US Dollar flirts with a break below 108.00 in the DXY after PCE print

- The US Dollar is residing not far from its fresh two-year high level seen in Asian trading on Friday

- Quadruple Witching – the simultaneous expiration of four types of derivative contracts – is set to take place in the US trading session.

- The US Dollar Index (DXY) reached 108.55 and looks set to end the year on a rather elevated level.

The US Dollar (USD) is residing not far from its fresh two-year high of 108.55 that was hit during the Asian-Pacific trading session. The move was supported by rising US Treasury yields, widening the rate-differential gap with other countries. This means more support for the US Dollar because it becomes more valuable to invest in and get a nice return on your deposit.

Friday will be the last chance for traders to move any positions they might have with volatility set to spark up. That comes because of the so-called Quadruple Witching, which takes place four times per year – each third Friday of March, June, September, and December. During Quadruple Witching, four types of financial contracts expire simultaneously: stock index futures, stock index options, stock options, and single-stock futures. All these need to be rolled over, unwinded and settled, leading to a significant increase in trading volumes and sometimes volatility surrounding the main assets.

The US economic calendar saw already the release of the Personal Consumption Expenditures (PCE) Price Index for November. All data points came in below the consensus view, making it a rather disinflationary release. Though be it that the actual numbers are marginally lower, it does not change much to the recent stance from the Federal Reserve.

Daily digest market movers: PCE not moving the needle anymore

- Federal Reserve Bank of San Francisco President Mary Daly said during an interview on Bloomberg Surveillance, that even no rate cuts might happen in 2025. Should the labor market weaken further, more than two rate cuts could be put back on the table.

- A government shutdown is still looming in the US. A vote in the House of Representatives failed to pass the stopgap bill. Vice-President-elect JD Vance will meet with the Freedom Caucus this Friday to try and get the liquidation of the debt limit proposed, according to Bloomberg News..

- President-elect Donald Trump, meanwhile, has shifted his focus to Europe by threatening with tariffs as well if the block does not make up its deficit in NATO by buying Oil and Gas from the US, Bloomberg reports .

- The Personal Consumption Expenditure (PCE) data for November has been released

- Monthly Headline PCE came in at 0.1%, from 0.2%. The yearly gauge went to 2.4%, lower than the expected 2.5% and just above the previous 2.3%.

- The monthly Core PCE measure fell to 0.1% from 0.3%, lower than the 0.2% estimate. The yearly component remained stable at 2.8%; below the 2.9% expected

- Around 15:00 GMT, the final reading for the University of Michigan data was published. The Consumer Sentiment Index for December remained stable at 74. The 5-year inflation expectation rate fell to 3.0%, from 3.1%.

- US equities are erasing earlier gains and are almost heading positive for this Friday. European equities are facing a sub-zero close.

- The CME FedWatch Tool for the first Fed meeting of 2025 on January 29 sees an 89.3% chance for a stable policy rate against a small 10.7% chance for a 25 basis points rate cut.

- The US 10-year benchmark rate trades at 4.52%, retreating from its fresh seven-month high at 4.59% seen Thursday.

