodities could also have far-reaching implications. Commodity markets will obviously become more volatile if the banks activity is curtailed and equity markets will be affected by the impact on the bank’s bottom line.

The PBOC scrapped the floor on lending rates over the weekend, another step in the direction of a more market orientated system.

Finally press reports in Australia suggest that a rate cut in August is almost certain and that Treasury will downgrade GDP forecasts.

USD/JPY has been reasonably volatile this morning, up and down inside a 50 pip range, but the overall range edges are still holding. Buying dips rather than breaks is still the preferred strategy.

EUR/JPY is targeting important daily highs at 133.80.

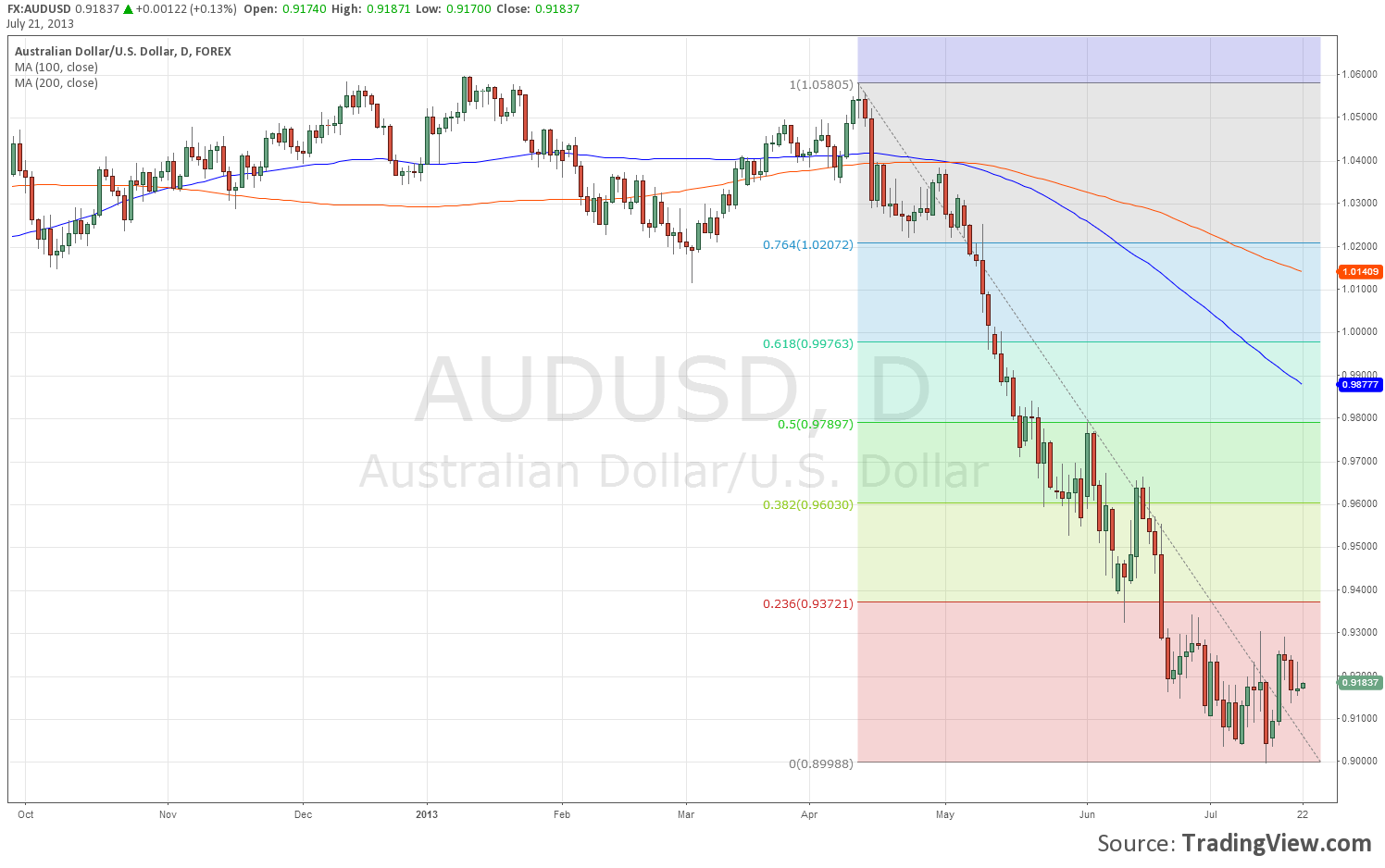

AUD/USD is trading inside obvious parameters at .9000/.9350 but the main factor here for me is the heavily oversold dailies and I still expect to see a minimum retracement towards .9600 in coming weeks. On the day, resistance should be solid at .9260 with support levels starting at .9140.

AUD/NZD has bounced back above 1.1600 after the Wellington earthquake but still looks to be stuck in a 1.1500/1.1800 range.

EUR/USD is once again back in range trading mode inside a 1.30/1.32 range but I am maintaining my bullish bias for an eventual break higher (at current rate that could be in 2020!!).

EUR/GBP is sitting on previous support at .8600 and EUR/CHF has gone to sleep again near 1.2375.

Good luck today.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.