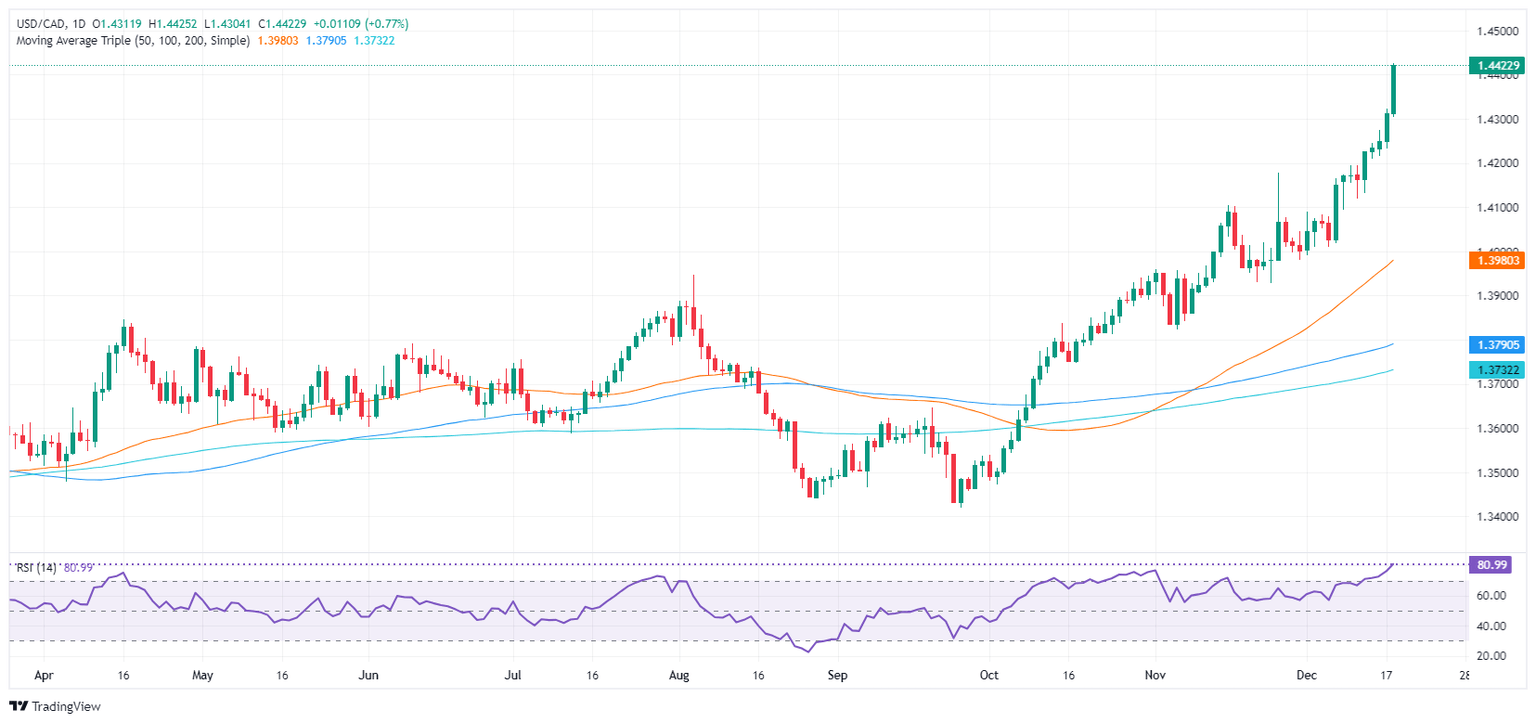

USD/CAD refreshes four-year highs above 1.4400 post-Fed hawkish cut

- USD/CAD spikes after the Federal Reserve reduces interest rates by 25 basis points to a range of 4.25%-4.50%.

- Federal Reserve’s decision was nearly unanimous, with Cleveland Fed President Beth Hammack casting the sole dissenting vote.

- The Summary of Economic Projections (SEP) reveals only two anticipated rate cuts through 2025 and 2026, aiming for a federal funds rate of 3.4%.

The USD/CAD soared to fresh yearly highs after the Federal Reserve slashed interest rates at the December meeting while opting to adopt a gradual approach to monetary policy next year. At the time of writing, the pair trades volatile at around 1.4400.

USD/CAD rallies following a Federal Reserve rate cut and projections of four rate cuts in two years

The Federal Reserve lowered interest rates by 25 basis points, setting the target range to 4.25%-4.50%. The decision was not unanimous, with an 11 to 1 vote, as Cleveland Fed President Beth Hammack voted to hold rates. While the accompanying policy statement saw only minor adjustments from the previous meeting, traders' attention shifted to the newly released Summary of Economic Projections (SEP).

The Fed's statement highlighted solid economic growth and a gradual easing of labor market conditions. Despite this, the committee reiterated, "The risks to achieving its employment and inflation goals are roughly in balance."

According to the SEP, officials expect only two rate cuts across 2025 and 2026, which would bring the federal funds rate down to 3.4% over the next two years.

Other projections indicate that the Fed’s preferred inflation measure, the Core PCE, is expected to decline gradually, ending at 2.8% in 2024, 2.5% in 2025, and 2.2% in 2026. On the growth front, the economy is projected to expand by 2.5% in 2024, 2.1% in 2025, and 2.0% in 2026.

The Unemployment Rate is expected to end the current year at 4.4% and remain unchanged at 4.3% in 2025 and 2026.

USD/CAD Reaction to Fed’s decision

The USD/CAD refreshed four-year highs, climbing past the March 2020 peak of 1.4349, which opened the door to test the 1.4400 figure. The pair has climbed past the latter and is eyeing a 2020 peak of 1.4560, but first, buyers must clear the 1.4500 psychological figure. In the event of a pullback, the pair's first support would be 1.4400, followed by the 1.4350 figure.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.