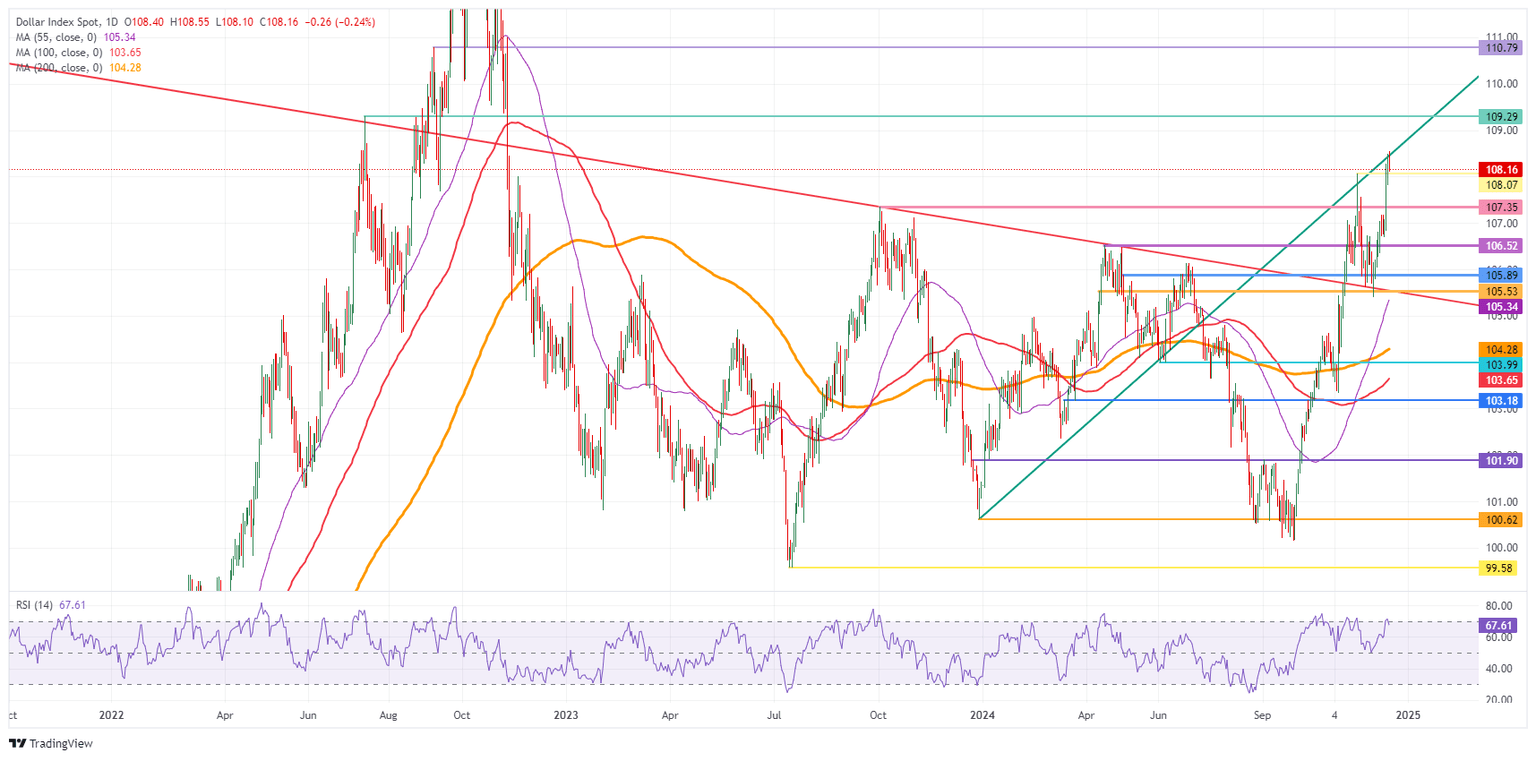

US Dollar Index Technical Analysis: Taking profit now

The US Dollar Index (DXY) is gearing up for the last rather normal trading day in terms of volumes. After another strong performance, it looks like the US Dollar will remain orbiting around elevated levels before heading into the New Year. The sole element that could trigger some softness would be if a Christmas rally emerges in equities and leads to a retreat in yields, softening the Greenback.

On the upside, a trend line originating from December 28 2023 looks to have foiled any further uptick moves for now after two firm rejections on Thursday and Friday. The next firm resistance comes in at 109.29, which was the peak of July 14, 2022, and has a good track record as a pivotal level. Once that level is surpassed, the 110.00 round level comes into play.

The first downside barrier comes in at 107.35, which has now turned from resistance into support. The second level that might be able to halt any selling pressure is 106.52. From there, even 105.53 could come under consideration while the 55-day Simple Moving Average (SMA) at 105.23 is making its way up to that level.

US Dollar Index: Daily Chart

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.