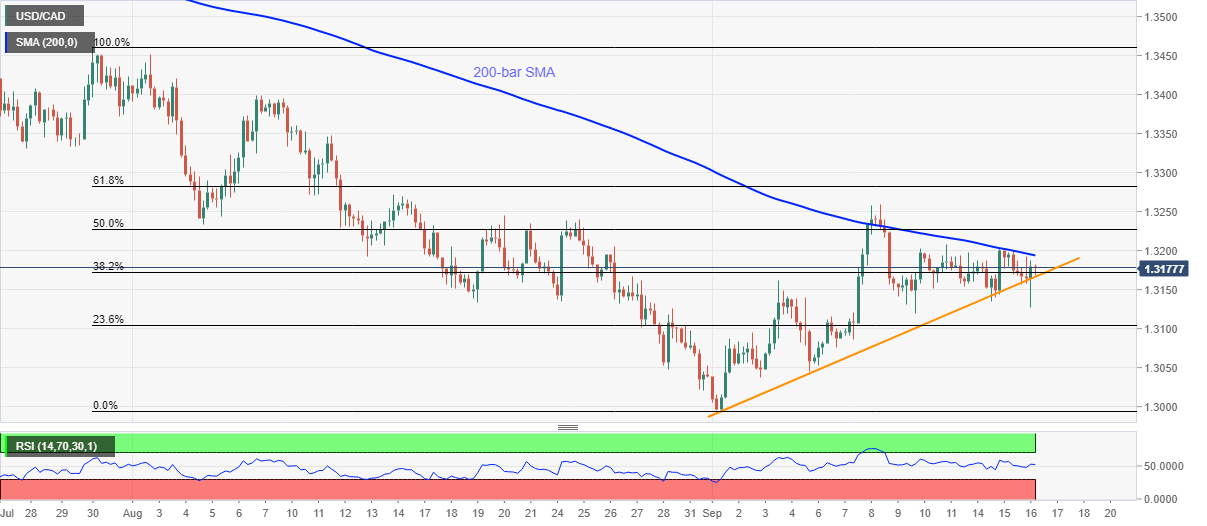

- USD/CAD remains chopped between 200-bar SMA and the monthly support line.

- Normal RSI conditions suggest continuation of the sideways moves.

- Sellers can aim for the sub-1.3100 area on the trend line break, key Fibonacci retracements may lure bulls above SMA.

USD/CAD fades bounce off intraday low of 1.3169 around 1.3176 during the pre-Tokyo open trading on Thursday. In doing so, the quote stays inside the key technical indicators, namely 200-bar SMA and an ascending trend line from September 01, amid the normal RSI conditions.

While the traders are funneling down the breakout points, odds of recovery from the multi-day lows marked during the early-month become high.

As a result, buyers will look for a clear break above the 200-bar SMA level of 1.3193 to aim 50% and 61.8% Fibonacci retracement of USD/CAD fall from July 30 to September 01, respectively around 1.3230 and 1.3280.

On the contrary, a downside break of the mentioned support line, at 1.3166 now, will break the 1.3100 threshold to revisit the September 04 low around 1.3045. Though, the monthly bottom close to 1.2995 may question the bears afterward.

All in all, USD/CAD is gradually inching closer to the breakout points and is worth watching with an upside bias.

USD/CAD four-hour chart

Trend: Sideways

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD falls back toward 1.1150 as US Dollar rebounds

EUR/USD is falling back toward 1.1150 in European trading on Friday, reversing early gains. Risk sentiment sours and lifts the haven demand for the US Dollar, fuelling a pullback in the pair. The focus now remains on the Fedspeak for fresh directives.

GBP/USD struggles near 1.3300 amid renewed US Dollar demand

GBP/USD is paring back gains to trade near 1.3300 in the European session. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, briefly supporting Pound Sterling but the US Dollar comeback checks the pair's upside. Fedspeak eyed.

Gold hits new highs on expectations of global cuts to interest rates

Gold (XAU/USD) breaks to a new record high near $2,610 on Friday on heightened expectations that global central banks will follow the Federal Reserve (Fed) in easing policy and slashing interest rates.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.