USD/JPY Price Analysis: Shies from 160.00 as Japan’s intervention fears intensify

- USD/JPY faces pressure in an attempt to recapture 160.00 as fears of Japan’s intervention deepen.

- The BoJ looks to raise interest rates further as weak Yen continues to boost inflationary pressures.

- The US Dollar will be guided by the US core PCE inflation data for May.

The USD/JPY pair exhibits a subdued performance slightly below the psychological resistance of 160.00 in Tuesday’s European session. The rally in the asset appears to have stalled as investors expect a stealth intervention by Japan’s authority against excessive FX moves to limit the downside in the Japanese Yen.

Fears of Japan’s intervention in the FX domain intensified after country’s main currency diplomat Masato Kanda said on Monday that the government would intervene around the clock if necessary.

Also, expectations for the Bank of Japan (BoJ) to tighten policy further have improved as weak Yen is resulting in higher inflation by making exports competitive in global markets and increasing import costs. The BoJ minutes for the latest meeting showed that one member advocated for an increase "without too much delay" to help bring inflation back down, Reuters reported.

Meanwhile, the US Dollar (USD) struggles to gain ground as investors expect that the Federal Reserve (Fed) will deliver two rate cuts this year and will choose the September meeting to begin the policy-normalization process. This week, the major trigger for the US Dollar will be the United States (US) core Personal Consumption Expenditure price index (PCE) for May, which will be published on Friday.

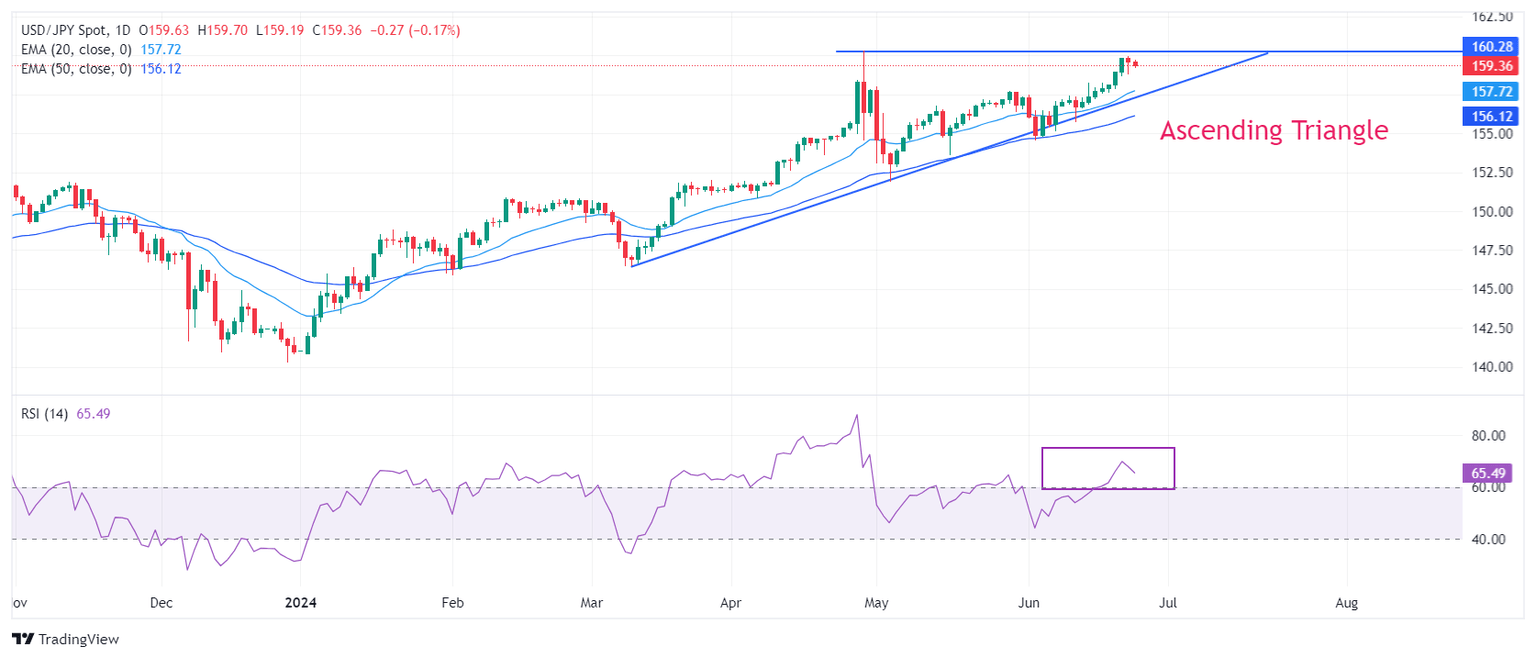

USD/JPY hovers near the horizontal resistance of the Ascending Triangle chart formation on a daily timeframe, which is plotted from April 29 high of 160.32. The upward-sloping border of the above-mentioned chart pattern is placed from March 11 low near 146.50.

Advancing 20- and 50-day Exponential Moving Averages (EMAs) near 157.70 and 156.10, respectively, indicate that the overall trend is bullish.

The 14-day Relative Strength Index (RSI) oscillates inside the 60.00-80.00 range, suggesting that momentum is already in favor of bulls.

More upside would appear if the asset breaks above multi-year high of 160.00. Breach of the latter will expose the pair in unchartered territory towards 162.00

On the flip side, a breakdown below May 16 low at 153.60 will expose the asst towards May 3 low at 151.86, followed by the psychological support of 150.00.

USD/JPY daily chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.