US Dollar gives back part of its gains and sees recovery halting

- The US Dollar is recovering from Monday’s meltdown and advances against the Japanese Yen.

- Overnight, the RBA confirmed the Fed’s stance that a few data points are not enough to change the narrative.

- The US Dollar index flirts with a break above 103.00 and could turn this week’s performance into positive territory.

The US Dollar (USD) recovers mildly on Tuesday, with the Greenback edging higher against the Japanese Yen (JPY). The turnaround was already triggered in the US trading session on Monday when President of the Federal Reserve Bank of Chicago, Austan Goolsbee, tried to soothe markets by saying that a few easing data points are not enough to open the debate on a recession. Royal Bank of Australia (RBA) president Michelle Bullock joined that thesis and even added that another rate hike is not off the table, while the RBA decided to keep its interest rate unchanged during its August meeting earlier on the day.

On the economic front, the main point for this week is already out of the way. The Institute for Supply Management (ISM) data was released on Monday and helped spark the turnaround in the Dollar’s appeal as the ISM Service Purchasing Managers Index (PMI) expanded at a faster pace than expected. The main theme on Tuesday is the US Trade Balance data for June. Nothing really market moving expected from this.

Daily digest market movers: Easing US session

- Markets are recovering from Monday’s route, and equities move higher across the board. The Greenback is outpacing the Japanese Yen by over 1% in the European trading session.

- US Vice President Kamala Harris has been formally nominated as the Democratic candidate for the upcoming Presidential elections in November.

- At 12:30 GMT, the US Goods and Trade Balance data for June will be released:

- Goods and Services Trade Balance deficit came in smaller, from $75 billion to a smaller $73.1 billion.

- At 14:00 GMT, the TechnoMetrica Institute of Policy and Politics (TIPP) has released its monthly Economic Optimism Survey for August. The previous reading was at 44.2, and came in at 44.5 for August.

- The US Treasury is heading to markets to sell 52-week bills and allocate 3-year notes at sharply lower rates than previously.

- Equity markets are jumping higher, with the Japanese Nikkei and Topix closing Tuesday with 10% gains each. US equities had a slow start, though are now seeing a recovery as well.

- The CME Fedwatch Tool shows a 73.5% chance of a 50 basis points (bps) interest rate cut by the Federal Reserve in September. Another 25 bps cut is expected in November by 54.5%, while a 29.7% chance for a 50 bps cut and 15.8% for no cut at all are being pencilled in for that meeting.

- The US 10-year benchmark rate trades at a new 52-week low at 3.85%, shooting higher as investors flee away from bonds and back into equities.

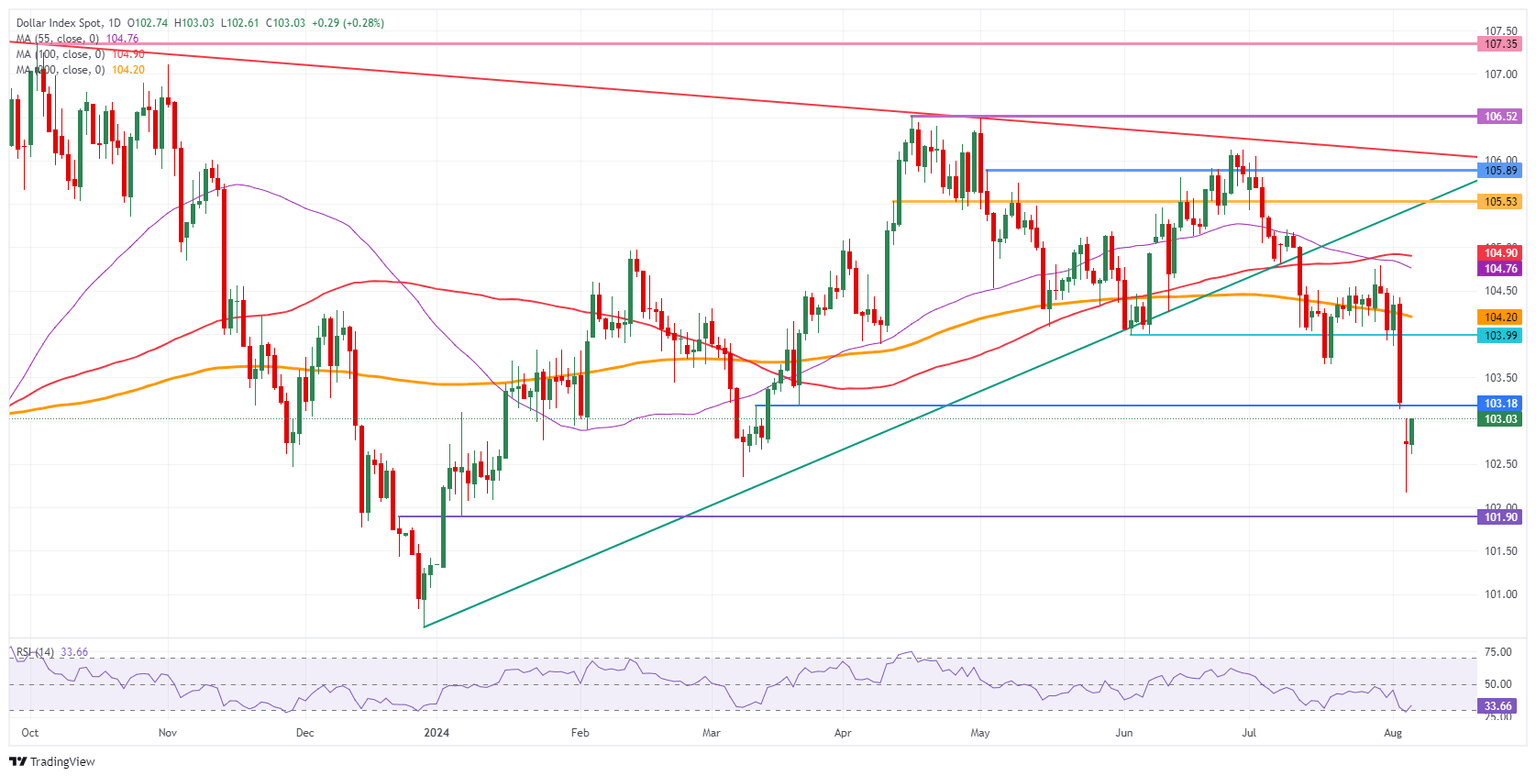

US Dollar Index Technical Analysis: No conviction across the board

The US Dollar Index (DXY) is recovering, and it could turn into a very profitable week for the Greenback. Many investors and experienced traders will have used Monday’s route to do some bargain hunting and used the momentum to go against the tide as a recession in the US is clearly not in focus. With a very light US data calendar ahead, the risk for any underperforming data looks limited, which means that the DXY has room to rally back to July levels.

The three-tiered recovery is already in play, with the first up at 103.18, a level held on Friday though snapped on Monday in the Asian hours. Once the DXY closes above that level, next up is 104.00, which was the support from June. If the DXY can make its way back above that level, the 200-day Simple Moving Average (SMA) at 104.22 is the next resistance level to look out for.

On the downside, the oversold Relative Strength Index (RSI) indicator should prevent the DXY from making more hefty losses. Support nearby is the March 8 low at 102.35. Once through there, pressure will start to build on 102.00 as a big psychological figure before testing 101.90, which was a pivotal level in December 2023 and January 2024.

US Dollar Index: Daily Chart

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.