Starting 2016, the Financial Sector Could Be the Key to Sustainable Growth

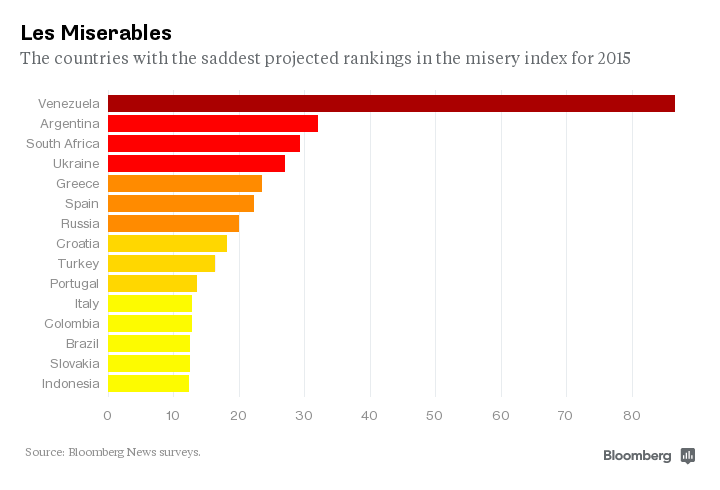

In Bloomberg’s Misery Index of 2015, Argentina was ranked second after Venezuela due to the country’s high inflation rate of 30 percent at the time, combined with an unemployment rate of 7 percent earlier in the year. With such dire economic figures, it’s no surprise why most foreign investors have shunned away from South America’s second-largest economy in spite of its vast natural resources and economic potential.

Achur Iskounen, an equity and commodity trader who once benefited from trading the Argentine markets, is now reluctant to reinvest in Argentina because of some of the political and economic instabilities. Achur ran a hedge fund in New York City from 2012 until 2014, in which he made a special-situation investment to buy Argentine equities (YPF, IRSA) and shorted Brazilian equities (PetroBras, LaTAm Airlines). Achur’s bullish speculation on Argentinian stocks had the best performance in his portfolio because during that 24-month period (2012–2014), Argentina had the best performing equity markets in the world.

Argentina – Stock Market Data

| 2010 | 2011 | 2012 | 2013 | 2014 | |

| Stock Market (annual variation in %) | 51.8 | -30.1 | 15.9 | 88.9 | 59.1 |

Are Foreign Investors Wrong About Argentina?

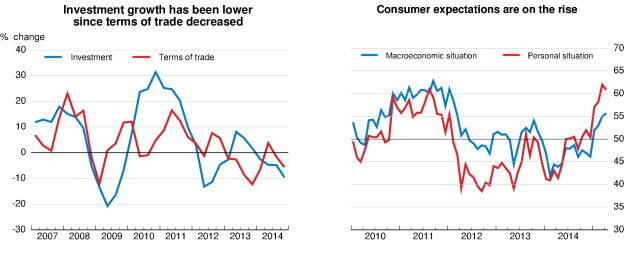

Most of Argentina’s financial dilemmas are based on monetary policies that have more to do with politics than economic fundamentals. For example, inflation and the bonds “holdout” have been major concerns, but inflation has somewhat decreased recently to 28 percent from 30 percent, and it is expected to decline further in 2016. The recent slow economic activities and lower energy prices have put less pressure on domestic prices. Moreover, the discrepancy between the formal and informal exchange rate which had pressure on inflation – originating from the lame-duck government restrictions on currency markets – has stabilized between 40 and 50 percent since the end of 2014, and it is expected to continue moderating throughout this year and the next due to the expectation that a new government will implement more orthodox economic policies. In a recent interview with Financial Times, elected president Mauricio Macri promised to bring inflation down to a single digit in a couple of years. And as for the bondholders holdout, Macri plans to work with debtors and the IMF to fix the issue.LatinFocus Consensus Forecasts panelists expect GDP to contract 0.1 percent in 2015, which is up 0.1 percentage points from earlier projections. For 2016, the panel sees the economy rebounding and expanding 2.0 percent. These small optimistic outlooks and projections of Argentina’s economy are partly due to results in recent elections, which show a shift in voter sentiment against the incumbent government and its policies. For instance, consumer confidence index increased from 52.9 in April to 55.0 in May 2015 (after the primary elections), which marked the highest value since January 2012, according to the Universidad Torcuato di Tella (UTDT).

