- Debates rarely determine the outcome of US presidential elections.

- Most voters have already made up their minds about the candidates.

- A poor or excellent performance for either candidate may not matter.

- Markets and the electorate will only respond to a catastrophe.

- Market prefer certainty, especially in elections, if they can get it.

The attractions of tonight’s first presidential debate are those of the spectacle and high-stakes sports event rather than a policy deliberation between learned contestants.

President Donald Trump and challenger former Vice-President Joe Biden will attempt to convince the few remaining uncommitted voters and the even scarcer changeable ones, that each deserves the most powerful position in American politics.

Chris Wallace of Fox News, who will moderate the debate at Case Western University in Cleveland Ohio, has chosen six topics, approved by the nonpartisan Commission on Presidential Debates. He will devote one of six 15 minutes segment to each.

The topics are the records of President Trump and former Vice President Joe Biden, the Supreme Court, COVID-19, the economy, race and violence in the cities and the integrity of the elections. The discussion will run 90 minutes without interruption.

Candidates

Both candidates are experienced debaters though their styles are very different. President Trump prefers a less formalized approach with an almost incidental use of facts, driven by his slashing and disconcerting attacks on his opponents. In 2016 he disposed of 16 Republican candidates in the primaries, almost all of whom had far more political experience and greater exposure to the standardized format of televised political debating.

Biden has been in office for 47 year and is considered excellent at political argument. In the 2012 campaign he easily disposed of the highly regarded Speaker of the House Paul Ryan in their debate.

Agendas

Mr. Trump and Mr. Biden will bring their own agenda. Each will attempt to stress the points for himself and against his opponent that his campaign considers the most telling and praiseworthy or damning. Without a specific format for addressing each other, they will try to fit their attacks into answers and questions from Mr. Wallace.

President Trump will try to tie Biden to the Democratic Party positions on the recent riots and looting in many cities controlled by Democrats. He will talk about the Democratic support for the extreme environmental measures of the so-called Green New Deal, the Democratic support for health care for illegal aliens and $4 trillion in new taxes the candidate has said will be enacted ‘immediately” if he wins.

When Mr Biden was asked if some police funding could be redirected to other uses he said, “Yes, absolutely.” Mr. Biden is also vulnerable on his and his Vice-Presidential candidate Kamala Harris’s opposition to fracking, a major industry in Pennsylvania, Ohio, and other essential swing states.

His son Hunter’s business dealings in China and Ukraine while his father was Vice-President will be worked in by Trump as could Tuesday's report that the Obama administration was informed in September 2016 that the ‘Steele dossier’ used against Trump in the election and later as a basis for the Mueller Special Counsel Investigation was a Russian disinformation product procured and shopped by the Clinton campaign.

All of these topics will appear in Mr. Trump's brief.

Mr. Trump’s record will be a major point of attack for Biden, led by the President’s performance in the COVID-19 pandemic, a topic with which every American has recent and perhaps frightening experience.

Trump’s many comments and tweets will no doubt be quoted and repeated by the Democrat as evidence of attitudes Biden will characterize as objectionable if not racist. The Republican’s checkered business history and associates will be pitched against him.

The President's nomination of Amy Coney Barrett to the Supreme Court will be called hypocritical since the Republicans refused to consider President Obama’s final choice in 2016. This week’s New York Time’s story on Trump’s taxes will perhaps be cited by Biden as proof of questionable dealings.

Presidential debates

Presidential debates

Despite their large audience and obsessive media focus debates have not been decisive factors in American presidential elections. In 2012 Mitt Romney was widely seen as the victor in his first debate with President Obama who went on to an easy triumph.

Most voters have long-since decided who they are backing by the September and October debates, either because of long-established preferences or familiarity with the candidates and their records. The universe of persuadable voters is very small.

