Verizon slips after announcing $20 billion Frontier acquisition

- Verizon agrees to pay $20 billion in cash for Frontier Communications.

- Frontier is largest pure fiber telecom in the US, deal will extend Fios offering to 25 more states.

- VZ stock sank more than 3% on Wednesday and continues to trade lower on Thursday.

- Dow Jones is trading nearly one percentage point lower on Thursday, performing worse than S&P 500, NASDAQ.

Verizon (VZ) shareholders have not taken kindly to the announcement that the telecom will be acquiring Frontier Communications (FYBR).

Shares of VZ fell 3.4% on Wednesday when the rumors emerged and have caved another 0.4% at the time of writing on Thursday.

Meanwhile, Frontier stock rallied just under 38% on Wednesday before plunging 9.5% on Thursday when the final figure of $20 billion underwhelmed their initial hopes.

The Dow Jones Industrial Average (DJIA), of which Verizon is a member, is off 0.9% in the morning session. That performance is worse than both the S&P 500 and the NASDAQ, though both are also somewhat lower. Then again, the Dow has been weak all week.

Verizon stock news

Verizon will acquire Frontier for $38.50 per share in an all-cash deal that values the company at $20 billion.

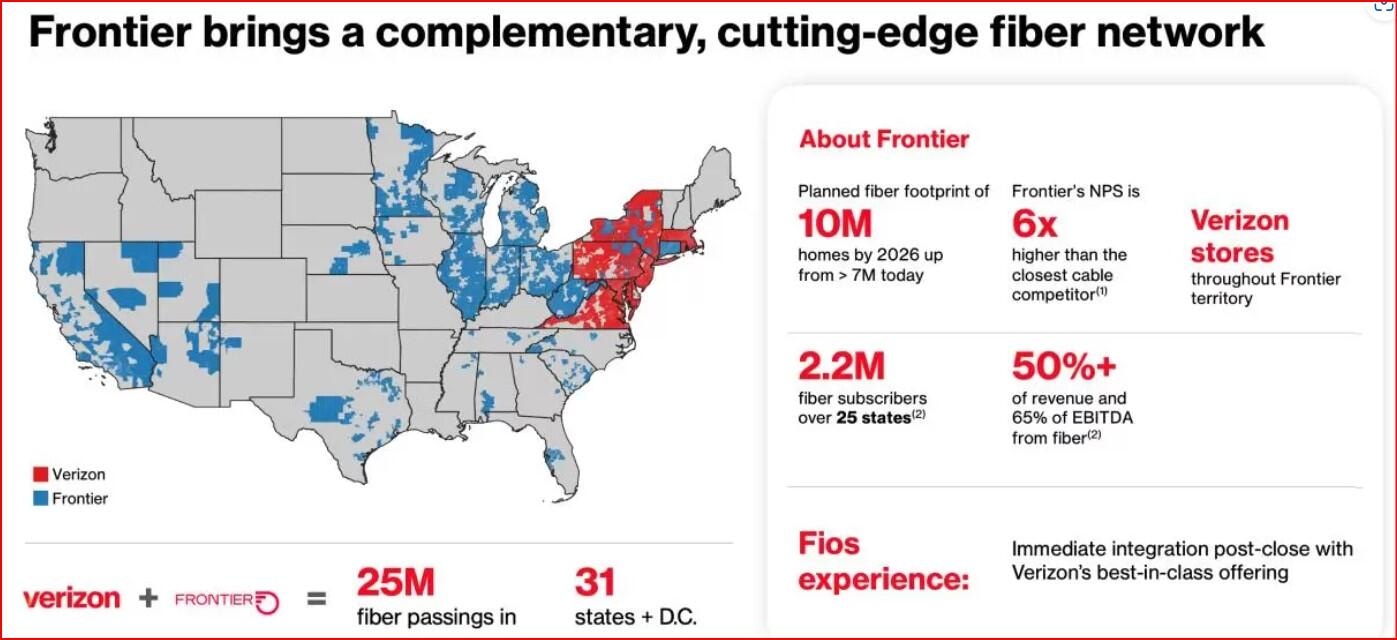

Verizon says it will gain 2.2 million subscribers from Frontier via the latter’s advanced fiber offerings in 25 states. Verizon, which largely offers home and business internet services in the region spanning Virginia through New York state and Massachusetts, will expand its Fios offering in the Midwest, South and West Coast in locales that encompass a total of 31 states and Washington, D.C.

In a statement Verizon said that upon closing the acquisition would immediately be “accretive to revenue and Adjusted EBITDA growth” but by year three would account for $500 million in annual run-rate cost synergies.

Frontier Communications fiber offerings (blue) extend to 25 additional states (Verizon press release)

Frontier is the largest “pure-play fiber internet provider”, according to Verizon, which said it will integrate Frontier’s 7.2 million fiber locations into its own network, as well as expand its current offerings by an additional 2.8 million fiber locations by the end of 2026.

“The acquisition of Frontier is a strategic fit,” said CEO and Chairman Hans Vestberg. “It will build on Verizon’s two decades of leadership at the forefront of fiber and is an opportunity to become more competitive in more markets throughout the United States, enhancing our ability to deliver premium offerings to millions more customers across a combined fiber network.”

Verizon management also reaffirmed full-year 2024 guidance of adjusted earnings per share (EPS) of $4.50 to $4.70 and wireless service revenue growth of 2% to 3.5%.

Verizon stock forecast

Verizon stock is still up 9% year to date despite this week's pullback. VZ shares were retesting topside resistance at $43.00 just prior to the acquisition rumors emerging on Wednesday.

VZ stock has been consolidating within a tight rectangle with $43.00 as resistance and $38.75 as support since the start of the year. Verizon's share price recovered in late 2023 after hitting a 13-year low just above $30.00 in October of last year.

Verizon has found support on Thursday at the blue 50-day Simple Moving Average (SMA) and is now recovering toward the 20-day SMA. The best bet is that the current nervousness will decline in the coming weeks. At that point bulls will once again take a swipe at $43.00.

VZ daily stock chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Clay Webster

FXStreet

Clay Webster grew up in the US outside Buffalo, New York and Lancaster, Pennsylvania. He began investing after college following the 2008 financial crisis.