After the first round of the presidential elections, the financial markets rallied in Argentina. Buenos Aires stocks climbed and the Merval benchmark index went up 10 percent in one day. Banco Macro rose 15.3 percent, Banco Francés 8 percent, Grupo Financiero Galicia 9.5 percent and Pampa Energía 8.8 percent.

Argentina’s financial and energy stocks also rallied on Wall Street with Banco Macro surging 24.3 percent; Grupo Financiero Galicia 20.6 percent; and Banco Francés 18.2 percent. In the energy sector, stocks of Pampa Energía climbed 16.9 percent, Transportadora de Gas del Sur 15.5 percent, Telecom 14.4 percent and YPF 13.7 percent.

Should Foreign Investors Invest in Argentina?

Argentina is usually an archetype for financial crisis and uncertainty, but one thing is for sure: a new government will bring some form of positive economic changes in the next five years. Anything else is considered better than the current situation. Even with the moderate or shrinking financial growth in Argentina, it still has some strong fundamental forces like highly educated population (arguably highest in the region); fastest growing middle class in LATAM; and a shrinking unemployment rate from 7.5 earlier this year to 6.6 in Q4 (the lowest unemployment rate in the region). Argentina’s strong infrastructures and vast natural resources also make the country an attractive buy for foreign investments. In spite of Achur’s bearish sentiment toward Argentina, he still admits that Brazil is behind Argentina in infrastructure and logistics. According to Archur, “Brazil liberalized their port legislation and is putting a very heavy emphasis on logistics, roads, rail projects. Many of these things are investments Argentina already made in the last 50 years.”The expected monetary policy restructure in Argentina after the change of government will more likely cause abundant liquidity, and increased growth in median household income relative to GDP. For 2016, analysts expect official GDP to expand 2.3 percent. Experts see non-official GDP contracting 1.5 percent in 2015; they expect it to rebound to a 2.0 percent expansion in 2016.

Argentina is currently highly undervalued considering that political risk is the main factor. The country’s US Dollar Bonds are currently paying 9 percent annually, while total debt is under 40 percent of GDP and foreign currency debt currently is at 20 percent. Similarly, Argentina’s main equity index, the MERVAL, has a Cyclical Adjusted Price to Earnings ratio (CAPE) at an estimated six times earnings – much cheaper than most emerging markets. Therefore, most investors should look at Argentina’s financial markets as one of the primary sectors for investments.

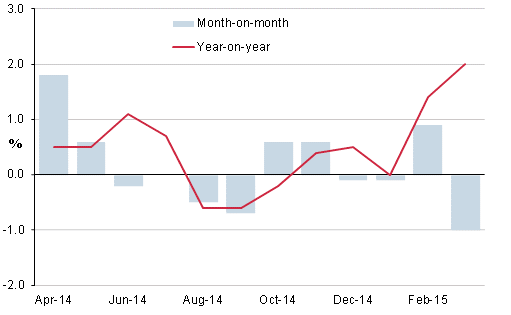

Argentina Economic Chart

Note: Month-on-month and year-on-year changes of economic activity in %.

Source: Argentina National Statistical Institute (INDEC) and Focus Economics calculations.