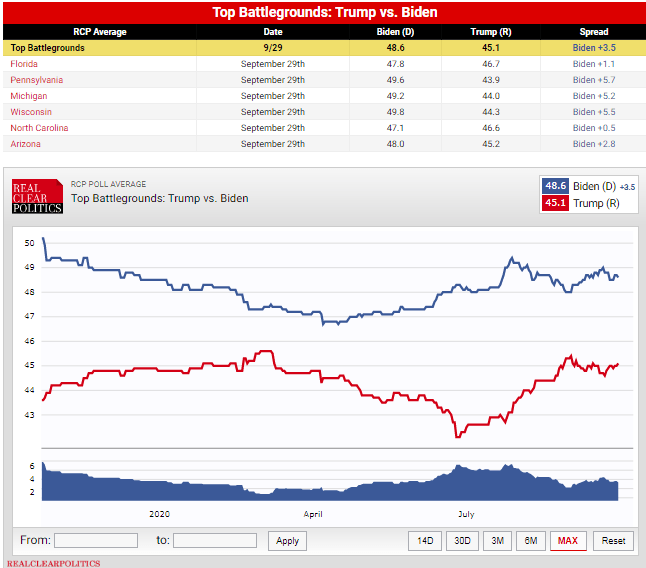

Debate performance is not going to change the minds of the vast majority of the electorate. Still, with the miniscule margin of Mr. Trump’s victory in 2016, those few voters who are available for persuasion are the deciding factor for both candidates and they will compete hard for the advantage.

Each candidate will try to throw his opponent off stride with attacks, accusations and probably questions and charges posed directly to the other, ignoring the moderator. Mr. Trump in particular is known for the slang and derogatory names he coins for his rivals and his aggression.

Catastrophic risks

Each candidate has a particular vulnerability and how or if it surfaces will probably determine the outcome of this debate and, if egregious, the election.

Mr. Biden’s question is his fitness for office. His campaign, when compared to the frenetic personal activity of Trump, has barely registered with the public.

Mr. Biden has held few in-person campaign stops, conducted only a handful of press briefings, usually with submitted question and held no rallies. There have been questions about his reading answers from Teleprompters and a seemingly unending series of misstatements and odd non-sequiturs in speeches and interviews.

The Trump campaign has harped on these mistakes to such a degree that in the last few days they have let it be known that they consider Biden a dangerous competitor. Clearly they have recognized the problem of low expectations for Mr. Biden’s performance.

For Mr.Trump the risks are two-fold. The first is message discipline. His natural bombast can lead him to statements and positions that stray far from his intended delivery and risk seeming both evasive and ill-informed. Second, his inherent aggression and instinct to hit back can and has in the past, pushed him to statements that appear callous and offensive. His greatest risk is that a Biden attack will goad him to a quote that will be used against his campaign to deadly effect.

In the final analysis Mr. Biden’s risk, though perhaps smaller, is far more dangerous. Any notable sign of cognitive decline will be seen by the audience and probably sink his candidacy.

Conclusion: Markets risk and the electorate

Even though they approach the debate from very different analytic and emotional dimensions, the response of both the markets and the general electorate to a catastrophic debate event will be the same, though the timing will be different. The market response will be immediate; the electorate’s will take a week or more to register in the polls.

If Mr. Biden or Mr. Trump falters, the uncertainty generated will damage both the dollar and equities and boost credit prices, lowering interest rates.

However, if over the next week or so polling then begins to tilt towards Trump or towards Biden the greater the turn the more the chance of a stronger dollar and stock prices.

In the end markets are more interested in a decision than they are in specific candidate. If the debate can provide an answer now, it is better than waiting for the election.

Follow our US campaign coverage:

Presidential Debate Preview: Trump may lose due to his own buildup, market implications

US 2020 Election:Ginsburg and the Supreme Court--Republican opportunity and Democratic danger

2020 US Elections: Democrats nominate Biden and Harris--Will Trump hatred be enough?

2020 Elections: Biden widens gap against Trump, why that may trigger a market bounce

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY holds rebound near 156.00 after probable Japan's intervention-led crash

USD/JPY consolidates the rebound near 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.