US Dollar rips higher after Trump secures presidential title with Red Sweep looming

- The US Dollar on a tear, with more than one-percentage gain against most major peers.

- Former US President Donald Trump secured over 270 electoral votes needed to become the next US president.

- The US Dollar index trades above 105.00, the highest level since early July.

The US Dollar (USD) keeps surging into the US session on Wednesday after former US President Donald Trump secured enough electoral votes to become the next US president. The former US President has secured 277 votes, more than enough to surpass the magic 270 threshold needed to secure a majority. An additional element that might result in more US Dollar strength is the fact that the Republicans have secured a majority in the Senate. While the race to control the US House of Representatives is still undecided, it looks like Trump will not be a lame-duck president and will have support from both institutions when it comes to passing laws.

The US economic calendar is very light on Wednesday. It looks like traders will be able to further assess and focus on the outcome of the US presidential election. Besides the Mortgage Bankers Association (MBA) weekly Mortgage Application numbers, nothing special is expected on the economic data front.

Daily digest market movers: A lot of assumptions

- At the time of writing, former US President Donald Trump has secured 277 electoral votes and has comfortably reached the 270 threshold to win. Vice President Kamala Harris is lagging behind with only 224.

- Thursday the Federal Reserve will have its monetary polic meeting and policy rate decision. Markets will be on edge whether Fed Chairman Jerome Powell will make any comments or will announce any changes to the monetary policy on the back of former US President Donald Trump winning a new term as President.

- Asian equities saw China being hurt, with tariffs underway once Trump is sworn in next year. European and US equities are rallying higher.

- The CME FedWatch Tool is backing a 25 basis point (bps) interest-rate cut by the Federal Reserve (Fed) on Thursday’s meeting with a 97.5% probability. More interesting is the December 18 meeting, where a 50 bps interest-rate cut from the current level is expected by a 68.4% chance, suggesting that markets anticipate a rate cut this week and in December. Before the US election outcome, the probability was still at 80%.

- The US 10-year benchmark rate trades at 4.45%, flirting with a break above the 4.46% high earlier.

US Dollar Index Technical Analysis: Looking for a good level to breath

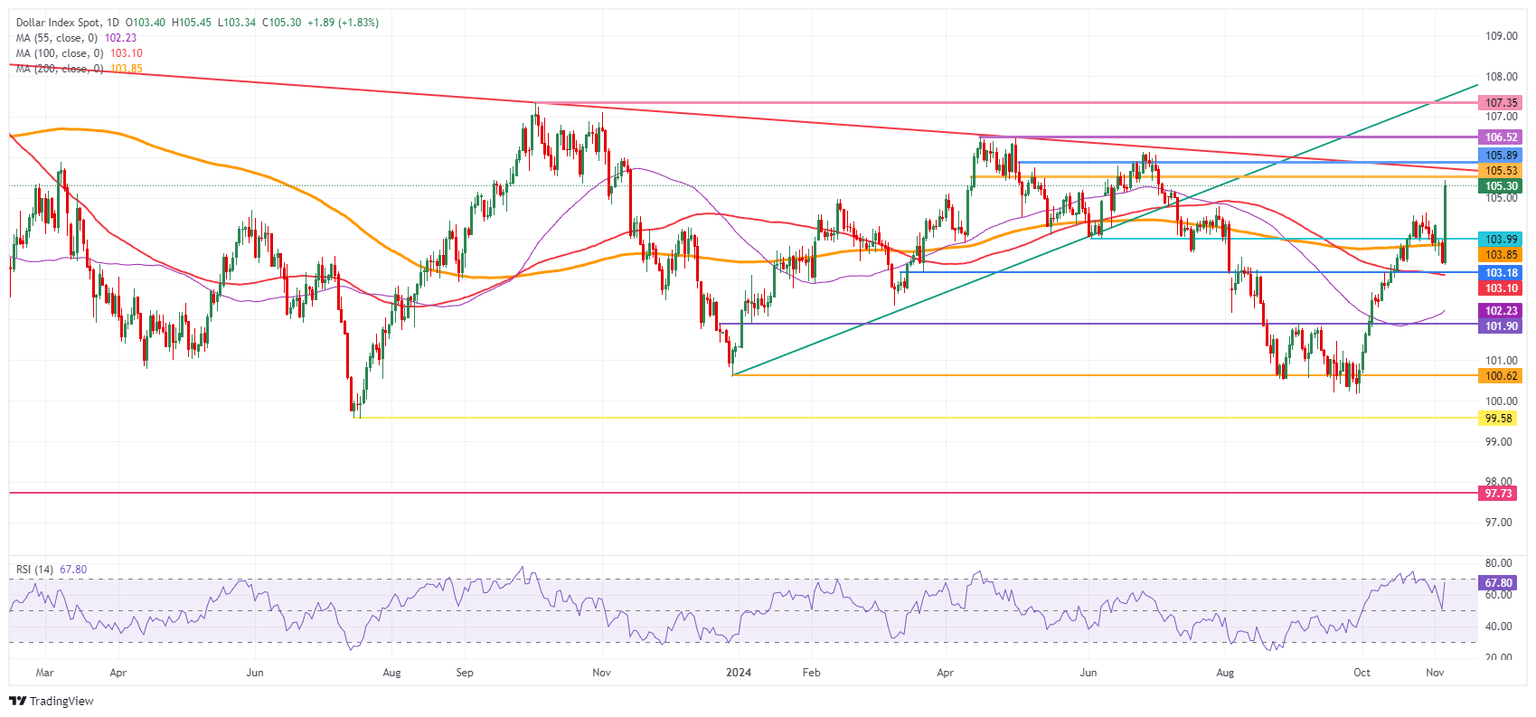

The US Dollar Index (DXY) is reclaiming its throne as the King of all currencies. The Greenback has been gaining in several big figures against most of the major G20 currencies, resulting in a US Dollar Index that broke above the 105.00 level. With a small fade taking place at the moment, looking for near support will be vital, while markets will need to wait for a few months until Donald Trump is sworn in again as President and starts to take measures, introduce tariffs, and other elements that will move all asset classes.

The new levels to look out for on the upside are not seen since June and July. The first up is 105.53 (April 11 high), a very firm cap resistance, with 105.89 (May 2 high) just above. Once that is broken, 106.52, the high of April and a double top, will be the last level standing before starting to talk about 107.00.

On the downside, last week’s peak at 104.63 looks to be the first pivotal support nearby. Should the fade become bigger, the round level of 104.00 and the 200-day Simple Moving Average (SMA) at 103.85 should refrain from sending the DXY any lower.

US Dollar Index: Daily Chart

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.