USD/CAD Price Analysis: Rises to 1.3800 ahead of US CPI and Fed’s policy decision

- USD/CAD climbs to near 1.3800 as the US Dollar strengthens ahead of a volatile Wednesday.

- Investors will keenly focus on the Fed’s dot plot for the interest rate outlook.

- BoC Macklem may provide cues over subsequent rate cuts.

The USD/CAD pair jumps to near the round-level resistance of 1.3800 in Tuesday’s American session. The Loonie asset strengthens as the US Dollar (USD) rises to the monthly high. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, jumps to 105.40 as market sentiment remains risk-averse ahead of the United States (US) Consumer Price Index (CPI) data for May and the Federal Reserve’s (Fed) interest rate decision, which are scheduled for Wednesday.

The S&P 500 delivered significant losses in the opening session, exhibiting investors' weak risk appetite. Investors remain cautious ahead of the Fed’s dot-plot, which will indicate where policymakers see the Federal fund rate heading. The Fed’s decision on interest rates is widely expected to be unchanged, as inflation is far from the desired rate of 2%.

Fed officials have been advocating for maintaining the current interest rate framework for a long time until they gain greater confidence that inflation is progressively declining. Soft inflation data for three or four months could build that confidence among policymakers.

Meanwhile, the Canadian Dollar will dance to the tunes of the speech from Bank of Canada (BoC) Governor Tiff Macklem, which is scheduled for Wednesday. BoC Macklem will provide more cues about whether the central bank will announce subsequent rate cuts.

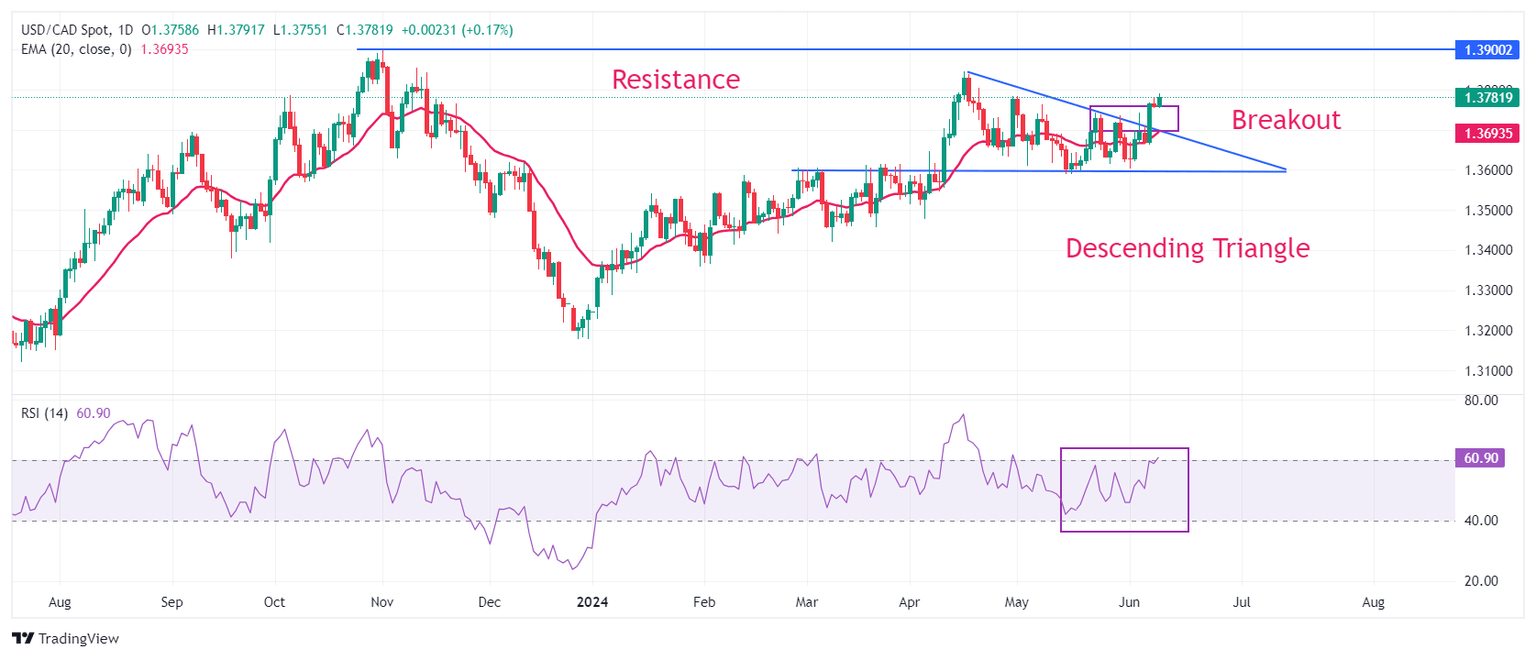

USD/CAD strengthens after a breakout of the Descending Triangle chart pattern formed on a daily timeframe. The upward-sloping 20-day Exponential Moving Average (EMA) near 1.3700 suggests that the near-term trend is bullish.

The 14-period Relative Strength Index (RSI) jumps above 60.00. A sustainable move above the same will push momentum towards the upside.

Fresh buying opportunity would emerge if the asset breaks above April 17 high at 1.3838. This would drive the asset towards 1 November 2023 high at 1.3900, followed by the psychological resistance of 1.4000.

In an alternate scenario, a breakdown below June 7 low at 1.3663 will expose the asset to May 3 low around 1.3600 and April 9 low around 1.3547.

USD/CAD daily chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.