US Dollar attempts to avoid another leg lower ahead of Wednesday's Fed meeting

- The US Dollar turns flat at the start of the US trading session.

- Limited reaction as expected on the Retail Sales data.

- The US Dollar Index moves away from this year's low, though a very marginal bounce.

The US Dollar (USD) trades flat on Tuesday, after spending most of the day in red digits with selling pressure at hand. The Federal Open Market Committee (FOMC) convenes on Tuesday to debate the upcoming US Federal Reserve’s (Fed) policy decision on Wednesday and how big the initial Fed’s interest rate cut will be. Then, the markets will finally hear from Fed Chairman Jerome Powell at the press conference.

On the economic data front, the Retail Sales did not really move the needle as such. It was expected that there would not be a substantial move with most traders keeping their powder dry for the Fed meeting on Wednesday. The Retail Sales came in, mostly in line of expectations and even the revisions were really marginal.

Daily digest market movers: Sidelined until Wednesday

- Retail Sales data for August did not really shake markets. Monthly Retail Sales grew by 0.1%, after growing by 1.0% in July which was revised to 1.1%. Sales excluding Cars and Transportation grew by a little 0.1%, from 0.4% the prior month.

- At 13:15 GMT, Industrial Production data for August saw a surprise uptick to 0.8%, coming from the contraction by 0.6% in July.

- At 14:00 GMT, Federal Reserve Bank of Dallas President Lorie Logan delivered pre-recorded welcoming remarks at the Eleventh District Banking Conference in Dallas. Logan isn't expected to talk about monetary policy because the Fed is within its blackout period ahead of its meeting on Wednesday.

- The National Association of Home Builders (NAHB) has released September’s Housing Market Index, with a steady 41 against the previous reading of 39.

- European and US equities are sprinting higher at the New York opening bell, with all major indices up over 0.50%.

- The CME Fedwatch Tool shows a further declining chance of a 25 basis points (bps) interest rate cut by the Fed on Wednesday, by only 33.0%, further down from the 66% seen a week ago. Meanwhile, markets have increased the chances of a 50 bps cut to 67.0%. For the November 7 meeting, another 25 bps cut (if September is a 25 bps cut) is expected by 18.0%, while there is a 52.3% chance that rates will be 75 bps (25 bps + 50 bps) and a 29.7% probability of rates being 100 (25 bps + 75 bps) basis points lower compared to current levels.

- The US 10-year benchmark rate trades at 3.64%, bouncing off the 15-month low for now.

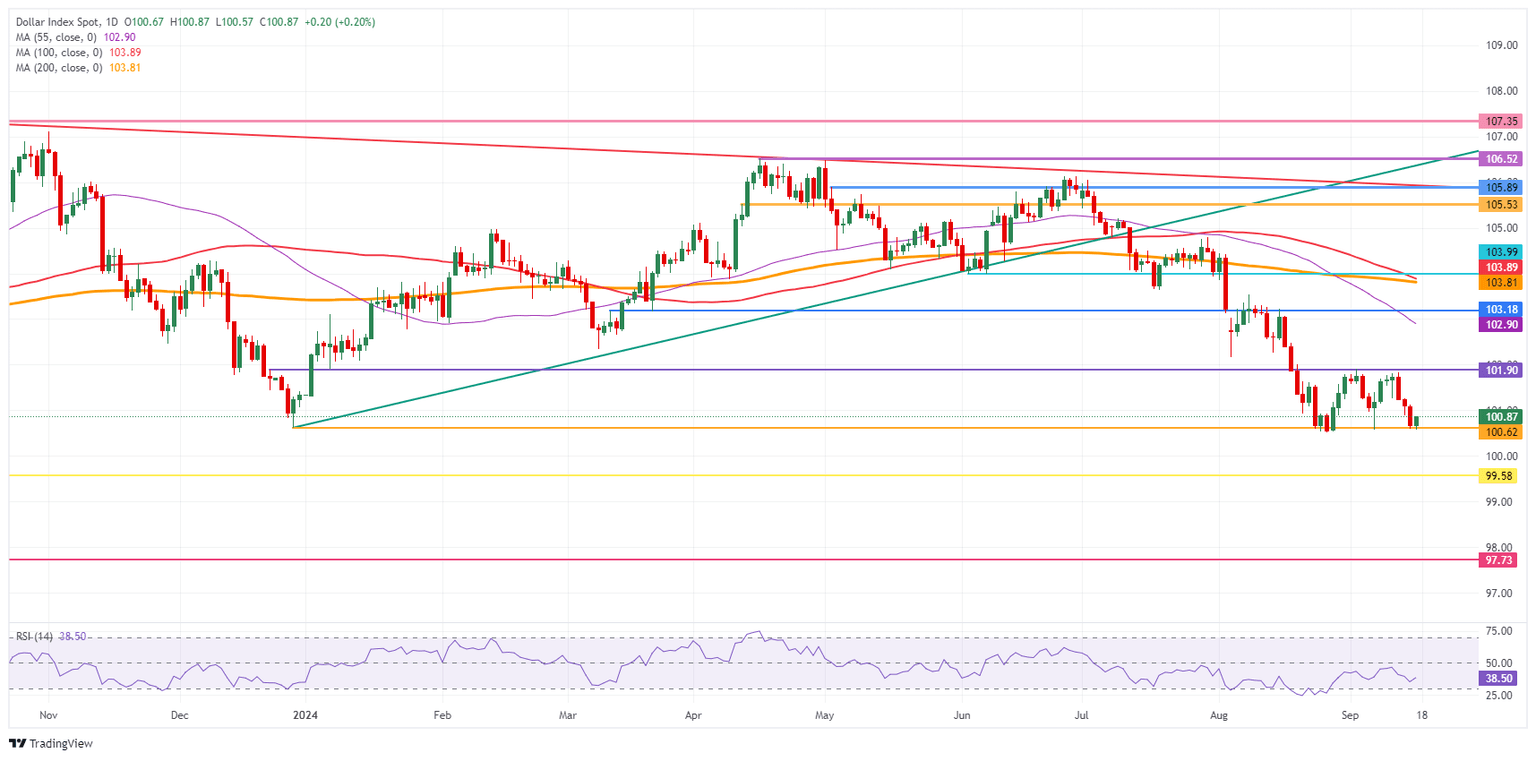

US Dollar Index Technical Analysis: Rangebound until the final moment

The US Dollar Index (DXY) respects the boundaries in which it has been trading during the last month, nearly the yearly lows. A very small bounce is noticeable on the chart, though it is not really running away from that lower band. The risk is that the DXY could snap below it when the Fed delivers its rate cut.

The upper level of the recent range is 101.90. Further up, a steep 1.2% uprising would be needed to get the index to 103.18, with the 55-day Simple Moving Average (SMA) at 102.89 on the way. The next tranche up is very misty, with the 200-day SMA at 103.81 and the 100-day SMA at 103.88, just ahead of the big 104.00 round level.

On the downside, 100.62 (the low from December 28, 2023) holds strong and has already made the DXY rebound two times in recent weeks. Should it break, the low from July 14, 2023, at 99.58, will be the next level to look out for. If that level gives way, early levels from 2023 are coming in near 97.73.

US Dollar Index: Daily Chart

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.