The Important Role of the Capital Markets in Argentina’s Growth

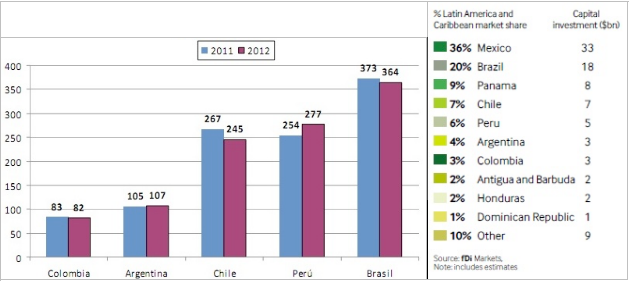

The backbone behind any economic growth is usually the financial markets. A well-functioning financial market becomes increasingly important as growth progresses. A well-functioning financial system must grow with the economy as a whole if forecasted growth is to be sustainable in the country. In the past, the financial markets have not been well recognized nor were a priority in Argentina. The financial markets will/should become increasingly important as a facilitator of economic growth, assuming politics do not continue to inhibit the process. One may argue that for the past few decades, Argentina has been going through a case of “financial repression,” but what needs to be fully understood moving forward is that the health and effectiveness of the financial sector is bound with the performance of the country’s economy as a whole. Given the lack of development of the financial system in Argentina in recent years, there was no mechanism by which domestic and foreign capital could be absorbed efficiently; hence, there have been capital outflows instead of inflows. (The current issue with the “hold out” hedge funds also did not really help Argentina’s causes with foreign investors.) In 2011, there were capital outflows of $21.5 billion in Argentina.Foreign direct investment in Argentina went from $5.4 billion in the first half 2012 to $4.2 billion in 2013. Albeit other countries in the region experienced the same decline ($23.7 billion in 2013 in Brazil compared to $43.2 billion in 2012; $12.3 billion in Chile in 2102 t0 $9.7 billion in 2013), except for Mexico, which benefited from an increase in FDI from $9.6 billion in 2012 to $22.5 billion in 2013, according to the United Nations and fDi Intelligence. Most of Mexico FDI inflows in that period went into the manufacturing sector, with the Modelo acquisition accounting for roughly 70 percent of the FDI. Foreign direct investments declined sharply in LATAM in 2014 with an overall 39 percent in capital investment and 16 percent in a number of FDI projects. Usually the top two sectors of FDI in LATAM, according to fDi Intelligence, are businesses and financial services because most transnationals tend to or have a need to reinvest their profits in those sectors. Reinvested profits are a component of FDI that has increased in the past decade in LATAM and the Caribbean, according to ECLAC, exceeding capital contributions in the last few years. In 2013 the reinvestment trend was broken and capital contributions accounted for 42 percent of total FDI, reinvested earnings 38 percent, and inter-company loans 20 percent. Therefore, the argument for a strong financial sector to absorb FDI earnings makes more sense now than ever. Argentina, for example, has the second-largest economy in the region but is almost ranked sixth in total of FDI market share in LATAM while its financial market prowess barely cracks the top five in the region. (It’s also ranked sixth, behind Brazil, Mexico, Chile, Peru and Colombia based on stock market capitalization). The charts below demonstrate a possible correlation between a country’s equity market size and the percentage/amount of FDI.

Numbers of Companies Listed in the Stock Markets vs. FDI in LATAM

Argentina is trying to move in the right direction toward strengthening and creating a more robust financial market sector. In November 2012 (ratified in 2014) the Argentine Congress passed the Capital Market Law (Law 26,831), which is designed to be an impetus for a healthy financial sector in Argentina. The general goals and principles of this law are as follows:

a) Promoting the participation of small investors, union associations, industry groups and trade associations, professional associations and all public savings entities in the capital market, particularly encouraging mechanisms designed to promote domestic savings and channel such funds towards the development of production;

b) Strengthening mechanisms for the protection of and prevention of abuses against small investors for the protection of consumers’ rights;

c) Promoting access of small and medium-sized companies to the capital market;

d) Fostering the creation of a federally integrated capital market through mechanisms designed to achieve an interconnection of computer systems from different trading markets, with the use of state-of-the-art technology;

e) Encouraging simpler trading procedures available to users to attain greater liquidity and competitiveness in order to provide the most favorable conditions for the implementation of transactions.

