2020 Elections: Biden widens gap against Trump, why that may trigger a market bounce

- A batch of polls conducted after the dust settled from party conventions show Biden enlarging his lead.

- President Trump may push for a larger fiscal package to increase his chances.

- Markets have room to rise after the recent downward correction.

"It's the economy stupid" – that comment around Clinton's 1992 election campaign is where President Donald Trump is hoping to beat challenger Joe Biden. Republicans have been reluctant to support another generous package – and even reduced their offers to below $1 trillion – after the encouraging jobs report.

August's Non-Farm Payrolls statistics showed the unemployment rate sharply fell to 8.4% – far better than expected. However, they may change their calculous after looking at recent worrying polls for their standard-bearer.

Providing more stimulus could win votes and help Trump be seen as capable on handling the economy. He is far behind on two other issues that matter to Americans – handling of the virus and race relations. Despite touting "Law and Order," polls have shown that voters trust Biden to provide calm rather than Trump.

Moreover, the president reportedly called described dead soldiers as "losers" and "suckers" – a message that is incompatible with supporting the military nor the police.

Boosting the economy could distract attention from these topics – and also shore up equities, which have been correcting. The president partially measures his success on the performance of stock indexes.

Trump trails in battlegrounds

Raven Pack's election monitor shows Biden is set to flip five states from Democrat to Republican" Pennsylvania, Michigan, Wisconsin, Florida, and the latest to switch its preference is North Carolina. That would give Biden a 108 electoral vote win – higher than Trump's margin in 2016.

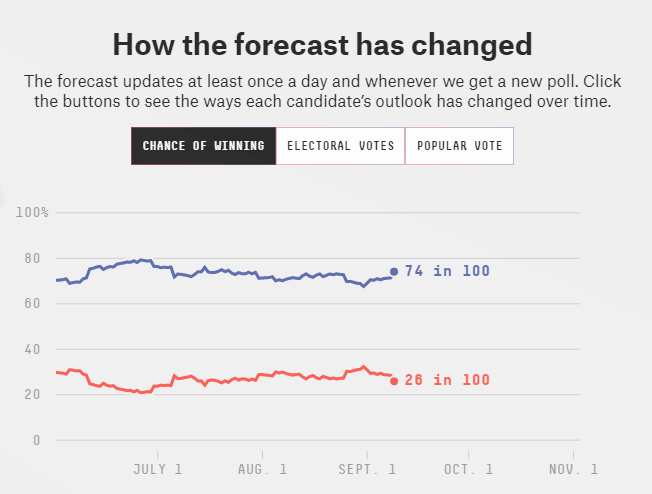

Nate Silver's FiveThirtyEight is showing Biden has a 74% chance of winning, up from 71% when the model was launched in early August. That means Trump received no convention bounce. The latest push toward the Democrat came from an NBC poll showing a nine-point lead for Biden in Pennsylvania, a key battleground state that Trump carried in 2016.

Source: FiveThirtyEight

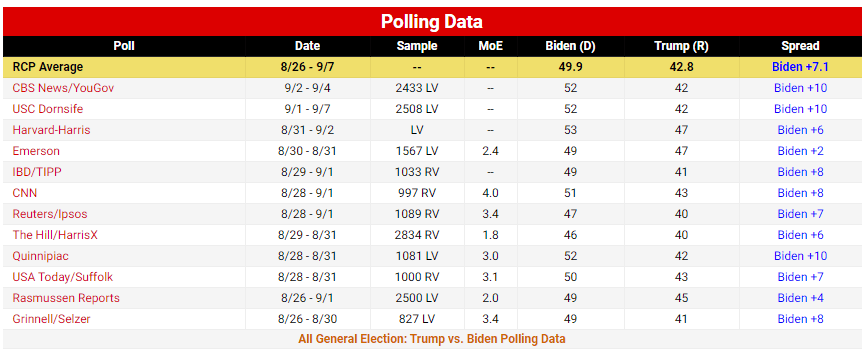

RealClearPolitics is pointing to a Biden lead of 7.1% in national polls, mostly unchanged from several weeks ago. The RCP Average does not include the latest Ipsos poll pointing to a 12-point gap.

Source: RealClearPolitics

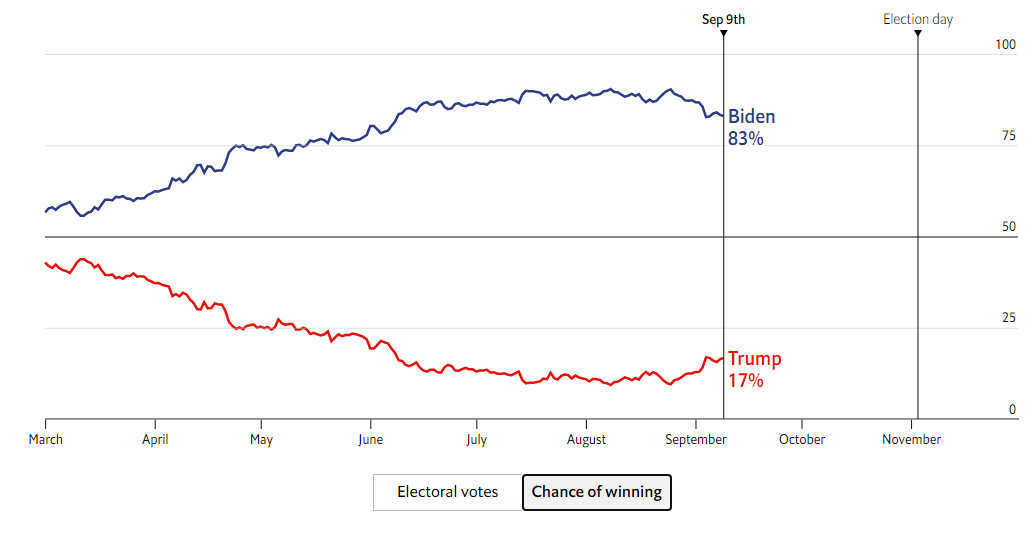

The Economist's model is showing sliding chances for a Biden victory – but he still has a broad 83% probability of replacing Trump at the White House according to the magazine's model.

Source: The Economist

Conclusion

Markets tend to prefer full Republican control of Congress and the White House – allowing for deregulation and lower taxes. However, there is still time ahead of the elections. Currently, investors are concerned about the lack of emergency federal help – most of that lapsed at the end of July.

With diminishing chances of re-election – and perhaps a delay in obtaining a coronavirus vaccine – the president may now opt to push his fellow Republican fiscal hawks toward compromising with Democrats and boosting the economy. That may boost stocks, at least in the short term.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.