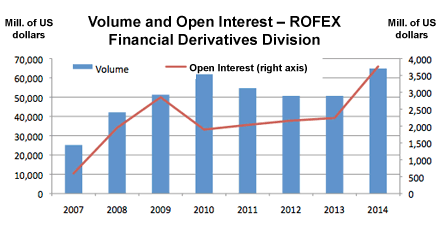

Since the law has passed, there have already been promising changes and improvements in the capital markets. In 2014, ROFEX and Merval signed a trading interconnection agreement (ROFEX is Rosario’s Futures Exchange – Argentina’s main futures and commodity exchange institution – and Merval is MERcado de VALores, which is the most important index of the Buenos Aires Stock Exchange). Their respective brokers will be able to trade and settle the products of both markets on an equal basis. It’s a historical event for the capital market in Argentina. The markets will be able to connect their platforms, control risks, charge fees, and guarantee and settle trades, making this process more transparent and efficient for brokers. As a result, there has been an increase in trading activities in the financial markets. The year 2014 marked a turning point for financial derivatives traded in ROFEX. There was an annual growth of 28.03 percent, and total amount of $64,853 million was reached, a new all-time high for some traded products.

As regards to open interest, the total number of outstanding contracts in 2014 averaged $3,763 million per day, up 68.07 percent from previous year. Recently open interest on the USD has reached $12 billion with daily volumes of $400 to $500 million.

Argentina’s financial market institutions have also taken proactive initiatives to grow and strengthen the country’s financial sector. For instance, ROFEX organized a national program to register and train those who are interested in the financial markets. They are upgrading their technology by allowing all trades to go through DMA (Direct Market Access) – an access route to the Market Electronic system which allows end customers not only to see market data in real time, but also to place their own orders in the market’s central book, by means of online pre-trade risk controls. ROFEX has also entered an agreement with ATA (Algorithmic Traders Association) to teach and educate Argentine traders about difference algorithmic trading strategies. The terms of the agreement is to allow Argentine traders to be able to trade at the capacity of the traders in Europe and North America, and at the same time, through ATA’s global traders network, open the door for foreign traders to explore the Argentine capital markets. They have also made an agreement with Chicago-based TopstepTrader to give U.S. and global traders access to their products while giving traders in Argentina an opportunity to become prop traders for a CME group through the TopstepTrader Combine program.

Argentina’s Challenges Also Equal Opportunities

The restructuring and strengthening of the financial markets, combined with a more stable political environment, will be some of the factors that will help sustain economic growth in Argentina in the near future. It is common knowledge in Argentina that the country’s economy goes into a 10-year cyclical growth-and-burst phase. Ironically, this cycle usually coincides with which political party is in power. Considering the past decade has been on the downside of this cycle, many locals are expecting growth in the next few years to come, hence, one should expect higher and stronger increases in consumer confidence starting 2016. Argentina’s current yields and cheap equities should also be an attractive, affordable investment opportunity for foreign investors. Considering Brazil is currently overvalued while their economy slides deeper into recession, and Chile is dealing with its corruption issues and slow economic growth, Argentina presents a more viable emerging market option for investors in the region. For the past few decades, the country has been constantly moving within a spectrum of great potential to miserable overall economic performances with politics and poor government policies being the main driving force. Argentina’s most powerful resource – its human capital – is often undermined by governments and their shortsighted, unstable policies.

Recommended Content

Editors’ Picks

EUR/USD trades above 1.0700 after EU inflation data

EUR/USD regained its traction and climbed above 1.0700 in the European session. Eurostat reported that the annual Core HICP inflation edged lower to 2.7% in April from 2.9% in March. This reading came in above the market expectation of 2.6% and supported the Euro.

GBP/USD recovers to 1.2550 despite US Dollar strength

GBP/USD is recovering losses to trade near 1.2550 in the European session on Tuesday. The pair rebounds despite a cautious risk tone and broad US Dollar strength. The focus now stays on the mid-tier US data amid a data-light UK docket.

Gold price remains depressed near $2,320 amid stronger USD, ahead of US macro data

Gold price (XAU/USD) remains depressed heading into the European session on Tuesday and is currently placed near the lower end of its daily range, just above the $2,320 level.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Mixed earnings for Europe as battle against inflation in UK takes step forward

Corporate updates are dominating this morning after HSBC’s earnings report contained the surprise news that its CEO is stepping down after 5 years in the job. However, HSBC’s share price is rising this morning and is higher by nearly 2%.